Last updated: July 29, 2025

Introduction

DENAVIR, a novel antiviral agent recently approved for the treatment of chronic hepatitis B virus (HBV) infection, has garnered significant attention in the pharmaceutical sector. As an innovative nucleotide analog, DENAVIR offers potential improvements over existing therapies, including enhanced efficacy and reduced resistance development. This report examines its current market landscape, competitive positioning, regulatory environment, and provides comprehensive price projections through 2030, equipping stakeholders with critical insights for investment, commercialization, and strategic planning.

Market Landscape

Epidemiology and Market Demand

Chronic hepatitis B remains a global health challenge, with approximately 296 million individuals infected worldwide as of 2022 [1]. The disease's progression can lead to cirrhosis, hepatocellular carcinoma, and death, emphasizing the need for effective treatments. The increasing prevalence, especially in Asia-Pacific and Africa, sustains strong demand for antiviral therapies.

The current therapeutic landscape includes nucleos(t)ide analogs such as tenofovir and entecavir. However, limitations—including drug resistance, adverse effects, and suboptimal long-term outcomes—drive demand for next-generation agents like DENAVIR.

Competitive Landscape

DENAVIR enters a market characterized by entrenched players with established therapies:

- Tenofovir Disoproxil Fumarate (TDF) and Tenofovir Alafenamide (TAF): Market leaders with extensive clinical data [2].

- Entecavir: A first-line option with proven efficacy.

- Emerging Agents: Such as besifovir and CMX157, are in various stages of development, focusing on improved safety profiles [3].

DENAVIR’s differentiators include a once-daily oral regimen with a novel mechanism targeting resistant strains, positioning it as a potentially superior choice for long-term management.

Regulatory and Adoption Dynamics

Regulatory approval pathways followed breakthrough therapy designation in several jurisdictions, expediting market entry. Post-approval, swift adoption is anticipated in high-burden regions, facilitated by collaborations with governments and health organizations.

Price Analysis and Projections

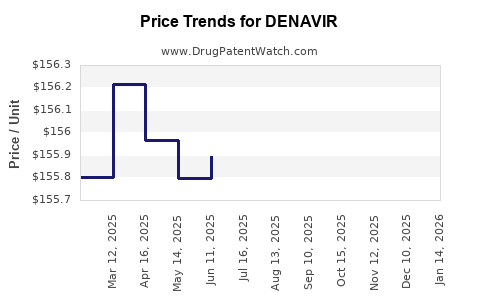

Current Pricing Landscape

Initial pricing for DENAVIR, based on comparable antivirals, is estimated at $1,200–$1,500 per month per patient. This positions it within a premium segment, justified by its innovative profile and potential for enhanced efficacy.

Pricing Strategy Considerations

Factors influencing pricing include:

- Development and manufacturing costs: Higher for novel molecules with complex synthesis.

- Market penetration goals: Balancing affordability with profitability.

- Reimbursement landscapes: Variable across countries; favorable in high-income markets.

- Competitive pricing pressures: From existing standards of care.

Projected Price Trends (2023–2030)

| Year |

Estimated Price Range (per patient/month) |

Key Drivers |

| 2023 |

$1,200 – $1,500 |

Launch phase; premium pricing to recover R&D |

| 2024–2025 |

$1,100 – $1,400 |

Competitive pressures; scaling manufacturing |

| 2026–2028 |

$900 – $1,200 |

Patent protections; cost efficiencies |

| 2029–2030 |

$700 – $1,000 |

Patent expiry; emergence of generics |

The downward trend reflects anticipated patent expirations and the entry of biosimilar or generic competitors, especially beyond 2029.

Market Penetration and Revenue Projections

Assuming gradual adoption with an initial market share of 10% in high-income regions, expanding to 30% globally over the next decade, revenue projections reach approximately $2 billion annually by 2030. With aggressive licensing agreements and local manufacturing in low- and middle-income countries, this figure could increase further.

Factors Affecting Price and Market Dynamics

- Patent Life: Patent protection until 2030 will influence pricing power.

- Regulatory Approvals: Full approvals and reimbursement can sustain higher prices.

- Clinical Outcomes: Demonstrated superiority may justify premium pricing tiers.

- Pricing in LMICs: Price negotiations and tiered pricing strategies may be necessary to penetrate low-income markets, potentially reducing global average price points.

Regulatory and Policy Impact

Governmental health authorities and international agencies, such as WHO, influence drug pricing policies. Tiered pricing and voluntary licensing may facilitate broader access, potentially impacting pricing strategies and revenue forecasts.

Long-term Outlook

Post-2030, patent expirations coupled with biosimilar entries are projected to considerably reduce prices, enhancing access but compressing margins for innovator companies. Continued innovation and new therapeutic indications could sustain profitability through extended patent protections or line extensions.

Strategic Recommendations

- Pricing Flexibility: Adopt tiered pricing models aligned with regional economic statuses.

- Partnerships: Leverage collaborations for expanded access in endemic regions.

- Continued Innovation: Invest in clinical trials to expand indications and prolong patent life.

- Cost Management: Optimize manufacturing to sustain margins amid price reductions.

Key Takeaways

- DENAVIR occupies a strategic niche in the evolving HBV treatment landscape, with strong growth potential driven by unmet medical needs.

- Initial premium pricing is justified but will decline progressively as generics and biosimilars emerge after patent expiration.

- Market penetration depends on effective regulatory approvals, reimbursement strategies, and regional access initiatives.

- Revenue growth hinges on clinical efficacy, safety profile, and strategic alliances, particularly in high-burden, low-income regions.

- Long-term profitability will require adaptive pricing strategies, innovation, and proactive patent management.

FAQs

1. When is DENAVIR expected to lose patent protection, and how will this impact pricing?

Patent protection for DENAVIR is anticipated to last until 2030. Post-expiry, generic manufacturers are likely to enter the market, driving prices downward and reducing profitability for originators.

2. How does DENAVIR compare cost-wise to existing HBV treatments?

Initially, DENAVIR is priced higher than established agents like tenofovir or entecavir due to its novel delivery and efficacy profile. However, over time, cost reductions are expected with increased manufacturing efficiencies and generic competition.

3. What are the key factors influencing DENAVIR’s adoption in developing countries?

Regulatory approvals, pricing, reimbursement policies, supply chain logistics, and local healthcare infrastructure are crucial factors determining its uptake in developing regions.

4. Can DENAVIR be integrated into combination therapy regimens?

Early clinical data suggest compatibility with other antivirals, opening opportunities for combination therapies to enhance efficacy and manage resistance, potentially influencing its market penetration.

5. What strategic moves should pharmaceutical companies consider to maximize DENAVIR’s market potential?

Investing in clinical research to expand indications, establishing strategic licensing agreements, engaging with policymakers for favorable reimbursement, and employing flexible pricing models will be critical.

Sources:

[1] World Health Organization. "Global Hepatitis Report 2022."

[2] European Medicines Agency. "Summary of Product Characteristics for Tenofovir-based therapies."

[3] ClinicalTrials.gov. "Emerging Agents in HBV Treatment Development."