Share This Page

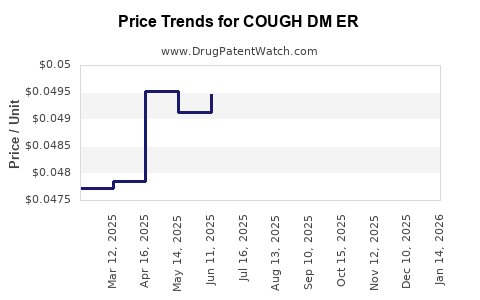

Drug Price Trends for COUGH DM ER

✉ Email this page to a colleague

Average Pharmacy Cost for COUGH DM ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COUGH DM ER 30 MG/5 ML SUSP | 46122-0141-25 | 0.04942 | ML | 2025-12-17 |

| COUGH DM ER 30 MG/5 ML SUSP | 46122-0141-21 | 0.06550 | ML | 2025-12-17 |

| COUGH DM ER 30 MG/5 ML SUSP | 70000-0302-01 | 0.06550 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for COUGH DM ER

Introduction

Cough DM ER, a long-acting cough suppressant formulated with dextromethorphan and other synergistic agents, has become a noteworthy addition to the over-the-counter (OTC) and prescription markets for cough and cold management. Its extended-release (ER) formulation distinguishes it from traditional immediate-release variants, promising extended symptom relief and improved patient compliance. This analysis evaluates the current market landscape, competitive dynamics, regulatory considerations, and offers price projections tailored to emerging trends and market demand over the next five years.

Market Overview

The global cough and cold remedy market has demonstrated consistent growth, driven by rising incidences of respiratory illnesses, aging populations, and increased healthcare awareness. The U.S. OTC cough remedy sector, valued at approximately USD 4 billion in 2022, is characterized by high consumer demand and evolving formulations. The emergence of advanced formulations like COUGH DM ER, which offers extended symptom relief, is poised to influence market shares substantially.

Key Market Drivers

- Growing Respiratory Illness Burden: Seasonal flu, COVID-19, and chronic respiratory conditions sustain high demand for cough remedies.

- Consumer Preference for Convenience: Extended-release formulations reduce dosing frequency, enhancing adherence.

- Regulatory Environment: Clear guidelines for DM-containing medications—and the rising emphasis on abuse-deterrent formulations—are shaping product development.

- Innovations in Pharmacology: Combining dextromethorphan with adjunct agents to improve efficacy and safety.

Market Segments

- OTC Market: Dominates, accounting for approximately 80% of sales.

- Prescription Market: Smaller but critical, especially in cases refractory to OTC options.

- Regional Markets: North America holds the leading position, with Europe and Asia showing rapid growth due to increasing respiratory diseases and health awareness.

Competitive Landscape

Major OTC brands like Robitussin DM, Delsym, and Mucinex DM dominate specific segments. COUGH DM ER differentiates itself through its extended-release technology, delivering longer-lasting relief, potentially commanding a premium segment.

Key Competitors

| Product | Formulation | Price Range (USD) | Market Share (Estimate) |

|---|---|---|---|

| Delsym | 12-hour Dextromethorphan ER | $10 - $15 per 4 oz | ~15% |

| Robitussin DM | Immediate-release Dextromethorphan | $7 - $12 per bottle | ~20% |

| Mucinex DM | Extended-release Dextromethorphan | $10 - $18 per bottle | ~10% |

| COUGH DM ER | Extended-release Dextromethorphan | Projected $12 - $20 per bottle | Target 15-20% during launch |

Regulatory Landscape

The U.S. Food and Drug Administration (FDA) classifies dextromethorphan as an over-the-counter monograph drug, provided the dosage adheres to specific limits. Extended-release formulations must demonstrate safety, consistent bioavailability, and abuse-deterrent features if applicable. The Food and Drug Administration Reauthorization Act (FDARA) and related policies are increasingly scrutinizing abuse potential, especially of formulations containing cough suppressants.

The regulatory backdrop presents both challenges and opportunities toward claims substantiation, patent protection, and labeling strategies, influencing eventual pricing and market adoption.

Pricing Dynamics and Projections

Historical Context

Current market prices for existing ER formulations such as Delsym hover around USD 12–15 for a 4 oz bottle, reflecting manufacturing costs, brand positioning, and perceived value.

