Last updated: July 30, 2025

Introduction

Demeclocycline, a synthetic tetracycline derivative, has garnered attention primarily within niche antimicrobial applications. Although it remains an experimental compound with limited commercial presence, understanding its potential market trajectory is vital for pharmaceutical stakeholders, investors, and competitors. This analysis explores current market dynamics, competitive landscape, regulatory pathways, and future price projections for Demeclocycline, offering strategic insights for industry decision-making.

Pharmacological Profile and Clinical Status

Demeclocycline is a semi-synthetic tetracycline analog designed to enhance antibacterial activity and pharmacokinetic stability. Its mechanism involves inhibiting bacterial protein synthesis by binding to the 30S ribosomal subunit, similar to other tetracyclines.

Current status indicates its experimental phase, with limited clinical trials primarily targeting resistant bacterial strains (e.g., multi-drug-resistant Staphylococcus aureus). No widespread regulatory approval has been granted; thus, its commercialization remains nascent, with potential pathways involving the FDA's New Drug Application (NDA) process or equivalents in other jurisdictions.

Market Landscape

Existing Antibiotic Market Dynamics

The global antibiotic market is projected to reach USD 52 billion by 2025, driven almost entirely by broad-spectrum agents addressing outpatient and hospital settings (source: IQVIA). However, rising antimicrobial resistance (AMR) presents an evolving challenge, creating demand for novel agents with unique mechanisms or improved profiles.

Positioning of Demeclocycline

Given its novel structure, Demeclocycline could fill critical gaps left by existing tetracyclines, such as overcoming resistance or reducing side effects. Nonetheless, barriers include limited clinical data, manufacturing scalability, and regulatory uncertainties.

Competitive Landscape

- Established Tetracyclines: Doxycycline, Minocycline, Tetracycline remain front-runners with significant market share.

- Emerging Antibiotics: Agents like omadacycline and eravacycline, which also target resistant bacteria, compete in the same niche. These drugs have gained approvals and possess validated market entry strategies.

Without substantial differentiation, Demeclocycline faces significant barriers to market penetration.

Regulatory and Reimbursement Environment

Strict regulatory pathways influence market entry timelines. The Orphan Drug Act or Fast Track designations could expedite approval if Demeclocycline targets resistant infections with unmet needs. Reimbursement hinges on demonstrating compelling clinical benefits, cost-effectiveness, and safety, influencing pricing potential.

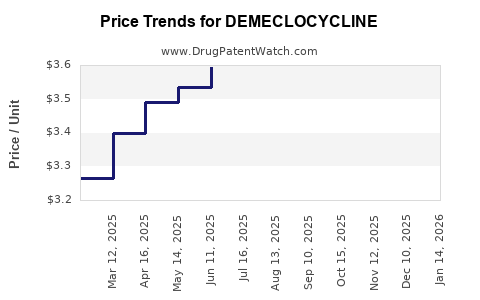

Pricing Strategies and Projections

Initial Pricing Considerations

-

Development Stage Cost: R&D expenses for novel antibiotics average USD 2-3 billion, with clinical development constituting a significant portion (source: Tufts Center for the Study of Drug Development).

-

Market Entry Price: Assuming a niche indication with high unmet need, initial prices may range from USD 200 to USD 400 per treatment course, reflecting the premium status for resistant infections and novelty.

Factors Affecting Price Trajectory

- Generic Competition: Post-patent expiry, prices could decline steeply, aligning with traditional tetracycline costs (USD 10–50 per course).

- Market Penetration: If Demeclocycline demonstrates superior efficacy or safety, premium pricing can be sustained longer.

- Regulatory Incentives: Fast-track or orphan drug designations could support premium pricing during initial years.

