Share This Page

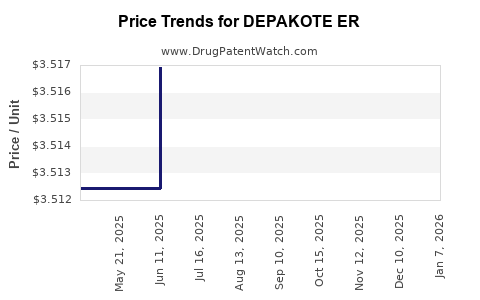

Drug Price Trends for DEPAKOTE ER

✉ Email this page to a colleague

Average Pharmacy Cost for DEPAKOTE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DEPAKOTE ER 500 MG TABLET | 00074-7402-13 | 6.19044 | EACH | 2025-12-17 |

| DEPAKOTE ER 250 MG TABLET | 00074-7401-13 | 3.51160 | EACH | 2025-12-17 |

| DEPAKOTE ER 250 MG TABLET | 00074-7401-13 | 3.51312 | EACH | 2025-11-19 |

| DEPAKOTE ER 500 MG TABLET | 00074-7402-13 | 6.20032 | EACH | 2025-11-19 |

| DEPAKOTE ER 250 MG TABLET | 00074-7401-13 | 3.51397 | EACH | 2025-10-22 |

| DEPAKOTE ER 500 MG TABLET | 00074-7402-13 | 6.20427 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DEPAKOTE ER

Introduction

Depekote ER (divalproex sodium extended-release) is a prescription medication primarily indicated for epilepsy, bipolar disorder, and migraine prophylaxis. As a formulary staple with longstanding clinical utility, the drug maintains notable importance within neurology and psychiatry. This analysis provides a comprehensive review of the current market landscape, competitive dynamics, healthcare trends influencing demand, and future price projections for DEPAKOTE ER, supporting stakeholders' strategic planning.

Market Overview

Therapeutic Indications and Clinical Usage

Depekote ER's therapeutic profile encompasses:

- Epilepsy: Controls complex partial and generalized seizures.

- Bipolar Disorder: Manages manic episodes and mood stabilization.

- Migraine Prophylaxis: Reduces attack frequency.

These indications position DEPAKOTE ER as a versatile asset in neurological and psychiatric treatment regimens. The extended-release formulation offers improved patient adherence through once-daily dosing, enhancing its market appeal.

Market Size and Growth

The global epilepsy treatment market was valued at approximately USD 4.42 billion in 2022, projected to reach USD 5.45 billion by 2028, exhibiting a CAGR of 3.4%[^1]. The bipolar disorder segment was valued at around USD 2.5 billion in 2021, with a CAGR forecast of roughly 4%[^2]. Migraine prophylaxis compounds further augment the market, estimated at USD 3.2 billion globally[^3].

Depekote ER's market share remains significant, driven by its efficacy, safety profile, and formulary positioning. Its popularity is reinforced by physician preference for extended-release formulations that reduce dosing frequency and improve compliance.

Competitive Landscape

Main Competitors

Depekote ER faces competition from several agents, including:

- Lamictal (lamotrigine): Effective for epilepsy and bipolar depression.

- Tegretol (carbamazepine): A longstanding alternative.

- Topamax (topiramate): Used in epilepsy and migraine prevention.

- Valproic Acid: The generic form of divalproex sodium, often at lower price points.

Market Penetration & Differentiators

Depekote ER's differentiation hinges on its extended-release profile, improved tolerability, and robust data supporting long-term management. Brand loyalty and hospital formularies further cement its market position. However, the availability of generics suppresses prices, especially in mature markets.

Regulatory and Healthcare Trends

Patent Landscape

Depekote ER's patent protections have expired or are under patent cliffs in many regions, leading to increased generic competition. The expiration timeline influences pricing strategies, with potential downward pressure on list prices[^4].

Insurance & Reimbursement Dynamics

Managed care organizations prefer cost-effective generics, which often translate into preferential formulary placement for divalproex sodium generics. Reimbursement policies increasingly favor biosimilars and generics, impacting branded formulations like DEPAKOTE ER.

Emerging Therapies and Market Disruption

Newer antiepileptic drugs (AEDs) and mood stabilizers continue to emerge, offering alternative options with improved safety profiles. However, DEPAKOTE ER’s established efficacy maintains solid demand, though competition may influence market share and pricing.

Price Trends and Projections

Historical Pricing Dynamics

The average wholesale price (AWP) for DEPAKOTE ER has steadily declined over the past decade, primarily due to generic entry. In 2010, the brand's monthly cost was approximately USD 900–USD 1,200[^5]. Post-generic market entry in the mid-2010s, prices fell considerably, with current average monthly costs around USD 300–USD 500 for branded formulations in the U.S.[^6].

