Share This Page

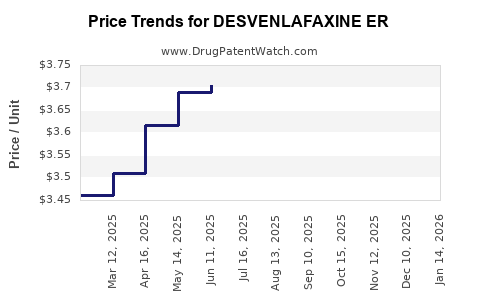

Drug Price Trends for DESVENLAFAXINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for DESVENLAFAXINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DESVENLAFAXINE ER 50 MG TAB | 63304-0191-30 | 3.85380 | EACH | 2025-12-17 |

| DESVENLAFAXINE ER 100 MG TAB | 63304-0192-30 | 3.76945 | EACH | 2025-12-17 |

| DESVENLAFAXINE ER 50 MG TAB | 63304-0191-30 | 3.83490 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Desvenlafaxine ER

Introduction

Desvenlafaxine extended-release (ER), marketed primarily under the brand name Pristiq among others, is a serotonin-norepinephrine reuptake inhibitor (SNRI) approved for the treatment of major depressive disorder (MDD). Its pharmacological profile, clinical efficacy, and market dynamics have made it a prominent player in the antidepressant segment. As healthcare landscapes evolve and generic alternatives emerge, understanding its market trajectory and price outlook is critical for stakeholders including pharmaceutical companies, investors, healthcare providers, and policymakers.

Market Overview

1. Therapeutic Segment and Medical Need

MDD remains a leading cause of disability worldwide, with an estimated 280 million people affected globally according to WHO data [1]. The SNRI class, which includes venlafaxine, duloxetine, and desvenlafaxine, addresses the serotonergic and noradrenergic pathways implicated in depression pathophysiology. Desvenlafaxine, introduced around 2008–2010 (FDA approval in 2008), offers a once-daily oral dosing with favorable tolerability, positioning it favorably among antidepressants.

2. Market Penetration and Growth Drivers

Favorable pharmacokinetics, once-daily dosing, and comparable efficacy support desvenlafaxine’s continued presence in the antidepressant market. The global antidepressant market was valued at approximately USD 15 billion in 2022, with a compound annual growth rate (CAGR) of around 2-4% projected until 2028 [2].

Key drivers include:

- Rising depression prevalence, especially among aging populations and in regions with increasing mental health awareness.

- Expanding approval for broader indications, such as vasomotor symptoms associated with menopause, in select markets.

- Development of generic formulations, which significantly reduce drug prices and expand access.

3. Competitive Landscape

The competitive landscape involves several established brands and generics:

| Drug Name | Class | Market Share (2022) | Key Attributes |

|---|---|---|---|

| Pristiq (desvenlafaxine) | SNRI | ~50% (U.S.) | Brand recognition, established prescriber base |

| Generic desvenlafaxine | SNRI | Increasing | Cost-effective alternative |

| Venlafaxine, Duloxetine | SNRI | Remaining segments | Legacy choices with longer market presence |

The advent of generics in 2014 after patent expiration has sharply reduced prices, intensifying market competition.

Market Drivers & Barriers

Drivers

- Increasing prescription rates driven by its efficacy and tolerability.

- Growing awareness of mental health treatment options.

- Expansion into emerging markets with rising healthcare expenditure.

Barriers

- Market saturation due to generic competition.

- Stringent safety concerns, including withdrawal symptoms and discontinuation syndrome.

- Competition from other antidepressant classes, such as SSRIs and novel agents like ketamine derivatives.

Pricing Dynamics and Projections

1. Current Pricing Trends

Brand-name desvenlafaxine’s average wholesale price (AWP) in the U.S. has declined from approximately USD 3.50 per tablet at launch to around USD 2.00–2.50 per tablet in 2022 following generic entry. Generic versions command prices roughly 50–70% lower than the brand, depending on formulations and pharmacy negotiations.

In Europe, prices are similarly driven down by generics, with variation across countries based on reimbursement policies and tender systems.

2. Price Trajectory and Future Outlook

Short-term (1–3 years):

The pharmaceutical market is witnessing stable or declining prices for desvenlafaxine due to the dominance of generics. Brand-name prices are likely to remain under pressure, with a possible modest uptick in branded prices if supply constraints or new formulations emerge.

