Share This Page

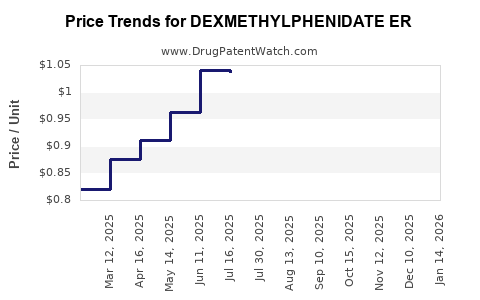

Drug Price Trends for DEXMETHYLPHENIDATE ER

✉ Email this page to a colleague

Average Pharmacy Cost for DEXMETHYLPHENIDATE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DEXMETHYLPHENIDATE ER 10 MG CP | 00115-9919-01 | 1.62939 | EACH | 2025-12-17 |

| DEXMETHYLPHENIDATE ER 10 MG CP | 31722-0230-01 | 1.62939 | EACH | 2025-12-17 |

| DEXMETHYLPHENIDATE ER 10 MG CP | 49884-0049-01 | 1.62939 | EACH | 2025-12-17 |

| DEXMETHYLPHENIDATE ER 10 MG CP | 00527-8107-37 | 1.62939 | EACH | 2025-12-17 |

| DEXMETHYLPHENIDATE ER 5 MG CAP | 70010-0004-01 | 1.12685 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dextroamphetamine Extended-Release (DEXMETHYLPHENIDATE ER)

Introduction

Dextroamphetamine Extended-Release (DEXMETHYLPHENIDATE ER) represents a significant therapeutic agent in the treatment of Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy. As a long-acting stimulant, its market dynamics are influenced by evolving healthcare landscapes, regulatory policies, competitive products, and demographic trends. This article offers an in-depth analysis of current market conditions and projects future pricing trajectories, providing actionable insights for stakeholders across pharmaceutical manufacturing, investment, and healthcare sectors.

Market Overview

Therapeutic Indications and Market Demand

Dextroamphetamine ER, marketed under various brand names such as Dexedrine Spansules and Adderall XR, addresses ADHD—a condition affecting approximately 8.4% of children and 2.5% of adults in the United States alone[1]. The increased recognition and diagnosis of ADHD, coupled with expanding adult patient populations, bolster baseline demand.

Narcolepsy management constitutes a secondary but significant application, with stimulant medications remaining first-line treatments. The global ADHD therapeutics market, valued at approximately USD 17 billion in 2022, is projected to grow at a CAGR of 6.2% through 2030[2], underpinning DEXMETHYLPHENIDATE ER’s market expansion.

Competitive Landscape

The competitive ecosystem includes methylphenidate-based formulations, amphetamine variants, and emerging non-stimulant therapies like atomoxetine and guanfacine. Key branded products include:

- Adderall XR (validated for ADHD)

- Vyvanse (lisdexamfetamine)

- Focalin XR (dexmethylphenidate)

Generic formulations of dextroamphetamine ER have gained considerable market share, driven by affordability and patent expirations, notably the entry of multiple bioequivalent products.

Regulatory and Reimbursement Factors

FDA approvals for generic versions have widened access, leading to price erosion in mature markets. Reimbursement policies increasingly favor generics, pressuring branded product prices. Nonetheless, strict regulatory standards and patent provisions continue to influence market entry timelines and pricing.

Current Pricing Dynamics

Brand vs. Generic Pricing

Brand-name DEXMETHYLPHENIDATE ER prescriptions command premiums—annual costs ranging from USD 3,000 to USD 5,000 per patient[3]. In contrast, generics are priced approximately 30-50% lower, facilitating broader access and expanding market volume.

Price Trends and Influencing Factors

Recent trends indicate a declining trajectory for DEXMETHYLPHENIDATE ER prices, attributable to:

- The proliferation of bioequivalent generics.

- Cost-containment measures enforced by insurers.

- Shift towards multi-source formulations.

However, premium formulations with extended-release profiles or proprietary delivery systems may retain higher prices due to perceived intra-dose durability and abuse-deterrent features.

