Share This Page

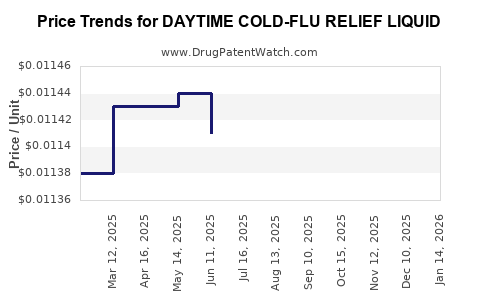

Drug Price Trends for DAYTIME COLD-FLU RELIEF LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for DAYTIME COLD-FLU RELIEF LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DAYTIME COLD-FLU RELIEF LIQUID | 70000-0191-02 | 0.01132 | ML | 2025-12-17 |

| DAYTIME COLD-FLU RELIEF LIQUID | 70000-0191-02 | 0.01140 | ML | 2025-11-19 |

| DAYTIME COLD-FLU RELIEF LIQUID | 70000-0191-02 | 0.01137 | ML | 2025-10-22 |

| DAYTIME COLD-FLU RELIEF LIQUID | 70000-0191-02 | 0.01130 | ML | 2025-09-17 |

| DAYTIME COLD-FLU RELIEF LIQUID | 70000-0191-02 | 0.01132 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for DAYTIME COLD-FLU RELIEF LIQUID

Introduction

The over-the-counter (OTC) drug market for cold and flu remedies remains a robust sector within the broader pharmaceutical industry. Among these, DAYTIME COLD-FLU RELIEF LIQUID caters to a substantial segment, addressing symptoms such as congestion, fever, sore throat, and cough. Analyzing current market dynamics, competitive landscape, regulatory factors, and future pricing trends offers vital insights for stakeholders aiming to optimize investment strategies and market positioning.

Market Landscape and Consumer Demand

The global cold and flu remedy market is projected to reach approximately $12 billion by 2027, growing at a compound annual growth rate (CAGR) of around 4.5% from 2022-2027 [1]. This growth stems from increasing awareness of self-care, aging populations, and recurring seasonal outbreaks.

Daytime formulations like DAYTIME COLD-FLU RELIEF LIQUID target consumers seeking quick symptom relief without disrupting daily activities. These products are favored over nighttime equivalents due to their non-sedative profiles, broad OTC availability, and marketing emphasis on convenience and rapid efficacy.

Market segmentation indicates a dominant share from North American markets, driven by established OTC channels and high consumer health literacy. Emerging markets, particularly in Asia-Pacific, exhibit increasing demand, driven by urbanization, rising disposable income, and expanding pharmacy networks [2].

Competitive Environment

Key competitors encompass both branded OTC products and private-label offerings. Major brands such as Tylenol Cold & Flu, Advil Cold & Sinus, and generic equivalents dominate shelf space. The competitive advantage hinges on formulation efficacy, brand recognition, and regulatory clearance.

Private label variants have gained traction due to lower price points, often compromising on branding but matching efficacy with comparable ingredients such as acetaminophen, phenylephrine, and dextromethorphan. Strategic marketing and shelf positioning remain pivotal in this high-competition sphere.

Innovation within formulations—adding natural ingredients, or combination therapies—also influences market dynamics, though regulatory pathways for new formulations present barriers [3].

Regulatory Dynamics and Impact

The OTC drug market in major regions, especially the U.S., is overseen by bodies like the FDA. Regulatory compliance influences product formulation, labeling, and marketing. Recent regulatory emphasis on safety, such as restrictions on phenylephrine dosing and warnings around pediatric use, affects market offerings and price points.

Importantly, patent status is limited for multi-ingredient OTC drugs, which accelerates generic entry and exerts downward pricing pressure. Nonetheless, innovative delivery forms or combination therapies can create differentiation opportunities and potentially allow for premium pricing.

Pricing Structures and Trends

Historically, the retail price for a 4 oz bottle of DAYTIME COLD-FLU RELIEF LIQUID ranges from $6 to $10, depending on brand, formulation, and retailer. Private label counterparts often retail at $4 to $7, leveraging consumer price sensitivity.

Current retail prices are largely driven by production costs, marketing expenses, and perceived value. The dominant players have maintained relatively stable pricing, while private labels and generics have driven market-wide price erosion over the past five years.

Pricing projections for the next 3-5 years suggest modest increases aligned with inflation and raw material costs. However, market saturation, increased competition from generics, and regulatory price controls (particularly in countries like Canada and parts of Europe) may constrain overall pricing growth [4].

Supply Chain and Cost Factors

Raw material sourcing for active ingredients such as acetaminophen, phenylephrine, and other excipients influences price projections. Supply chain disruptions, notably during global health crises like COVID-19, caused raw material shortages and cost volatility.

