Last updated: July 30, 2025

Introduction

Dabigatran etexilate, marketed primarily under the brand name Pradaxa, represents a pivotal oral anticoagulant used for stroke prevention in non-valvular atrial fibrillation (NVAF), treatment and secondary prevention of venous thromboembolism (VTE), and other clot-related conditions. Since its FDA approval in 2010, dabigatran has disrupted traditional warfarin therapy, emphasizing convenience and predictable pharmacokinetics. As the global demand for anticoagulants intensifies driven by aging populations and rising cardiovascular disease prevalence, understanding its market dynamics and pricing trajectory becomes paramount for manufacturers, investors, and healthcare policymakers.

Global Market Size and Growth Trajectory

Current Market Size and Regional Distribution

As of 2022, the global dabigatran market was valued approximately at USD 2.5 billion, with forecasted compounded annual growth rates (CAGRs) around 8-10% through 2027 [1]. North America dominates, driven by high AF prevalence, early adoption, and favorable reimbursement frameworks. The US accounts for over 60% of global sales, owing to extensive healthcare infrastructure and insurance coverage. Europe holds a significant share, with expanding markets in Asia-Pacific driven by rising awareness and healthcare infrastructure development.

Drivers of Market Growth

- Expanding Indications: Dabigatran’s approval for multiple clinical indications broadens its utilization.

- Demographic Shifts: Aging populations increase the incidence of NVAF and VTE, amplifying demand.

- Competitive Dynamics: Introduction of novel oral anticoagulants (NOACs) like rivaroxaban, apixaban, and edoxaban intensify market competition but also expand overall anticoagulant use.

- Healthcare Policy & Reimbursement Trends: Growing recognition of NOACs’ clinical benefits encourages reimbursement and formulary integration.

Market Segmentation

- By Indication: NVAF, VTE, orthopedic surgery prophylaxis.

- By Region: North America (45%), Europe (25%), Asia-Pacific (15%), Latin America and Middle East (15%).

- By Distribution Channel: Hospital pharmacies (70%), retail pharmacies (30%).

Competitive Landscape and Market Share

Multiple pharmaceutical giants participate in the dabigatran market, with Boehringer Ingelheim as the primary patent holder and market leader. Patent expirations are imminent or have occurred in several geographies, exposing the market to generics and biosimilars, which could alter pricing and market share dynamics.

Key Competitors:

- Boehringer Ingelheim: Proprietary brand Pradaxa.

- Emerging Generics: In markets with patent expirations (e.g., Europe, Canada), generic manufacturers are poised to enter, driving prices downward.

- Other NOACs: Rivaroxaban (Xarelto), Apixaban (Eliquis), Edoxaban (Savaysa) dominate alternative therapies, creating a competitive landscape influencing dabigatran’s market share.

Pricing Trends and Forecasts

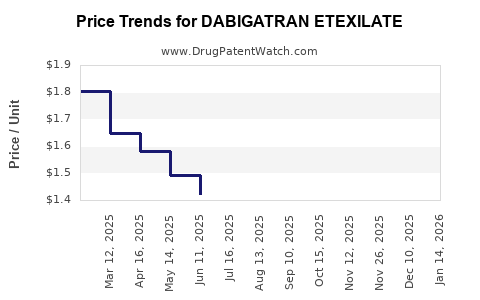

Current Pricing Landscape

In the US, the retail list price for Pradaxa is approximately USD 300-400 for a 30-day supply, with actual reimbursement rates often lower due to negotiated discounts. In Europe, prices vary significantly across countries, with some markets implementing cost containment measures.

Influencing Factors on Price

- Patent Status: Patent exclusivity maintains higher prices. Upcoming patent expirations portend potential price erosion.

- Generic Entry: Post-patent expiration, generic versions could reduce per-unit costs by 50-70%, as seen with other NOACs.

- Reimbursement Policies: Favorable insurance coverage sustains premium pricing; restrictions or formulary shifts can induce discounts.

- Market Penetration and Volume: Increased utilization might offset price reductions through higher overall revenue.

Price Projection (2023–2027)

- Short Term (2023–2024): Stable pricing expected in markets with ongoing patents; minor discounts through pharmacy benefit managers (PBMs) might marginally lower consumer prices.

