Share This Page

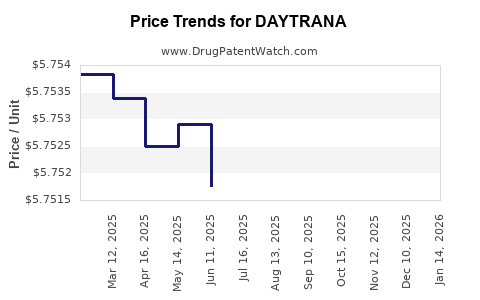

Drug Price Trends for DAYTRANA

✉ Email this page to a colleague

Average Pharmacy Cost for DAYTRANA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DAYTRANA 30 MG/9 HOUR PATCH | 68968-5555-03 | 5.77446 | EACH | 2025-11-19 |

| DAYTRANA 10 MG/9 HR PATCH | 68968-5552-01 | 5.76675 | EACH | 2025-11-19 |

| DAYTRANA 10 MG/9 HR PATCH | 68968-5552-03 | 5.76675 | EACH | 2025-11-19 |

| DAYTRANA 15 MG/9 HR PATCH | 68968-5553-03 | 5.74736 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DAYTRANA

Introduction

DAYTRANA, a transdermal patch delivering methylphenidate, is a prominent pharmaceutical product employed primarily for Attention Deficit Hyperactivity Disorder (ADHD) management. Approved by the FDA in 2006, DAYTRANA offers an alternative to oral stimulants, leveraging transdermal delivery to ensure steady plasma concentrations, improved adherence, and reduced gastrointestinal side effects. As ADHD diagnoses continue to rise globally, understanding the market dynamics, competitive landscape, and future pricing trends for DAYTRANA is imperative for stakeholders—pharmaceutical companies, healthcare providers, investors, and policymakers.

Market Overview

Global ADHD Market Growth

The global ADHD drug market was valued at approximately USD 14 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4-6% through 2030, driven by increased awareness, diagnosis rates, and prescription rates across North America, Europe, and Asia-Pacific (APAC). The growth trajectory underscores strong demand for both stimulant and non-stimulant medications.

Industry Position of DAYTRANA

Within the stimulant segment, DAYTRANA holds a niche market share, mainly favored in pediatric populations and among patients requiring alternative delivery forms. Despite competition from oral formulations like Concerta, Vyvanse, and other transdermal options such as Quillivant XR, DAYTRANA benefits from its unique patch design, which offers prolonged release over 9 hours, ease of use, and improved compliance.

Key Market Drivers

- Rising ADHD Diagnoses: The CDC estimates 9.4% of children aged 3-17 are diagnosed with ADHD in the U.S. alone, with similar trends observed worldwide (CDC, 2022).

- Preference for Non-Oral Delivery: Patients with swallowing issues or preference for patch-based administration favor DAYTRANA.

- Innovations in Drug Delivery: Advances in transdermal technology bolster its therapeutic appeal.

- Off-Label Uses: Emerging off-label applications expand its potential market.

Market Challenges

- Pricing and Reimbursement: Coverage variability influences market penetration.

- Competitive Landscape: Increasing availability of generics and alternative formulations exert pressure on prices.

- Adherence Issues: Skin irritation may limit sustained use.

Competitive Landscape

Brand and Generic Competition

While DAYTRANA remains branded and patent-protected, the presence of multiple generic methylphenidate patches and oral alternatives intensifies competition. The expiration of key patents in the U.S. has led to increased generic availability, often resulting in substantial price reductions for comparable products.

Pricing Dynamics

Traditionally, branded patches like DAYTRANA command higher prices due to innovation premiums, whereas generics offer significantly lower costs, influencing overall market share distribution. The price difference for methylphenidate patches in the U.S. can range from double to triple that of equivalent generics.

Price Projections

Current Price Benchmarks

As of 2023, the average wholesale price (AWP) for a 30-day supply of DAYTRANA (30 mg, once daily) ranges between USD 350 and USD 450, depending on the supplier and dosage strength. Insurance reimbursement rates are variable, but often favor generic formulations, pressuring DAYTRANA’s retail pricing.