Manufacturers are exploring alternative sourcing and economies of scale to mitigate cost pressures. The rising cost of raw ingredients and packaging directly impacts final retail pricing, potentially creating room for premium formulations or combination therapies.

Future Price Projections (2023-2028)

Based on current industry data:

- Base Scenario: Retail prices for DAYTIME COLD-FLU RELIEF LIQUID are expected to increase at an annual rate of 1.5-2%, primarily due to inflation, raw material costs, and marketing investments.

- Optimistic Scenario: Innovations such as natural or organic formulations, or larger package sizes, could command a premium, enabling 3-4% annual price increases.

- Pessimistic Scenario: Regulatory clampdowns or aggressive generic competition may lead to flat or decreasing prices, approximately 0-1% annually.

Overall, average retail prices are projected to hover in the $6.50 - $11 range by 2028, with variations depending on market segment and regional factors.

Market Entry and Pricing Strategies

For new entrants, competitive penetration will require aggressive pricing, product differentiation, and strategic branding. Partnership with established pharmacy chains or online retailers could enhance visibility while enabling targeted pricing strategies.

Leverage formulation innovation, such as combining natural ingredients with existing active components, to justify premium pricing and carve niche markets.

Regulatory and Market Expansion Opportunities

Expanding into emerging markets necessitates compliance with local regulatory standards, which often involve registration fees, local testing, and marketing approvals. Success depends on adapting formulation and packaging to regional preferences, potentially impacting costs and pricing.

In addition, recent trends favoring immune support and natural remedies open avenues for reformulation, which could impact pricing structures positively.

Conclusion

The market for DAYTIME COLD-FLU RELIEF LIQUID remains resilient over the coming years, with modest growth driven by rising global demand, competitive innovation, and evolving consumer preferences. Price stability will be challenged by intense competition and regulatory pressures, though innovation and strategic branding remain key to maintaining profitability.

Stakeholders should monitor raw material costs, regulatory developments, and consumer trends meticulously to adapt pricing strategies accordingly. Emphasis on differentiated formulations and expansion into new markets will be essential in harnessing growth opportunities.

Key Takeaways

- The global OTC cold and flu remedy market is projected to grow at a CAGR of 4.5%, with daytime relief formulations remaining in high demand.

- Pricing for DAYTIME COLD-FLU RELIEF LIQUID is expected to increase modestly, averaging 1.5-2% annually, balancing inflation, raw material costs, and competitive pressures.

- Generic and private-label products are primary competitors, exerting downward price pressure; innovation remains vital for premium pricing.

- Supply chain resilience and formulation innovation will influence cost structures and pricing prospects.

- Regional regulatory environments and market expansion strategies offer both risks and opportunities for pricing and profitability.

FAQs

1. How will increased raw material costs affect the retail price of DAYTIME COLD-FLU RELIEF LIQUID?

Increases in raw material costs—particularly active ingredients—could lead to higher manufacturing costs, prompting manufacturers to adjust retail prices upward. In competitive markets, companies may absorb some costs temporarily but eventually pass them on to consumers, influencing overall pricing trajectories.

2. What role does regulatory policy play in influencing product pricing?

Regulatory policies can affect cost structures through requirements for product safety testing, labeling, and approval processes. Stricter regulations might raise compliance costs, potentially leading to higher retail prices. Conversely, policies promoting competition or price controls can exert downward pressure.

3. Are there significant regional differences in pricing for DAYTIME COLD-FLU RELIEF LIQUID?

Yes. Mature markets like North America and Europe tend to have higher retail prices due to higher regulatory standards, marketing expenses, and consumer willingness to pay. Emerging markets often feature lower prices driven by lower purchasing power and differing regulatory requirements.

4. How might product innovation influence future pricing strategies?

Innovative formulations—such as natural ingredients or combination therapies—can justify higher prices by offering perceived added value. These strategies can enable companies to target premium segments, offsetting competitive price wars in standard formulations.

5. What opportunities exist for new market entrants in the cold-flu OTC sector?

New entrants can capitalize on innovation, such as natural or organic formulations, unique delivery mechanisms, or targeted marketing. Exploring emerging markets and forming strategic partnerships with retail chains are also key opportunities to capture market share.

References

[1] Grand View Research, "Cold & Flu Remedies Market Size & Trends," 2022.

[2] MarketsandMarkets, "OTC Pharmaceutical Market by Type, Region, and Distribution Channel," 2021.

[3] U.S. Food and Drug Administration, OTC Drug Review Updates, 2022.

[4] IBISWorld, "Generic Drug Market Overview," 2022.

More… ↓