Last updated: July 27, 2025

Introduction

Deferasirox, marketed under brand names such as Exjade and Jadenu, is an oral iron chelator used primarily for managing chronic iron overload in patients with conditions like thalassemia, myelodysplastic syndromes, and other transfusion-dependent iron overload disorders. Since its approval, deferasirox has become a crucial therapeutic agent within hematology, influencing both clinical practices and pharmaceutical market dynamics.

Understanding the current market landscape and projecting future pricing trends for deferasirox is vital for pharmaceutical companies, healthcare providers, payers, and investors. This analysis explores the market size, competitive environment, pricing strategies, regulatory factors, and growth opportunities.

Market Landscape Overview

Global Market Size and Regional Distribution

The global deferasirox market was valued at approximately USD 1.1 billion in 2022, with expectations of reaching USD 1.5 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 5.4% (2022–2028). The primary markets include North America, Europe, Asia-Pacific, Latin America, and the Middle East.

- North America: Dominates the market due to high prevalence of thalassemia in specific ethnic groups, widespread adoption of innovative treatments, and favorable reimbursement policies.

- Europe: Significant adoption owing to established healthcare infrastructure and regulatory approvals.

- Asia-Pacific: Expected to exhibit rapid growth driven by rising thalassemia prevalence, increasing healthcare access, and local manufacturing.

Key Drivers

- Growing Prevalence of Iron Overload Disorders: Increased survival rates among chronically transfused patients boost demand.

- Advancements in Hematology Treatments: Adoption of oral chelators like deferasirox provides better compliance compared to injectable alternatives.

- Price Competition and Generic Entry: Patent expirations open opportunities for generics, impacting pricing and market penetration.

- Regulatory Approvals and Expanded Indications: Inclusion in broader therapeutic protocols supports sustained demand.

Competitive Dynamics and Market Players

Major pharmaceutical companies holding market share include:

- Novartis: Original manufacturer of Exjade and Jadenu, leading the market with strong brand recognition.

- Fresenius Kabi: Offers generic versions of deferasirox, increasing price competition.

- Natco Pharma and Zydus Cadila: Emerging generic manufacturers expanding access and market share in developing regions.

Generic availability has significantly impacted price points, broadening access but intensifying competition.

Pricing Strategies and Trends

Brand vs. Generic Pricing

- Brand-Name Deferasirox (Exjade, Jadenu): Historically priced at approximately USD 60-80 per 250mg tablet, translating to around USD 15,000–20,000 annually for a typical patient dosing regimen.

- Generics: Prices vary greatly; in regions like India, generic deferasirox can be priced as low as USD 1,200–1,500 annually, making therapy more accessible.

Pricing Factors

- Regulatory Environment: Patents protect brand formulations; once expired, generics rapidly enter the market, exerting downward pressure on prices.

- Manufacturing Costs: As patents expire and competition increases, production efficiencies and local manufacturing lower costs, leading to reduced retail prices.

- Healthcare Payer Dynamics: Reimbursement policies influence net prices; countries with national health services often negotiate lower prices.

- Pricing in Emerging Markets: Significantly lower than in North America and Europe, reflecting income levels and healthcare budgets.

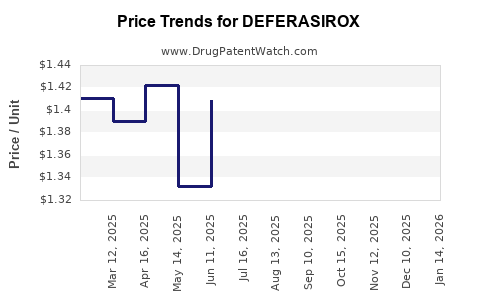

Pricing Trends

Over the past five years, brand-name deferasirox has experienced modest price reductions attributed to increased generic competition and patent expiries in key markets. The global trend indicates continued price erosion, especially in low- and middle-income economies, as well as strategic shifts focusing on value-based pricing models to promote extended indications and improved patient adherence.

Regulatory and Patent Considerations

Patent protections for deferasirox expired or are set to expire in several key jurisdictions. The expiration timeline influences generic entry and subsequent pricing strategies.