Future Pricing Trends

1. Patent Expiry Impact:

Given the patency timelines for DAYTRANA's formulation, subsequent patent expiration—likely within the next 2-3 years—will introduce generics, precipitating a steep decline in branded prices. Similar trajectories for other branded ADHD medications indicate price drops of 50-70% post-generic entry.

2. Market Competition and Reimbursement Policies:

Payers are increasingly incentivizing use of generics over branded drugs, pressuring DAYTRANA's pricing structure. Cost-containment measures, including formulary restrictions, may further diminish its market share and profit margins.

3. Innovation and New Delivery Technologies:

Emerging transdermal devices with improved compliance, reduced skin irritation, or combination therapies could influence DAYTRANA's pricing by either expanding its market or replacing it altogether.

4. Regional Variances:

In Europe and APAC, pricing policies and healthcare infrastructure influence adoption and prices. Countries with centralized healthcare systems may negotiate lower prices, whereas the U.S. market tolerates higher premiums due to private insurance coverage.

5. Impact of Off-Patent Competition:

The entry of low-cost generics is anticipated to lead to price reductions of approximately 40-70% within 1-3 years post-patent expiry, aligning with industry observations post-patent cliff for ADHD medications.

Market Entry and Growth Opportunities

- Differentiation: Innovations in patch technology, such as reducing skin irritation or extending duration, can sustain premium pricing.

- Expanding Indications: Off-label uses, such as ADHD in adults, could open new revenue streams.

- Geographical Expansion: Market penetration in emerging economies with rising ADHD awareness can offset domestic price pressures.

Regulatory and Policy Considerations

Healthcare reforms aimed at trade-offs between innovation incentives and cost control will shape the pricing landscape. Policies promoting generics or biosimilars might accelerate price erosion for DAYTRANA. Additionally, patent litigation and exclusivity periods influence timing and magnitude of price adjustments.

Conclusion: Strategic Implications

DAYTRANA's market outlook is characterized by high near-term revenue potential, driven by established brand loyalty and clinical efficacy. However, impending patent expirations and intensifying competition forecast a significant decline in prices, emphasizing the need for strategic innovation, diversification, and market expansion to sustain profitability.

Key Takeaways

- The global ADHD market's growth underscores robust demand for formulations like DAYTRANA.

- Patent expiration within 2-3 years will catalyze generics' market entry, leading to 40-70% price reductions.

- Competitive pricing pressures from generics and formulary restrictions challenge current branded pricing strategies.

- Innovation in drug delivery or expanding indications offer avenues to maintain higher price points.

- Regional differences necessitate tailored pricing and marketing strategies to optimize revenue streams.

FAQs

-

When is DAYTRANA's patent set to expire?

The primary patent for DAYTRANA is expected to expire around 2024-2025, after which generic versions can enter the market. -

What factors influence DAYTRANA's current pricing?

Its price is influenced by manufacturing costs, brand premiums, reimbursement policies, and competition from generics and alternative therapies. -

How will generic entry affect DAYTRANA’s pricing?

Generics typically reduce prices by 50-70%, resulting in significant downward pressure on branded DAYTRANA prices. -

Are there opportunities to extend DAYTRANA’s market life post-patent expiry?

Yes. Innovation in patch technology, exploring new indications, and geographical expansion can prolong its market relevance. -

What are the primary challenges influencing DAYTRANA's future market share?

Key challenges include patent expiry, competition from generics, reimbursement restrictions, and skin irritation issues limiting patient adherence.

References

[1] CDC. (2022). Data and Statistics on ADHD. Centers for Disease Control and Prevention.

[2] Research and Markets. (2023). Global ADHD Drugs Market Report.

[3] IQVIA. (2023). Pharmaceutical Pricing and Reimbursement Data.

[4] FDA. (2006). FDA Approval of DAYTRANA.

[5] Industry reports on drug patent expiries and market dynamics.

More… ↓