Share This Page

Drug Price Trends for COSOPT EYE DROPS

✉ Email this page to a colleague

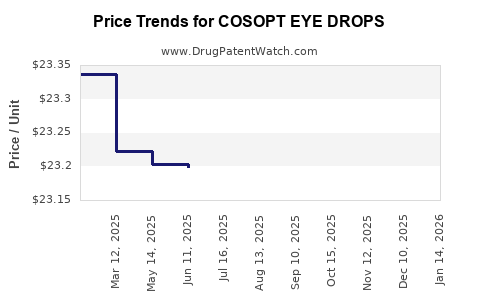

Average Pharmacy Cost for COSOPT EYE DROPS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COSOPT EYE DROPS | 82584-0605-10 | 23.21233 | ML | 2025-12-17 |

| COSOPT EYE DROPS | 82584-0605-10 | 23.20992 | ML | 2025-11-19 |

| COSOPT EYE DROPS | 82584-0605-10 | 23.22533 | ML | 2025-10-22 |

| COSOPT EYE DROPS | 82584-0605-10 | 23.26200 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for COSOPT Eye Drops

Introduction

COSOPT Eye Drops, an ophthalmic solution combining dorzolamide hydrochloride and timolol maleate, is primarily used for managing elevated intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. As a branded pharmaceutical product under Novartis, its market dynamics are influenced by competitive pressure, patent life, regulatory landscape, and emerging treatment alternatives. This analysis explores current market conditions, growth drivers, challenges, and projects pricing trajectories for COSOPT Eye Drops over the upcoming years.

Market Landscape

Market Size and Demographics

Glaucoma remains a leading cause of irreversible blindness worldwide, affecting approximately 76 million individuals globally, projected to reach 111.7 million by 2040 [1]. The increasing prevalence, especially among aging populations in North America, Europe, and parts of Asia, underpins sustained demand for IOP-lowering therapeutics like COSOPT.

The ophthalmic drugs market, valued at USD 6.2 billion in 2022, exhibits a compound annual growth rate (CAGR) of around 4.8%, driven by technological advancements and expanding indications [2]. COSOPT, as a prescribed dual-action agent, captures a significant portion of the fixed-dose combination market, particularly among patients requiring multiple medications.

Competitive Environment

Key competitors include prostaglandin analogs (e.g., latanoprost), beta-blockers (e.g., timolol alone), carbonic anhydrase inhibitors (e.g., brinzolamide), and newer drug classes such as Rho kinase inhibitors. Despite competition, COSOPT benefits from its dual mechanism—reducing aqueous humor production via both dorzolamide and timolol—making it a mainstay for specific patient populations.

However, patent expirations, particularly of some fixed-dose combinations, threaten market share. The imminent expiry of certain formulations could lead to generic entries, exerting downward pressure on pricing.

Regulatory and Reimbursement Landscape

COSOPT's patent protection has historically translated into premium pricing. Nonetheless, regulatory changes facilitating generic approvals and evolving reimbursement policies impact its market positioning. Countries with robust generic pharmaceutical markets, like the U.S. and Europe, are witnessing increased use of biosimilar or generic equivalents, influencing pricing strategies.

Market Drivers

- Rising Glaucoma Burden: Aging demographics and increased screening amplify drug demand.

- Patient Preference for Fixed-Dose Combinations: Simplifies treatment regimens, improving adherence.

- Clinical Efficacy and Safety Profile: Proven track record supports continued prescribing.

- Expanding Ophthalmic Market: Investment in ophthalmic healthcare infrastructure bolsters access.

Market Challenges

- Generic Competition: Patent expiry in select markets incentivizes generic formulations, pressuring prices.

- Pricing Regulations: Governmental controls in major markets often lead to regulated pricing.

- Innovation Pipeline: Emergence of newer agents with improved efficacy or tolerability may cannibalize demand.

Price Projections for COSOPT Eye Drops

Historical Price Trends

Historically, COSOPT maintained a premium price position attributable to brand recognition and patent protections. In the U.S., the average wholesale price (AWP) for a 5 mL bottle hovered around USD 150–180 before patent expiry pressures began mounting. European markets mirrored similar pricing patterns, adjusted for local tariffs and healthcare policies.

Projected Price Trajectory (2023-2028)

-

Short-term (2023–2024): Due to patent protection, prices are expected to remain stable with minimal reductions. Pricing may hover between USD 150–180 per bottle in the US, supported by brand loyalty and insurance reimbursement.

-

Medium-term (2025–2026): Introduction of generics following patent cliff could reduce prices by 20–40%. Brand prices may decline to USD 100–130, while generic counterparts could enter the USD 80–100 range, intensifying price competition.

-

Long-term (2027–2028): Market consolidation and improved access to generics could bring prices down further, potentially averaging USD 70–90 per bottle. Strategic pricing, bundling, and formulary negotiations will further influence actual transaction costs.

Influencing Factors

- Patent litigation and extensions—potentially delaying generic entry.

- Manufacturing costs—scale efficiencies in generics may reduce retail prices.

- Healthcare policy reforms—cost containment measures could impose price caps.

- Market penetration of biosimilars—a trend that could further lower prices.

Implications for Stakeholders

For pharmaceutical companies, understanding these dynamics informs strategic decisions around marketing, patent management, and lifecycle planning. For healthcare payers, pricing forecasts assist in budget allocation and formulary decisions. For providers, cost considerations affect prescribing behaviors, especially in cost-sensitive healthcare systems.

Key Takeaways

- The global glaucoma market continues to grow, underpinning sustained demand for COSOPT Eye Drops.

- Patent protections have historically enabled premium pricing; however, imminent patent expiries will exacerbate price competition.

- Generic entry in mature markets could reduce COSOPT’s price by up to 40% within the next 2–3 years.

- Strategic brand positioning, clinical differentiation, and market access negotiations remain crucial for maintaining profitability.

- Long-term pricing will be shaped increasingly by regulatory policies, biosimilar/generic competition, and healthcare system reforms.

FAQs

Q1: How does patent expiry affect COSOPT’s market pricing?

A: Patent expiry typically facilitates generic entry, leading to significant price reductions—often between 20% and 40%—as generic manufacturers compete on price.

Q2: Are there alternative therapies that could disrupt COSOPT’s market share?

A: Yes. Emerging therapies such as Rho kinase inhibitors and sustained-release devices may offer superior efficacy or convenience, posing a long-term threat.

Q3: How do reimbursement policies influence COSOPT’s pricing?

A: Reimbursement controls and formulary placements can pressure manufacturers to lower prices to maintain market access, especially in countries with strict healthcare budgets.

Q4: What strategies can Novartis adopt to sustain COSOPT’s profitability?

A: Enhancing formulation convenience, expanding into emerging markets, engaging in value-based pricing, and leveraging brand loyalty are viable approaches.

Q5: Will technological advances impact the pricing of ophthalmic drugs like COSOPT?

A: Advances such as biosimilars, personalized medicine, and digital adherence tools could influence pricing structures by increasing competition and improving treatment outcomes.

References

[1] Tham, Y. C., et al. (2014). Global prevalence of glaucoma and projections of blindness estimates. Ophthalmology, 121(11), 2081–2090.

[2] MarketsandMarkets. (2022). Ophthalmic Drugs Market by Product, Application, End User — Global Forecast to 2027.

More… ↓