Last updated: July 27, 2025

Introduction

Desmopressin, a synthetic analogue of vasopressin, is primarily utilized in the management of conditions such as diabetes insipidus, bedwetting (nocturnal enuresis), and certain bleeding disorders like mild hemophilia A and von Willebrand disease [1]. As a critical therapeutic agent, understanding its market landscape and future pricing dynamics is vital for pharmaceutical companies, healthcare providers, and investors aiming to optimize strategic decisions.

Current Market Overview

Market Size and Segmentation

The global desmopressin market was valued at approximately USD 1.2 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 4.5% through 2030 [2]. The market is segmented by formulation (intranasal, oral tablets, injectable), application (diabetes insipidus, bleeding disorders, nocturnal enuresis), and geography.

-

Formulation Breakdown

- Intranasal: Dominates current sales due to ease of administration and rapid onset.

- Oral tablets: Gaining traction owing to patient compliance.

- Injectable: Used predominantly in hospital settings, accounting for a smaller share.

-

Application Segmentation

- Diabetes Insipidus: Largest application segment, accounting for roughly 50% of revenues.

- Bleeding Disorders: Approximate 25%, chiefly in hemophilia A and von Willebrand disease.

- Enuresis: About 20%, primarily in pediatric populations.

Geographical Insights

North America leads the market due to high disease prevalence, better healthcare infrastructure, and widespread insurance coverage. Europe follows, with increasing adoption driven by updated clinical guidelines. The Asia-Pacific region presents growth opportunities driven by increasing healthcare expenditure, rising awareness, and expanding pharmacy networks.

Key Players and Market Share

Major pharmaceutical companies dominate desmopressin production and distribution:

- Ferring Pharmaceuticals: Historically the largest supplier, offering intranasal and injectable forms.

- Shire (a Takeda company): Known for oral formulations.

- Mitsubishi Tanabe Pharma: Offers generic versions and maintains significant market presence.

Brand dominance influences pricing strategies in different regions, with patent status remaining pivotal for market control.

Market Dynamics Influencing Price Trends

Patent Expiry and Generics

Desmopressin's primary patents expired between 2015-2018 in many jurisdictions, leading to increased generic competition. Generics typically reduce prices by 40-60%, intensifying market adoption and squeezing brand premiums [3].

Regulatory Approvals and Expanded Indications

New approvals, such as formulations for pediatric use or new delivery mechanisms, can influence prices through increased market size and competition. Conversely, stringent regulatory environments may impose price controls, restricting upward movements.

Manufacturing and Supply Chain Factors

Supply chain disruptions, particularly in the context of geopolitical tensions or pandemics, can constrain availability, temporarily enlarging prices. Conversely, advancements in manufacturing efficiency reduce production costs, exerting downward pressure on prices over time.

Pricing and Reimbursement Policies

Healthcare systems increasingly emphasize cost-effectiveness. Reimbursement frameworks and health technology assessments (HTAs) influence the negotiated prices, especially in Europe and North America.

Price Projection Outlook (2023-2030)

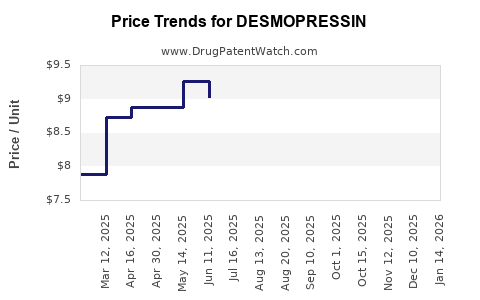

Short to Medium Term (2023-2025)

- Pricing stability in established markets: Due to existing patent protections, brand-name desmopressin retains premium pricing, with intranasal and injectable forms averaging USD 50–150 per unit.

- Grocery and pharmacy segment discounts: Generics entering the scene will lead to significant price reductions, with oral tablets potentially decreasing by 30-50%.

- Impact of biosimilars and generics: Increased competition is expected to suppress prices further, especially in outpatient settings.

Long-Term Trends (2026-2030)

- Moderate price erosion: Expected to plateau at 10-15% annually in mature markets as competition stabilizes.

- Emergence of value-based pricing models: Based on clinical outcomes, especially for chronic conditions like diabetes insipidus.

- Potential for premium pricing: For innovative formulations with improved delivery mechanisms or bioavailability, prices could stabilize or increase slightly.

Overall, average unit prices are projected to decline by 20-35% over the next decade in primary markets, driven by generic competition and technological advancements.

Strategic Implications for Stakeholders

- Pharmaceutical companies must innovate formulations and expand indications to obviate the impact of patent expiry.

- Healthcare payers will continue to scrutinize cost-effectiveness, favoring generics and biosimilars where clinically appropriate.

- Investors should monitor regulatory developments, patent statuses, and emerging biosimilar entrants as indicators of future price movements.

Conclusion

Desmopressin's market, though mature, remains dynamic, influenced heavily by patent cycles, regulatory decisions, and technological innovations. Short-term pricing is expected to decline alongside increased generic competition, while long-term prices will stabilize, shaped by value-based agreements and new formulation developments. Stakeholders must stay vigilant to these factors to navigate the evolving landscape profitably.

Key Takeaways

- The global desmopressin market was valued at approximately USD 1.2 billion in 2022, with expected steady growth.

- Patent expiries have significantly increased generic competition, exerting downward pressure on prices.

- Price erosion of 20-35% over the next decade is projected, with stabilization as competition matures.

- Innovations in drug delivery and expanded indications offer potential for premium pricing segments.

- Strategic focus on pipeline development, regulatory navigation, and market expansion remains vital for pharmaceutical firms.

FAQs

-

What are the main factors impacting desmopressin pricing?

Patent expiration, generic competition, regulatory approvals, manufacturing costs, and healthcare reimbursement policies are key influencers.

-

How will the entry of biosimilars affect desmopressin prices?

Although biosimilars are less common for synthetic peptides like desmopressin, similar biosimilar entrants could further reduce prices and expand access.

-

Which formulations currently command the highest prices?

Injectables and branded intranasal forms typically command higher prices due to convenience and brand loyalty.

-

Are there ongoing efforts to develop oral desmopressin formulations?

Yes, several pharmaceutical companies are investing in more bioavailable oral forms to boost patient compliance and reduce administration costs.

-

How do regional policies influence desmopressin pricing?

Pricing in Europe and North America tends to be higher due to less aggressive price regulation, while emerging markets experience more substantial discounts owing to government-led negotiations.

References

[1] Clinical Pharmacology, Desmopressin Overview, 2023.

[2] Market Research Future, "Desmopressin Market Forecast," 2023.

[3] IQVIA, "Pharmaceutical Pricing & Revenue Trends," 2022.