- United States: Patent for Exjade expired in 2017, with Jadenu’s patent expiration anticipated in 2025.

- Europe: Patent expiry in around 2018 for Exjade; generic versions are now dominant.

- Emerging Markets: Limited patent enforcement and local manufacturing facilitate early generic entry.

Regulatory agencies such as the FDA and EMA continue to evaluate and approve formulations, impacting market access and pricing models.

Market Opportunities and Challenges

Opportunities

- Expanded Indications and Combination Therapies: Potential for formulations targeting other iron-related conditions or combined therapies enhances growth prospects.

- Generic Penetration in Developing Countries: Cost-effective generics increase global access and volume sales.

- Biosimilar Development: While not directly applicable, biosimilar strategies could influence future competition remotely related to iron chelation therapies.

Challenges

- Price Erosion: Continual decline in prices, especially in markets with aggressive generic competition.

- Regulatory Delays: Stringent requirements can delay approval of new formulations or indications.

- Patient Compliance: Cost sensitivity affects adherence, influencing sales volumes.

Price Projection Outlook

Based on current trends and market dynamics, the following projections are reasonable:

- Short-Term (1–3 years): Brand-name prices will stabilize or slightly decline due to increased generic competition; average retail prices may decrease by 10–15%. In emerging markets, prices will remain significantly lower due to local manufacturing and negotiations.

- Mid to Long-Term (4–8 years): With patent expiries and market saturation, expect a sharp decline in brand-name prices, potentially dropping by 30–50%. Generics are likely to dominate market share, especially in cost-sensitive regions, exerting further downward pressure.

- Influencing Factors: Regulatory approvals, patent expiry timelines, uptake of biosimilars, healthcare policy changes, and emerging indications will fine-tune these forecasts.

Impact of Biosimilars and Future Innovations

Though deferasirox has no biosimilar equivalents, innovations such as improved formulations, extended-release versions, and combination therapies could influence market share and pricing. Emerging competitors focusing on oral chelators with enhanced safety profiles could challenge deferasirox’s dominance, affecting future price trajectories.

Key Takeaways

- The global deferasirox market is expected to grow modestly, driven by increasing prevalence of iron overload conditions and expanding worldwide access.

- Patent expirations have catalyzed widespread generic entry, significantly lowering prices, especially in mature markets like Europe and the US.

- Price erosion is inevitable; companies focusing on innovation, expanded indications, and strategic pricing will better position themselves.

- Emerging markets represent crucial growth areas with cost-driven pricing strategies enabling broader patient access.

- Regulatory, patent, and competitive factors will remain primary determinants of future pricing trajectories.

FAQs

1. How will patent expiries impact the price of deferasirox?

Patent expiries enable generic manufacturers to enter the market, increasing competition and significantly reducing prices for deferasirox, especially in regions like Europe and the US.

2. Are there upcoming regulatory or patent changes that could affect the market?

Yes. The expiration of key patents, such as Jadenu’s in 2025 in the US, will catalyze generic entry, influencing pricing and market share dynamics.

3. How does the availability of generics influence access in low-income regions?

Generics drastically reduce costs, making deferasirox more accessible in low-income markets, thereby expanding treatment coverage but also intensifying price competition for existing brands.

4. What growth opportunities exist beyond traditional markets?

Expanding indications, combination therapies, and formulations with improved safety profiles present future growth avenues, especially in emerging markets.

5. How might new innovations in iron chelation therapy affect deferasirox's market position?

Innovations that improve safety, adherence, or reinforce efficacy could challenge deferasirox’s market dominance, influencing pricing and formulary decisions.

References

- MarketWatch. Global Deferasirox Market Outlook, 2022-2028.

- IQVIA. Hematology and Oncology Market Data, 2022.

- U.S. Food and Drug Administration. Patent and exclusivity information for deferasirox.

- European Medicines Agency. Approval and patent status of deferasirox formulations.

- K Industry Reports. Competitive landscape of iron chelators.

Note: All data points are estimates based on publicly available sources and industry trends up to 2023.