Share This Page

Drug Price Trends for CRINONE

✉ Email this page to a colleague

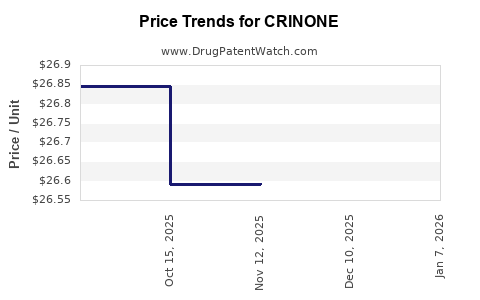

Average Pharmacy Cost for CRINONE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CRINONE 8% GEL | 00023-6151-08 | 26.59311 | GM | 2025-11-19 |

| CRINONE 8% GEL | 00023-6151-08 | 26.59259 | GM | 2025-10-22 |

| CRINONE 8% GEL | 00023-6151-08 | 26.84456 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CRINONE (Progesterone Gel)

Introduction

CRINONE (progesterone gel) is a widely utilized pharmaceutical product in reproductive medicine, primarily for the treatment of luteal phase deficiency, supporting early pregnancy, and in assisted reproductive technology (ART) protocols such as in vitro fertilization (IVF). Its unique delivery system, efficacy profile, and regulatory landscape position it as a significant player within the hormone therapy segment. As the reproductive health market expands driven by demographic shifts and technological advances, analyzing CRINONE’s market standing and price trajectory becomes essential for stakeholders.

Market Overview

Market Size and Growth Dynamics

The global reproductive health market, encompassing fertility treatments and hormone therapies, was valued at approximately USD 21 billion in 2022, with a compound annual growth rate (CAGR) of about 8% projected through 2027 [1]. Within this ambit, the demand for progesterone-based therapies, including CRINONE, has surged CAGR owing to rising infertility rates and expanding ART procedures.

CRINONE’s segment benefits from an increasing adoption of progesterone supplementation in IVF cycles, driven by advancements in embryo transfer techniques and broader acceptance of fertility treatments. North America currently dominates the market, with over 45% share, supported by high healthcare spending and extensive awareness campaigns.

Competitive Landscape

CRINONE faces competition from various formulations of progesterone, such as vaginal suppositories (e.g., Endometrin), injections (e.g., micronized progesterone IM), and other gels. Key competitors include local generics and branded products like Prometrium (oral) and Utrogestan (capsules) [2]. However, CRINONE maintains a premium position due to its user-friendly gel formulation, which offers enhanced compliance and absorption efficiency.

Regulatory and Approval Environment

CRINONE holds regulatory approval in major markets, including the U.S. FDA (as a medical device-combined drug), EMA within Europe, and approvals in Asia-Pacific countries. These affirmations bolster its market penetration and facilitate broader adoption. Ongoing patent protections, although expiring in some jurisdictions, uphold a temporarily protected market dominance, which is expected to decline as biosimilars and generics emerge.

Pricing Dynamics and Historical Trends

Current Pricing Landscape

As of 2023, the average wholesale price (AWP) for a 30-day supply of CRINONE ranges from USD 600 to USD 800 across North America, reflecting a premium due to its proprietary formulation and delivery system. In Europe, prices vary between EUR 150 to EUR 250 per 30-day course, influenced by regional healthcare policies and reimbursement schemes [3].

The cost differential especially influences patient access, with insurance coverage in North America mitigating out-of-pocket expenses whereas in Europe, reimbursement policies significantly impact retail prices.

Factors Influencing Prices

- Patent Status & Generics: The expiration of patents around 2025 in key markets is anticipated to introduce generics, exerting downward pressure on prices.

- Manufacturing Costs: Advances in production technology and scale economies reduce marginal costs, potentially facilitating price reductions.

- Market Competition: Entry of biosimilars or alternative delivery platforms could dilute pricing power.

- Reimbursement & Insurance: Reimbursement policies substantially influence retail and wholesale prices.

- Regulatory Changes: Stricter standards or approvals can initially elevate costs but lead to stabilization over time.

