Share This Page

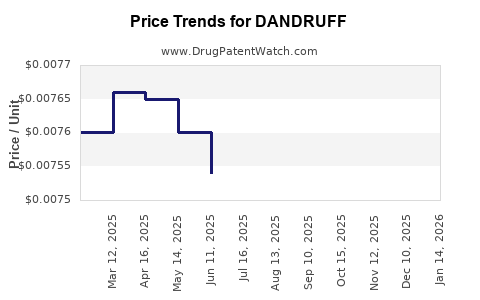

Drug Price Trends for DANDRUFF

✉ Email this page to a colleague

Average Pharmacy Cost for DANDRUFF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| DANDRUFF 1% SHAMPOO | 70000-0533-01 | 0.00725 | ML | 2025-12-17 |

| DANDRUFF 1% SHAMPOO | 70000-0533-01 | 0.00730 | ML | 2025-11-19 |

| DANDRUFF 1% SHAMPOO | 70000-0533-01 | 0.00736 | ML | 2025-10-22 |

| DANDRUFF 1% SHAMPOO | 70000-0533-01 | 0.00744 | ML | 2025-09-17 |

| DANDRUFF 1% SHAMPOO | 70000-0533-01 | 0.00747 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Dandruff Treatment Drugs

Introduction

The global market for dandruff treatments is a significant subset within the broader dermatological pharmaceutical and cosmetic segments. Dandruff, affecting up to 50% of the adult population worldwide, presents ongoing demand for efficacious, affordable, and innovative therapeutic options. As consumer awareness, product innovation, and healthcare investments grow, analyzing market dynamics and price trends becomes crucial for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Overview and Epidemiology

Dandruff, characterized by flaking scalp skin, affects a substantial segment across demographics. Its multifactorial etiology includes Malassezia yeast colonization, seborrheic dermatitis, dry scalp, and other scalp disorders. The prevalence varies worldwide but remains high, generating a steady demand for both over-the-counter (OTC) and prescription solutions.

The global anti-dandruff market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% from 2023 to 2030[1]. Growth drivers include rising awareness, innovations in active ingredients (ketoconazole, zinc pyrithione, selenium sulfide, climbazole), and increased cultural importance of scalp health.

Key Market Segments

Product Types

- OTC shampoos dominate, accounting for roughly 70% of sales, favored for convenience and affordability.

- Prescription medications, including topical antifungals and corticosteroids, serve more severe cases and constitute about 30% of the market.

Active Ingredients

- Zinc pyrithione remains the most widely used, favored for safety profile and efficacy.

- Ketoconazole, a potent antifungal, commands a significant market share, especially in prescribed formulations.

- Selenium sulfide and climbazole offer alternative options with specific efficacy profiles.

Distribution Channels

- Pharmacies (both OTC and prescription)

- E-commerce platforms expanding rapidly

- Beauty and specialty stores

Competitive Landscape

The market features key global players including Procter & Gamble, Unilever, Johnson & Johnson, L’Oréal, and local regional brands. Innovation focuses on both novel formulations and natural ingredient integration.

Recent trends include:

- Eco-friendly and natural formulations, aligned with clean beauty movement.

- Proprietary active compounds and delivery systems enhancing efficacy.

- Combination products targeting multiple scalp issues, such as itching and inflammation.

Regulatory and Patent Landscape

While OTC dandruff shampoos generally face less regulatory oversight, prescription formulations demand rigorous clinical trials and approvals from agencies such as the FDA, EMA, and other regional agencies. Patent protections often cover active compounds, delivery systems, and specific formulations, influencing market exclusivity and pricing strategies.

Patent expirations around commonly used actives like zinc pyrithione and ketoconazole have led to the emergence of generics, exerting downward pressure on prices. Innovations and new patents—particularly for natural or multi-mechanism products—present opportunities for premium pricing.

Pricing Trends and Projections

Current Pricing Landscape

- OTC shampoos range from USD 4 to USD 15 per bottle (250ml to 400ml), with premium brands reaching higher prices owing to marketed benefits or natural ingredients.

- Prescription shampoos such as ketoconazole 2% formulations can cost USD 25 to USD 50 per bottle, often covered partially by insurance.