Price Projection Analysis

Short-term Outlook (Next 2 Years)

Based on current patent expirations and generic entry patterns, branded DEXMETHYLPHENIDATE ER prices are expected to decline further by approximately 10-15% over the next two years[4]. Market penetration of generics will likely sustain competitive pricing pressures.

Medium to Long-term Outlook (3-5 Years)

Over the medium term, prices could stabilize or slight rebound if:

- Novel formulations with improved pharmacokinetics or abuse-deterrent platforms gain market share.

- Policy shifts favoring branded or branded-equivalent formulations for specific patient groups emerge.

- Supply chain or manufacturing disruptions for generics occur, constraining supply.

Predicting precise future prices involves uncertainty due to patent litigation, regulatory changes, and the emergence of alternative therapies, though a conservative estimate indicates a 15-25% overall price decline from current levels.

Impact of Emerging Technologies and Market Shifts

Innovations such as transdermal patch delivery or long-acting injectable formulations could shift the pricing landscape—potentially commanding premium prices due to enhanced compliance and reduced misuse. Conversely, increased adoption of non-stimulant therapies or digital therapeutics may mitigate volume growth, tempering price increases.

Key Market Drivers and Risks

| Drivers | Risks |

|---|---|

| Rising global ADHD prevalence | Regulatory hurdles for new formulations |

| Aging population with comorbidities | Patent litigation delaying generic entry |

| Healthcare policy favoring cost-effective generics | Market saturation in mature regions |

| Advances in drug delivery systems | Emergence of non-stimulant alternatives |

Pricing Strategies for Stakeholders

- Manufacturers should focus on innovating formulations that address unmet clinical needs, allowing for premium pricing.

- Investors may consider long-term plays in generic segments, given imminent patent expirations and market saturation.

- Healthcare providers and payers should emphasize formulary management to balance cost with therapeutic efficacy.

Conclusion

Dextroamphetamine ER remains a cornerstone in ADHD treatment amid a landscape characterized by escalating generic competition and evolving regulatory frameworks. Short-term prices will continue downward pressure owing to increased generic availability, while long-term prices may stabilize or slightly ascend with technological innovations and differentiated formulations. Stakeholders must navigate these dynamics with strategic agility to optimize market positioning and financial outcomes.

Key Takeaways

- The global ADHD therapeutics market offers significant growth potential; DEXMETHYLPHENIDATE ER plays a central role.

- Patent expirations and generic proliferation have precipitated a consistent decline in product prices over recent years.

- Innovations in drug delivery and abuse-deterrent features may support premium pricing for certain formulations.

- Major pricing shifts depend on regulatory developments, patent landscapes, and technological advancements.

- Strategic investment and market entry decisions should account for the expected 10-25% price decline over the next five years.

FAQs

1. What factors influence the pricing of Dextroamphetamine ER?

Pricing is primarily affected by patent status, availability of generic equivalents, manufacturing costs, regulatory approval, market competition, and payer reimbursement policies.

2. How will patent expirations impact DEXMETHYLPHENIDATE ER prices?

Patent expirations facilitate generic entry, leading to significant price reductions due to increased competition. Branded prices tend to decline by 30-50%, influencing overall market pricing.

3. Are there newer formulations of Dextroamphetamine ER that command higher prices?

Yes, formulations incorporating abuse-deterrent features or extended pharmacokinetics can justify higher prices, especially if they demonstrate superior safety, efficacy, or compliance benefits.

4. What role do healthcare policies play in shaping future prices?

Policies promoting cost-effectiveness, favoring generics, and emphasizing value-based care can exert downward pressure on prices, especially in public insurance programs.

5. How might emerging therapies affect Dextroamphetamine ER’s market share?

Non-stimulant medications and digital therapeutics could reduce demand for stimulant-based treatments, potentially constraining market growth and influencing pricing strategies.

Sources:

[1] Centers for Disease Control and Prevention (CDC). Data & Statistics on ADHD.

[2] Grand View Research. ADHD Therapeutics Market Analysis, 2023.

[3] GoodRx. Price Comparisons for ADHD Medications, 2023.

[4] IQVIA. Pharmaceutical Pricing and Market Trends Report, 2023.

More… ↓