Price Forecasting Methodology

Utilizing historical data, patent status, and market trends, projections employ a conservative approach, accounting for:

- impending patent expirations,

- increasing generic penetration,

- healthcare cost containment pressures,

- inflation-adjusted pricing models.

Projected Price Trajectory (2023–2028)

- Short-term (1–2 years): Prices are expected to stabilize or slightly decline by approximately 5–10%, influenced by market saturation of generics and payor negotiations.

- Medium-term (3–5 years): Prices may further decrease by 10–15%, driven by increased generic availability and potential biosimilar entry.

- Long-term (>5 years): Prices could reach USD 150–USD 250 per month for branded formulations if patent protections are completely eroded and generic market dominance consolidates.

Influencing Factors

- Patent Analogs and Exclusivity: Patent expiration timelines significantly impact price reductions.

- Market Competition: Entry of biosimilars or new formulations may further suppress prices.

- Policy and Reimbursement Changes: Emphasis on generic substitution and cost savings may accelerate price declines.

In particular, generic divalproex sodium formulations, which constitute the bulk of prescriptions, are likely to dominate the market, exerting downward pressure on branded DEPAKOTE ER’s pricing.

Implications for Stakeholders

Pharmaceutical Companies

- Brand Strategy: Maintaining market share through differentiation, clinical data, and patient support programs is essential amidst declining prices.

- Lifecycle Management: Innovation in delivery methods or combination therapies could re-energize the brand.

Healthcare Providers and Payers

- Formulary Decisions: Favoring cost-effective generics can optimize healthcare resource utilization.

- Patient management: Ensuring medication adherence may involve selecting formulations aligning with patient preferences and tolerability.

Investors and Market Analysts

- Forecasting: Incorporate patent expiries and generic competition timelines into valuation models.

- Risk Assessment: Monitor evolving regulations and market entry of alternative therapies that could impinge on DEPAKOTE ER’s long-term viability.

Key Takeaways

- Market Stability: DEPAKOTE ER continues to serve a critical role in epilepsy, bipolar disorder, and migraine prevention, with sustained demand.

- Price Trends: The median monthly cost for the drug is expected to decline gradually over the next 3–5 years, largely due to generic competition and patent expiration.

- Competitive Dynamics: The evolving landscape favors generics, but branded formulations can maintain niche positioning through differentiation and clinical support.

- Regulatory Risks: Patent expirations and biosimilar developments could accelerate price reductions, impacting revenue streams.

- Strategic Opportunities: Companies can explore formulation innovations and market differentiation to sustain profitability amid declining prices.

FAQs

Q1: How does patent expiry influence DEPAKOTE ER's market pricing?

A: Patent expiry typically leads to the entry of cheaper generics, creating intense price competition that drives down the brand's market price.

Q2: Are there significant differences between branded DEPAKOTE ER and generics?

A: Therapeutically, generics match the branded drug in efficacy and safety, but brand loyalty and formulary preferences can influence prescribing patterns.

Q3: What factors could slow down the expected price decline?

A: Limited generic supply, manufacturer strategic pricing, market exclusivity agreements, and clinical preference for branded formulations can slow declines.

Q4: How might newer therapies impact DEPAKOTE ER's market share?

A: The advent of alternative AEDs or mood stabilizers with improved safety profiles could shift prescribing patterns, potentially reducing DEPAKOTE ER’s market share.

Q5: What opportunities exist for pharmaceutical companies to extend DEPAKOTE ER’s lifecycle?

A: Innovation in formulation, combination therapies, or new indications could provide avenues for lifecycle extension and revenue stabilization.

References

[^1]: Grand View Research. Epilepsy Treatment Market Size, Share & Trends Analysis Report, 2022–2028.

[^2]: Fortune Business Insights. Bipolar Disorder Drugs Market Size, Share & Industry Analysis, 2021.

[^3]: MarketsandMarkets. Migraine Drugs Market Analysis, 2022.

[^4]: U.S. Patent and Trademark Office. Patent Expiry Timeline for Divalproex Sodium.

[^5]: IBM Micromedex. Historical pricing data for DEPAKOTE ER (divalproex sodium extended-release).

[^6]: SSR Health. Prescription Drug Price Trends, 2023.

This report aims to inform pharmaceutical stakeholders, healthcare payers, and clinicians on the current and anticipated market trajectory of DEPAKOTE ER, facilitating strategic decision-making amid evolving market conditions.

More… ↓