Projection Scenarios

| Scenario |

Year 1 Price Range |

Year 5 Price Range |

Key Assumptions |

| Optimistic |

USD 300–USD 400 |

USD 150–USD 250 |

Successful regulatory approval, demonstrated clinical advantage, limited competition. |

| Moderate |

USD 250–USD 350 |

USD 100–USD 200 |

Partial market acceptance, slow adoption, emerging competitors. |

| Conservative |

USD 200–USD 300 |

USD 50–USD 100 |

Limited efficacy, regulatory hurdles, rapid generic entry. |

Long-term Price Outlook

Post-patent expiration, prices typically decline 80–90%, with generics reducing costs and broadening access. Conversely, if Demeclocycline secures a substantial role in combating resistant infections, premium pricing could persist up to a decade.

Market Entry Challenges and Opportunities

Challenges

- Clinical development risks due to potential safety concerns.

- Competition from existing tetracyclines and other novel antibiotics.

- Regulatory uncertainties, especially if targeted at resistant infections with complex approval pathways.

- Limited manufacturing capacity and supply chain complexities.

Opportunities

- Strategic partnerships with government health agencies for antimicrobial resistance initiatives.

- Orphan or expedited drug designations to accelerate approval.

- Positioning as a niche treatment for highly resistant infections, commanding higher prices.

- Potential for combination therapies enhancing market appeal.

Regulatory and Commercial Strategy Recommendations

- Accelerate clinical trials focusing on resistant bacterial strains.

- Seek orphan drug or fast track designations where applicable.

- Establish collaborations with biotech firms possessing complementary antimicrobial pipelines.

- Develop compelling value dossiers emphasizing efficacy and safety advantages.

- Prepare scalable, cost-effective manufacturing processes to optimize margins.

Key Takeaways

- Market Entry Timing: Demeclocycline’s commercial success hinges on timely clinical development and regulatory approval; early engagement with regulatory agencies could facilitate smoother pathways.

- Pricing Potential: Premium pricing in niche resistant infections is feasible, but long-term profitability depends on clinical advantages and competition dynamics.

- Competitive Differentiation: To succeed, Demeclocycline must demonstrate superior efficacy or safety that clearly distinguishes it from existing antibiotics, especially in resistant infection settings.

- Strategic Positioning: Leveraging antimicrobial stewardship policies and resistance mitigation initiatives can underpin market acceptance.

- Long-term Outlook: Market share and price sustainability are susceptible to regulatory, clinical, and competitive factors; flexible strategies and continuous data generation are essential.

FAQs

1. What are the primary factors influencing Demeclocycline’s market success?

Regulatory approval speed, clinical efficacy, safety profile, competitive landscape, and pricing strategy are crucial. Demonstrating superiority over existing tetracyclines in resistant infections markedly impacts success.

2. How does antimicrobial resistance influence Demeclocycline’s market potential?

The rising prevalence of resistant bacteria creates demand for new antibiotics. If Demeclocycline effectively treats resistant strains, it can command premium pricing and establish a niche market.

3. What are typical price ranges for innovative antibiotics targeting resistant infections?

Initial treatment courses often range from USD 200–USD 400, with premium pricing possible for highly resistant or difficult-to-treat infections. Post-patent, prices tend to decline significantly.

4. What regulatory pathways could expedite Demeclocycline’s market entry?

Fast Track, Breakthrough Therapy, or Orphan Drug designations can accelerate approval. Success depends on demonstrating significant unmet needs and clinical advantages.

5. What strategic steps should companies consider for Demeclocycline’s commercialization?

Robust clinical trials targeting resistant bacteria, strategic partnerships, regulatory engagement, scalability in manufacturing, and clear differentiation from competitors are essential.

References

- IQVIA. Global Antibiotic Market Forecast. (2022).

- Tufts Center for the Study of Drug Development. Cost of Pharmaceutical R&D. (2021).

- FDA. Breakthrough Therapy and Fast Track Designations. (2022).

- MarketWatch. Antibiotics Market Size, Share & Industry Analysis. (2022).

- World Health Organization. Antimicrobial Resistance Global Report. (2022).