- Generic equivalents typically retail at 50-70% lower than branded options, intensifying market competition.

Factors Influencing Future Prices

- Patent expiries and the consequent rise of generics will likely drive prices downward.

- Innovative formulations such as plant-based, microbial-derived ingredients, and long-acting formulations may command premium pricing up to USD 20 to USD 30 per treatment cycle.

- Regulatory shifts prompting stricter quality and safety standards might influence premium product formulations and cost structures.

- Market penetration strategies through direct-to-consumer (DTC) channels and e-commerce will influence retail pricing dynamics.

Projected Price Trajectory (2023–2030)

- OTC shampoos are expected to see a modest annual price decrease of about 2-3%, driven by generic competition.

- Premium natural and technologically advanced formulations could maintain or slightly increase in price, with a projected CAGR of 2-4%.

- Prescription drugs may stabilize in price with inflation adjustments but will remain sensitive to patent status and market competition.

Overall, the average retail price for dandruff treatment products will likely decrease in the conventional segment due to increased generic availability but remain stable or increase modestly for innovative, patent-protected solutions.

Emerging Trends and Their Market Implications

Natural and Organic Products

The shift toward clean beauty influences price dynamics, with natural dandruff shampoos often commanding premium prices—up to USD 20-30 per bottle—despite comparable efficacy with conventional counterparts[2]. This segment is expected to expand at a CAGR of 6-8%, influencing market prices upward for specific formulations.

Personalized and Targeted Therapies

Advances in scalp diagnostics and targeted formulations are anticipated to generate higher-priced offerings, especially in prescription segments, potentially reaching USD 50–USD 70 per treatment course.

Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets with increasing disposable incomes.

- Development of natural, organic, and clinically proven formulations.

- Digital marketing strategies leveraging influencer and consumer reviews.

Challenges:

- Intense price competition with generics.

- Regulatory hurdles delaying innovative product launches.

- Consumer skepticism toward efficacy claims, emphasizing the importance of clinical validation.

Key Takeaways

- The dandruff treatment market is mature but retains growth potential driven by innovation, natural formulations, and regional expansion.

- Pricing will decline in standard OTC segments due to generic competition but remain elevated for patented or natural premium products.

- Strategic investments in R&D, regulatory compliance, and branding, particularly in the natural and personalized categories, can deliver competitive advantages.

- The growing prominence of e-commerce will influence pricing strategies, highlighting the need for digital presence and direct-to-consumer offerings.

Conclusion

The landscape for dandruff treatment drugs is characterized by steady growth, evolving consumer preferences, and competitive pricing influenced by patent status and innovation. Companies that focus on differentiating through natural ingredients, advanced delivery systems, and targeted therapies, while optimizing costs and navigating regulatory pathways, will position themselves favorably in this expanding market. Price projections suggest a gradual decline in traditional segments, balanced by opportunities in premium and natural product categories.

FAQs

-

What are the most effective active ingredients in dandruff shampoos?

Zinc pyrithione, ketoconazole, and selenium sulfide remain the most proven active ingredients, with evidence supporting their efficacy against Malassezia yeast and scalp inflammation. -

How will patent expirations affect dandruff drug prices?

Patent expirations typically lead to increased generic sales, reducing prices in the mass market. Innovation in formulations can sustain premium pricing for branded products. -

Are natural dandruff treatments as effective as conventional medications?

Many natural ingredients demonstrate comparable efficacy, especially in mild cases. However, rigorous clinical validation varies, and severe cases may require prescription treatments. -

What regional markets are expected to see the highest growth in dandruff treatment demand?

Emerging markets in Asia-Pacific and Latin America are projected for rapid growth due to increasing disposable income, urbanization, and heightened scalp health awareness. -

What is the outlook for innovation in dandruff therapy over the next five years?

Innovation will likely focus on natural, sustainable ingredients, personalized scalp healthcare solutions, and advanced delivery systems, enabling premium pricing and improved efficacy.

References

[1] MarketDataForecast, "Anti-Dandruff Market," 2023.

[2] Grand View Research, "Natural Hair Care Market," 2022.

More… ↓