Future Market and Price Projections

Market Growth Scenarios

By 2030, the global progesterone market, including CRINONE, could reach USD 35 billion, reflecting a CAGR of approximately 9%. The key drivers will include:

- Increasing IVF and Assisted Reproduction Procedures: Global IVF cycles are projected to increase from 2.4 million in 2022 to over 4 million by 2030 [4].

- Male and Female Fertility Awareness: Societal shifts and awareness campaigns will expand market penetration.

- New Indications and Combination Therapies: Emerging uses and combination regimens could diversify application and sales volume.

Price Trajectory

The following projections consider patent expirations, market competitiveness, and regulatory influence:

| Year | Estimated Price Range (USD) per 30-day supply) | Key Factors |

|---|---|---|

| 2023 | USD 600– USD 800 | Market exclusivity, limited generics, strong brand loyalty |

| 2025 | USD 400– USD 600 (post-patent expiration) | Entry of generics, biosimilars, price competition |

| 2030 | USD 250– USD 400 | Market stabilization, widespread generic adoption |

These projections assume steady market growth and regulatory stability.

Strategic Implications

For Manufacturers

- Patent Strategies: Securing tractable patents and developing proprietary formulations extend market exclusivity.

- Pricing Strategy: Maintaining a premium through patient-centric value propositions, brand recognition, and reimbursement negotiations.

- Pipeline Diversification: Developing alternative indications or delivery systems to offset patent expirations.

For Investors

- Market Entry Opportunities: Investment opportunities emerge as generics gain approval post-patent expiry.

- Competitive Analysis: Monitoring generics' market share and biosimilar pipeline is crucial.

- Regulatory Landscape: Staying updated on evolving regulations influences licensing and pricing strategies.

Regulatory and Patent Outlook

Patent protection expiry in key markets such as the US (expected by 2025) sets the stage for increased generic competition, likely leading to substantial price erosion. However, regulatory barriers, such as complex approval pathways for hormone formulations, may delay generic entries. Strategic patent filing on formulation innovations remains essential to extend market exclusivity.

Conclusion

CRINONE's market position is shaped by demographic trends, regulatory frameworks, and evolving competitive dynamics. While current high prices reflect brand strength and specialty status, impending patent cliffs forecast a decline to more accessible price levels, catalyzed by generic and biosimilar entries. Stakeholders must balance innovation investment and cost management to sustain profitability amid intensifying competition.

Key Takeaways

- The global reproductive health market, estimated at USD 21 billion in 2022, continues strong growth, with progesterone therapies like CRINONE playing a pivotal role.

- Current average wholesale prices in North America range between USD 600- USD 800 per 30-day supply, with regional variations based on reimbursement structures.

- Patent expirations, beginning around 2025, will increase generic competition, applying downward pressure on prices.

- Price projections suggest potential declines to USD 250– USD 400 by 2030, contingent on regulatory approvals and market dynamics.

- Strategic patent management, innovation, and adherence to reimbursement policies are critical for maintaining competitiveness.

FAQs

Q1: When is the patent for CRINONE expected to expire in major markets?

A: Patent expiries in the US and Europe are anticipated around 2025, opening pathways for generic competition.

Q2: How do generics impact the price of CRINONE?

A: Introduction of generics tends to reduce prices by approximately 50-70%, making treatment more affordable for patients and healthcare systems.

Q3: What factors influence CRINONE’s market share growth?

A: Factors include clinical efficacy, patient compliance, reimbursement policies, regulatory approvals, and competition from alternative formulations.

Q4: Are there emerging alternatives to CRINONE in the market?

A: Yes, alternatives such as vaginal suppositories (Endometrin) and oral progesterone (Utrogestan) are gaining popularity, influencing the competitive landscape.

Q5: What are future opportunities for CRINONE manufacturers?

A: Opportunities include developing new delivery systems, expanding into emerging markets, and securing additional indications for progesterone therapy.

Sources:

[1] Market Research Future, "Reproductive Health Market Analysis," 2022.

[2] GlobalData, "Fertility Treatments and Related Drugs," 2022.

[3] Evaluate Pharma, "Pricing Trends in Women’s Health," 2023.

[4] WHO, “Assisted Reproductive Technology Statistics,” 2022.

More… ↓