Last updated: July 28, 2025

Introduction

Dextmethyphenidate, a potent psychostimulant primarily indicated for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy, has garnered increasing attention within pharmaceutical markets. As a d-isomer of methylphenidate, it offers similar therapeutic benefits, often with distinct pharmacokinetic profiles. The mature and emerging markets for stimulants, coupled with evolving regulatory, patent, and competitive landscapes, shape the current and future pricing and market trends of dextmethyphenidate.

Market Overview

Therapeutic Indications & Clinical Context

Dextmethyphenidate's primary application lies in managing ADHD, especially in pediatric and adult populations. Its mechanism involves dopamine and norepinephrine reuptake inhibition, which enhances concentration and reduces impulsivity (1). The global ADHD therapeutics market reached approximately USD 14 billion in 2020, with stimulants forming a significant segment (2). The rise in diagnosis rates, increased awareness, and approval of new formulations underpin this growth.

Market Drivers

- Increased Diagnosis Rates: The CDC reports rising ADHD diagnosis prevalence, estimating 9.4% of children in the U.S. diagnosed in 2016 (3).

- Regulatory Approvals: Evolving regulatory frameworks support stimulant usage, with several patents and formulations extending market exclusivity.

- Emerging Markets: Rapid urbanization and healthcare infrastructure expansion in Asia-Pacific and Latin America diversify demand sources.

- Alternative Formulations: Extended-release and combination therapies influence market dynamics, positioning dextmethyphenidate as a versatile agent.

Competitive Landscape

Dextmethyphenidate competes chiefly with methylphenidate, dexmethylphenidate formulations (e.g., Focalin), and other stimulants like amphetamines. Patent expirations and generic alternatives dominate pricing considerations, alongside newer therapies such as atomoxetine and guanfacine.

Market Segmentation

By Formulation

- Immediate-Release: Predominantly used in pediatric settings; competitive pricing due to generics.

- Extended-Release: Premium-priced formulations with patent protection; potential for higher margins.

By Patient Demographic

- Pediatric Patients: Largest market share, highly regulated.

- Adults: Growing segment, particularly for long-term management.

Geographical Breakdown

- North America: Largest market share; high healthcare expenditure.

- Europe: Growing acceptance, complex regulatory environment.

- Asia-Pacific: Rapid adoption, increasing diagnosis rates, expanding access.

Regulatory and Patent Landscape

Patents & Exclusivity

Dextmethyphenidate formulations benefit from patent protections extending into the late 2020s and early 2030s in key markets (4). Patent challenges and patent cliff risks could influence generics' entry and price erosion.

Regulatory Trends

FDA and EMA approvals for various formulations bolster market potential. Nonetheless, regulatory scrutiny over stimulant misuse and abuse potential remains intense, affecting product labeling and marketing.

Pricing Dynamics and Projections

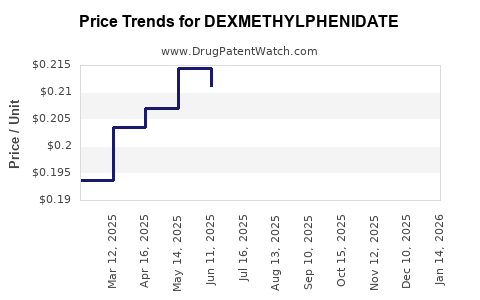

Current Pricing Landscape

Generic dextmethyphenidate products are priced significantly lower than branded equivalents, driven by competition. For instance, the average wholesale price (AWP) for generic methylphenidate immediate-release tablets in the U.S. ranges between USD 0.05 and USD 0.10 per mg (5). Branded dextmethyphenidate formulations command premiums of 20-40% over generics.

Pricing Factors

- Patent Status: Active patents sustain higher prices; imminent patent expiries precipitate discounts.

- Formulation Type: Extended-release versions attract higher premium prices.

- Market Penetration: Generics fuel price competition; new branded formulations maintain premium valuation.