- Medium Term (2025–2027): Introduction of generics in key markets could lead to price declines of 40-60%. A projected average decrease of 15-20% annually in these regions is reasonable, aligning with patterns observed in other branded pharmaceuticals post-patent expiry.

Forecasting Model Illustration:

| Year |

Estimated Market Price (USD) |

Notes |

| 2023 |

350 |

Brand dominance, stable pricing |

| 2024 |

340 |

Slight discounts, patent protections persist |

| 2025 |

250–300 |

Generic entry in major markets, price erosion begins |

| 2026 |

200–250 |

Increased generic competition, further price cuts |

| 2027 |

180–220 |

Mature generics, pricing stabilizes at lower levels |

Regulatory and Economic Factors Affecting the Market

- Patent Expirations: The EU patent for Pradaxa expired in 2022, opening the market to generics. US patent status faces legal challenges, with expiration expected circa 2024.

- Pricing Regulations: Countries adopting strict drug price controls (e.g., Germany, UK) are likely to accelerate price reductions.

- Cost-Effectiveness Analysis: Demonstrates that NOACs, including dabigatran, are cost-effective compared to warfarin due to reduced monitoring costs and lower adverse events.

Implications for Industry Stakeholders

Manufacturers must strategize around impending patent cliffs, potentially transitioning to biosimilar production or emphasizing innovative formulations to sustain revenue. Strategic collaborations and licensing agreements could delay generic erosion or diversify revenue streams. Payers and policymakers should monitor cost-effectiveness evaluations that influence formulary decisions, shaping demand and pricing.

Key Market Challenges and Opportunities

Challenges:

- Patent expiration and generic competition threaten profit margins.

- Intensity of price erosion in mature markets.

- Competition from other NOACs with varying efficacy and safety profiles.

Opportunities:

- Expansion into emerging markets with growing cardiovascular disease burden.

- Development of fixed-dose combination therapies.

- Innovations in drug delivery systems enhancing patient adherence.

Conclusion

Dabigatran etexilate remains a cornerstone in anticoagulation therapy with a strong foothold in global markets. However, impending patent expirations and evolving competitive landscapes underscore the importance of dynamic pricing strategies and robust pipeline development. Industry players must adapt rapidly to maintain market share and profitability, leveraging innovated formulations and regional expansion. Careful monitoring of regulatory developments and market entry timings will be vital for informed decision-making.

Key Takeaways

- The global dabigatran market is projected to grow at 8–10% annually through 2027, driven by demographic shifts and expanding indications.

- North America dominates the market, with Europe and Asia-Pacific offering substantial growth opportunities.

- Patent expiries in key jurisdictions will catalyze generic entry, precipitating significant price reductions (up to 50–70%) over the next few years.

- Strategic planning around patent cliffs, competitive positioning, and regional reimbursement profiles is essential.

- Investment in biosimilars, combination therapies, and innovative delivery methods can offset revenue declines post-patent expiration.

FAQs

-

When will generic versions of dabigatran become available in key markets?

Patent expiration in the EU occurred in 2022, with US patent expiry projected around 2024. These timelines will facilitate generic entry shortly thereafter, contingent upon regulatory and legal proceedings.

-

How does dabigatran’s pricing compare to other NOACs?

Generally, dabigatran’s price point is similar to rivaroxaban and apixaban in the US but varies regionally. Generics are expected to lower prices significantly, aligning dabigatran’s costs with other budget-friendly options.

-

What are the main drivers influencing dabigatran’s market share?

The primary factors include clinical efficacy, safety profile, reimbursement policies, patent status, and the competitive landscape of other NOACs.

-

What strategies can manufacturers employ post-patent expiry?

Developing biosimilars, innovating formulations (e.g., fixed-dose combinations), expanding regional markets, and pursuing lifecycle management can protect revenue streams.

-

How will healthcare policies affect dabigatran’s future pricing?

Cost containment initiatives and value-based pricing models are likely to exert downward pressure on prices, especially in countries with strict healthcare budgets.

Sources:

[1] GlobalData. "Anticoagulants Market Analysis," 2022.