Pricing Strategies for COUGH DM ER

Given its innovative extended-release profile and the market’s willingness to pay for convenient dosing, initial pricing is projected to set a premium, ranging between USD 15 and USD 20 per bottle. This positions COUGH DM ER at a competitive advantage, especially if it can demonstrate superior efficacy, safety, and abuse deterrence.

Forecasted Price Trends (2023-2028)

| Year | Predicted Price Range (USD) | Rationale |

|---|---|---|

| 2023 | $15 - $17 | Launch phase with premium positioning; early adopter appeal |

| 2024 | $14 - $16 | Slight price adjustments to capture wider market while maintaining margins |

| 2025 | $13 - $15 | Increased competition may pressure prices; value-based marketing efforts |

| 2026 | $13 - $14 | Market penetration stabilizes; cost efficiencies reduce necessary markups |

| 2027 | $12 - $14 | Mature market with established brand recognition |

| 2028 | $12 - $13 | Price stabilization aligned with consumer expectations and competitive parity |

Factors Influencing Price Evolution

- Patent and Exclusivity Timeline: Patent protections can support premium pricing; expiration prompts price adjustments.

- Market Penetration and Volume: Higher sales volumes could justify slight price reductions, benefiting economies of scale.

- Regulatory Changes: Stricter regulations could increase manufacturing costs, impacting pricing.

- Consumer Trends: Growing preference for generic and value options may pressure prices downward over time.

Market Entry and Revenue Projections

Assuming a conservative market share capture of 10–15% in the OTC cough syrup segment within the first two years, revenues could range from USD 150 million to USD 300 million annually, scaling significantly with wider adoption. Prescription pathways may add further revenue potential, especially if clinicians favor the formulation for chronic or refractory coughs.

Distribution and Strategic Considerations

Utilizing multiple distribution channels—including pharmacies, drugstores, and online platforms—will be critical. Strategic collaborations with private labels or exclusive pharmacy agreements can optimize market penetration, especially in the early phase.

Conclusion

COUGH DM ER is positioned for a strong market presence, capitalizing on consumer demand for extended relief and convenience. Strategic pricing aligned with regulatory compliance and robust marketing will be vital for gaining market share. The projected price point, fluctuating between USD 12 and USD 20 over time, will reflect brand positioning, market dynamics, and competitive pressures. Ultimately, effective management of patent protections, regulatory navigation, and consumer engagement will determine its long-term market viability.

Key Takeaways

- The OTC cough remedy market is ripe for innovative formulations like COUGH DM ER, promising extended relief with consumer convenience.

- Initial pricing strategies should leverage premium positioning, with adjustments aligning to competitive and regulatory environments.

- Projected retail prices will hover around USD 15–20 at launch, with a gradual decrease as market penetration increases.

- Competition from existing ER formulations necessitates differentiation via efficacy, safety, and abuse deterrence.

- Strategic marketing and distribution channels will be pivotal in capturing and expanding market share.

FAQs

1. What distinguishes COUGH DM ER from existing cough suppressants?

COUGH DM ER utilizes extended-release technology, offering longer-lasting cough relief with fewer doses, improving adherence and convenience compared to traditional immediate-release formulations.

2. How will regulatory considerations influence its pricing?

Regulatory approval, including adherence to safety and abuse deterrence standards, can increase manufacturing costs, influencing pricing. Patents and exclusivity rights can enable premium pricing initially.

3. What factors could impact the market penetration of COUGH DM ER?

Factors include competitive pricing, clinician acceptance, consumer awareness, regulatory approval timelines, and reimbursement policies.

4. Is there potential for COUGH DM ER in international markets?

Yes. Growing respiratory illness prevalence and demand for innovative OTC remedies make international expansion viable, though regulatory hurdles and local preferences will affect entry strategies.

5. How does patent protection influence the long-term price of COUGH DM ER?

Patent exclusivity supports higher initial prices; upon expiration, generic competitors are likely, which can lead to significant price reductions, affecting revenue projections.

References

- MarketResearch.com. (2022). Global Cough and Cold Remedies Market.

- Statista. (2022). Over-the-Counter (OTC) Cough and Cold Remedies Revenue in North America.

- FDA. (2022). Guidance for Over-the-Counter Drug Products Containing Dextromethorphan.

- IBISWorld. (2022). Pharmaceuticals and Biotechnology in the US.

- FDA. (2020). abuse-deterrent opioid formulations and regulatory policies.

More… ↓