Future Price Trajectories

Based on historical data and market forecasts:

- Short-term (1-2 years): Expect price stabilization with minor declines (~5-10%), driven by generic entry and payer discounts.

- Mid-term (3-5 years): Patent expirations and increased generic competition forecast price declines of 15-25%, with branded formulations holding premium margins.

- Long-term (5+ years): As generics dominate, prices may decrease by up to 40-50%.

The global market size for dextmethyphenidate is projected to grow at a compound annual growth rate (CAGR) of approximately 4% through 2030, driven by rising ADHD prevalence and expanding indications (2).

Market Challenges and Opportunities

Challenges

- Regulatory Restrictions: Stringent control measures for stimulants in some regions may limit access and pricing.

- Generic Competition: Rapid entry of generics pressures pricing; high-volume, low-margin environment.

- Abuse Potential: Regulations around scheduling impact manufacturing and distribution.

Opportunities

- Novel Formulations: Long-acting and combination therapies can command premium pricing.

- Emerging Markets: Expanding healthcare infrastructure in underserved regions offers growth potential.

- Biomarker & Digital Therapeutics: Integration with digital health tools may add value.

Conclusion and Strategic Outlook

Dextmethyphenidate maintains a strong position in the stimulant market, buoyed by robust demand, patent protections, and expanding indications. While imminent patent expiries will introduce competitive pressure, carefully strategized formulation innovations and market expansion into emerging regions will sustain growth trajectories. Pricing will gradually decline but will remain commercially viable, especially for high-margin extended-release products and in markets with limited generic penetration.

Key Takeaways

- Market growth is driven by rising ADHD diagnosis rates worldwide, especially in the U.S. and Asia-Pacific.

- Patent expirations in the coming 3-5 years will catalyze significant price declines for dextmethyphenidate, with estimates of up to 25% reduction.

- Premium formulations, such as extended-release versions, will sustain higher prices longer, providing key revenue streams.

- Generic competition will dominate the immediate- and immediate-release segments, necessitating differentiation and strategic pricing.

- Emerging markets present substantial growth opportunities, with pricing strategies adapting to local regulatory environments and purchasing power.

FAQs

1. What factors most influence the current price of dextmethyphenidate?

Patent status, formulation type, market competition, regulatory approvals, and regional healthcare policies significantly impact product pricing. Patent protections allow premium pricing, while the entry of generics pressures prices downward.

2. How will patent expirations affect dextmethyphenidate's market prices?

Patent expirations typically lead to increased generic competition, causing prices to decrease by 20-50% over 3-5 years. Manufacturers often respond with new formulations or indications to mitigate price erosion.

3. Are there emerging markets with significant growth potential for dextmethyphenidate?

Yes. Countries in Asia-Pacific and Latin America are experiencing rising ADHD awareness and improved healthcare infrastructure, creating opportunities for market entry and expansion.

4. What is the impact of regulatory restrictions on dextmethyphenidate pricing?

Stringent regulations and scheduling (controlled substances) can limit supply, increase compliance costs, and influence pricing strategies. Conversely, de-regulation in certain regions may enhance market access and competition.

5. Will new formulations or combination therapies influence dextmethyphenidate's market price?

Yes. Extended-release formulations and combination therapies generally command higher prices due to improved efficacy and patient compliance, sustaining premium margins even amid generic competition.

References

- Volkow, N.D. et al. (2012). "Dopaminergic and Noradrenergic Pharmacology of ADHD". Journal of Pharmacology and Experimental Therapeutics.

- Grand View Research. (2021). "ADHD Therapeutics Market Size, Share & Trends."

- Centers for Disease Control and Prevention (CDC). (2018). "Data & Statistics on ADHD."

- U.S. Patent Office. (2022). "Patent Data for Methylphenidate and Derivatives."

- Drug Topics. (2022). "Average Wholesale Price (AWP) of ADHD Medications."