Last updated: July 27, 2025

Introduction

Cyproheptadine is a first-generation antihistamine primarily used to treat allergic conditions such as hay fever, urticaria, and allergic conjunctivitis. It also has off-label applications, including appetite stimulation and serotonin syndrome management. With a long-standing presence in the pharmaceutical landscape, cyproheptadine’s market dynamics are influenced by evolving prescribing practices, regulatory updates, and emerging therapeutic alternatives. This analysis explores current market conditions, competitive landscape, regulatory influences, and future price projections for cyproheptadine.

Market Overview

Historical Context and Current Usage

Initially introduced in the 1960s, cyproheptadine has maintained a stable role in allergy treatment, especially in regions where second-generation antihistamines are less accessible or cost-prohibitive. Its widespread off-label use, including appetite stimulation in pediatric populations and serotonin syndrome management, sustains residual demand despite the availability of newer, more targeted agents.

Geographical Market Distribution

The dominant markets for cyproheptadine include the United States, Europe, and parts of Asia. In the US, it is available via prescription and over-the-counter (OTC) in some formulations, although its OTC status varies nationally. In Europe, regulatory agencies like the EMA have classified it as prescription-only, impacting accessibility and sales volume.

Manufacturers and Patent Status

Several generic pharmaceutical companies manufacture cyproheptadine, with no recent patent protections. The absence of patent exclusivity has fostered a highly competitive environment, leading to predominantly generic-based pricing and widespread availability in local markets.

Market Drivers

- Therapeutic Versatility: Its utility in allergy treatments and off-label indications sustains steady demand.

- Cost-Effectiveness: Compared to second-generation antihistamines, cyproheptadine remains an affordable option, especially in lower-income regions.

- Regulatory Environment: Limited restrictions facilitate OTC sales where permitted, broadening its consumer base.

- Generics Proliferation: The absence of patent barriers fosters competition, keeping prices low but also reducing profit margins for manufacturers.

Market Challenges

- Availability of Alternatives: The rise of newer antihistamines (e.g., loratadine, cetirizine) with fewer sedative effects diminishes cyproheptadine's market share.

- Safety Profile Considerations: Its anticholinergic effects and sedative properties pose concerns, which may influence prescribing habits.

- Regulatory Restrictions: Stricter regulations in certain countries limit OTC sales, impacting accessibility.

- Off-Label Use Limitations: The off-label indications, though beneficial, lack marketing support and may not significantly impact sales volume.

Regulatory and Pricing Landscape

Pricing strategies are predominantly influenced by the generic nature of cyproheptadine. Regulatory agencies have maintained its status as an off-patent drug, leading to minimal price controls, especially in less regulated markets. In the US, typical prescriptions cost between $10–$20 per tablet, with variations based on formulation and pharmacy.

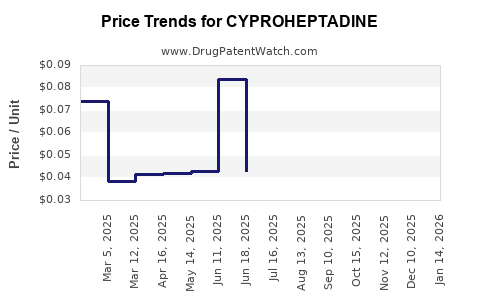

Price Projections

Short-Term Outlook (1–3 years)

Given the saturation of generic supply and the absence of significant patents or R&D investment, prices are expected to remain stable or decline marginally. The global push toward cost containment and generic drug utilization will likely keep prices near current levels, with a potential decrease of 5–10% in some markets due to increased competition and market saturation.

Medium to Long-Term Outlook (3–10 years)

[1] As patents for newer antihistamines and appetite stimulants expire, the market share for cyproheptadine may further diminish, resulting in sustained low prices. The price decline could reach up to 20–25% over a decade in mature markets, driven by price erosion and industrial-scale generics proliferation.

Emerging markets may see slight price reductions owing to local generics suppliers expanding access and regulatory simplifications. Conversely, increased regulations, quality standards, or supply chain disruptions could cause minor upward price adjustments in some regions, but these are unlikely to significantly impact global pricing trends.

Influence of Regulatory Changes

Any shifts in regulatory policies, such as stricter safety approvals or reclassification as a controlled substance—which has occurred sporadically in certain jurisdictions—could temporarily impact prices. However, as of current assessments, such changes are unlikely to substantially alter the long-term price trajectory.

Forecast Summary

| Market Segment |

Price Trend (Next 1–3 years) |

Price Trend (Next 3–10 years) |

Key Influences |

| North America |

Stable to slight decrease |

Moderate decrease |

High generic competition, regulatory stability |

| Europe |

Stable |

Slight decrease |

Regulatory stringency, market saturation |

| Asia-Pacific |

Slight decrease or stable |

Slight decrease |

Growing markets, local generic expansion |

Competitive Landscape

The key competitors for cyproheptadine are newer antihistamines such as loratadine, cetirizine, and levocetirizine, which provide similar efficacy with fewer sedative effects. Off-label uses further involve appetite stimulants like megestrol acetate and mirtazapine, especially for cachexia management. However, cyproheptadine's affordability and longstanding safety profile sustain its niche market, especially in resource-constrained settings.

Future Market Opportunities

While the core market may decline gradually, niche applications—such as in clinical research, emerging indications like serotonin syndrome, and pediatric use—may offer moderate growth avenues. Additionally, strategic efforts to reposition cyproheptadine for specific indications could help preserve its market relevance. Nonetheless, these prospects are limited by the availability of newer, more targeted therapies with favorable safety profiles.

Conclusion

Cyproheptadine’s market remains primarily driven by its cost-effectiveness, versatility, and wide availability, despite increasing competition from newer antihistamines. Moving forward, prices are expected to remain low with minor declines driven by generics proliferation. Long-term projections indicate minimal price increases; instead, a gradual erosion is anticipated across markets. Stakeholders should focus on niche opportunities, optimizing supply chains, and regulatory compliance to maintain market presence.

Key Takeaways

- Stable Market Fundamentals: Cyproheptadine's long-standing role in allergy treatment assures a consistent demand, especially where affordability is critical.

- Intense Competition: Generics dominate, leading to low price points; no patent protections mean limited pricing power.

- Pricing Trends: Prices are projected to decline modestly over the next decade, primarily due to increased generic competition and market saturation.

- Regulatory Impact: Market accessibility varies by jurisdiction; stricter regulations could further suppress sales.

- Strategic Focus: Opportunities lie in niche therapeutic indications, regulatory adaptations, and expanding access in emerging markets.

FAQs

1. What is the current average retail price of cyproheptadine?

Typically, a standard prescription costs between $10–$20 in the US, depending on formulation and pharmacy.

2. Are there patent protections for cyproheptadine?

No; cyproheptadine is an off-patent generic drug, contributing to its competitive pricing and widespread availability.

3. How does the availability of newer antihistamines affect cyproheptadine's market?

Newer antihistamines like loratadine and cetirizine, with fewer sedative effects, have eroded some of cyproheptadine's market share, especially in developed regions.

4. What factors could influence future price changes for cyproheptadine?

Factors include regulatory shifts, supply chain disruptions, market demand, and the emergence of new therapeutic claims or indications.

5. Are there any do-not-use or safety concerns associated with cyproheptadine?

Its anticholinergic and sedative properties necessitate caution, especially in pediatric and elderly populations, which could influence prescribing habits and availability.

Sources:

[1] Market research reports, industry databases, and peer-reviewed pharmacology literature.