Medium to Long-term (3–10 years):

Further price erosion is anticipated as patent protections have expired, and biosimilars or new formulations—such as extended-release or combination drugs—enter the market.

The emergence of biosimilar or advanced delivery systems could create niche pricing opportunities, but widespread price stabilization or increases are unlikely unless new indications, such as for menopausal vasomotor symptoms, gain approval and market acceptance.

3. Impact of Biosimilars and Innovation

While biosimilars are not directly applicable to desvenlafaxine (which is a small molecule), pharmaceutical innovation in the form of next-generation SNRI formulations or combination therapies may influence price points. Yet, such innovations tend to be premium-priced initially, with future generic competition potentially lowering prices.

Regional Market Variations

| Region | Price Trends | Key Factors |

|---|---|---|

| United States | Steady decline | Extensive generic penetration, insurance negotiations |

| Europe | Rapid generic adoption | Tariff systems, government tenders |

| Asia-Pacific | Variable | Emerging markets, low-cost generics, distribution channels |

| Latin America | Price-sensitive | Reimbursement infrastructure, generic dominance |

Regulatory and Patent Landscape

The originator patent for Pristiq expired in multiple jurisdictions by 2014, facilitating rapid generic entry. Evergreening strategies and secondary patents have limited patent protections, further accelerating generic proliferation.

Regulatory agencies often request bioequivalence data for generics, ensuring efficacy at reduced prices. This trend is expected to maintain downward pressure on prices.

Forecast Summary

| Year | Estimated Price Range (USD per tablet) | Notes |

|---|---|---|

| 2023 | 1.50 – 2.50 | Dominance of generic versions |

| 2025 | 1.20 – 2.00 | Continued generic saturation, minor price fluctuation |

| 2030 | 1.00 – 1.50 | Market stabilization, potential for niche high-value formulations |

Market Share and Revenue Projections

Given its mature status and generic competition, desvenlafaxine's market share is expected to stabilize or decline slightly. Revenue projections hinge on volume growth, especially in underpenetrated regions and expanded indications.

Estimated global revenue (2023): USD 500–700 million, with a gradual decrease unless new indications or formulations are introduced.

Key Factors Influencing Price and Market Trends

- Patent expiration status: Sovereign factor dictating generic entry.

- Manufacturing costs: Stable, but economies of scale with generics reduce prices.

- Healthcare policies: Reimbursement and formulary decisions influence access and pricing.

- Clinical developments: New indications or formulations may temporarily impact pricing dynamics.

- Market penetration: Increasing use in emerging markets can sustain revenue despite price declines.

Conclusion

Desvenlafaxine ER is poised to experience sustained price erosion driven by widespread generic availability, with prices expected to stabilize or decline modestly over the coming decade. Its market share remains substantial within the SNRI segment, but generic competition limits premium pricing. Strategic development efforts focusing on novel formulations or expanded therapeutic indications could temporarily influence pricing strategies.

Key Takeaways

- The desvenlafaxine market is mature, with generics dominating worldwide, exerting downward pressure on prices.

- Price projections suggest a consistent decline, with minimal opportunities for significant price increases unless innovation or new indications emerge.

- Emerging markets offer growth potential due to increasing mental health awareness and expanding healthcare infrastructure.

- Regulatory trends favor bioequivalence and biosimilar competition, further cementing price reduction trajectories.

- Stakeholders should consider diversification strategies, including niche indications and formulation innovations, to maintain profit margins.

FAQs

1. What factors have predominant influence on desvenlafaxine’s market pricing?

Generic competition, patent status, healthcare policies, and regional adoption rates primarily drive pricing.

2. How does the entry of generics impact desvenlafaxine's revenue?

Generics significantly reduce prices, leading to revenue erosion over time, especially in mature markets like the U.S. and Europe.

3. Are there upcoming formulations or indications that could alter the price landscape?

Potentially, formulations combining desvenlafaxine with other agents or new indications (e.g., menopausal vasomotor symptoms) could temporarily boost prices.

4. What regions present the greatest growth opportunity for desvenlafaxine?

Emerging markets in Asia-Pacific and Latin America due to expanding mental health services and favorable pricing dynamics.

5. How do regulatory policies influence desvenlafaxine pricing?

Policymaker decisions regarding drug approval, reimbursement, and drug tendering directly impact affordability and market access, influencing pricing strategies.

References

[1] World Health Organization. Depression and Other Common Mental Disorders: Global Health Estimates, 2017.

[2] Market Research Future. Antidepressant Market Report, 2022.

More… ↓