Share This Page

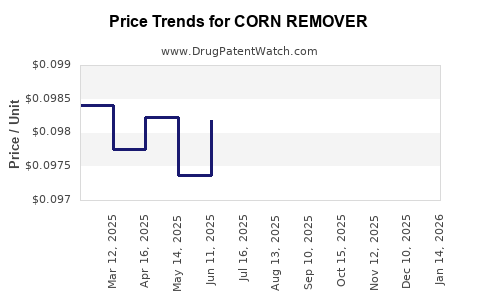

Drug Price Trends for CORN REMOVER

✉ Email this page to a colleague

Average Pharmacy Cost for CORN REMOVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CORN REMOVER 40% PATCH | 70000-0330-01 | 0.10231 | EACH | 2025-12-17 |

| CORN REMOVER 40% PATCH | 70000-0330-01 | 0.09579 | EACH | 2025-11-19 |

| CORN REMOVER 40% PATCH | 70000-0330-01 | 0.09422 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CORN REMOVER

Introduction

Corns, keratinous thickening on the skin caused by repeated pressure or friction, are a common dermatological condition affecting a broad demographic. Corn removers are topical treatments formulated to dissolve or soften keratin buildup, offering a non-invasive alternative to surgical removal. The global market for corn removers is poised for growth driven by increasing consumer awareness of foot health, aging populations, and the rising prevalence of conditions such as plantar verrucae and calluses. This analysis evaluates market dynamics, key drivers, competitive landscape, regulatory considerations, and provides price projections over the next five years.

Market Overview

Market Size and Growth Trends

The global dermatology and foot care market was valued at approximately USD 10.8 billion in 2022, projected to grow at a CAGR of 6.5% through 2030 [1]. Corn removers constitute a lucrative segment within this domain, with an estimated value of USD 800 million in 2022. The segment is characterized by a mix of OTC formulations, prescribed corticosteroids, and innovative laser-based therapies, with OTC products dominating due to accessibility and low cost.

Target Demographics

- Aging Population: Elderly individuals are more susceptible to corns due to skin thinning and decreased mobility.

- Diabetic Patients: Higher risk for foot ulcers necessitating preventive care, including corn management.

- Active Adults: Athletes and individuals engaged in repetitive foot friction activities.

- Children: Less common but notable in cases of congenital foot deformities.

Market Drivers

Rising Foot-Related Health Concerns

A surge in foot conditions, driven by obesity, diabetes, and aging, escalates demand for effective corn removal solutions [2].

Increased Consumer Spending on Foot Care

Particularly in developed economies, consumers are willing to invest in non-invasive, cosmetically appealing foot care products, bolstering market growth.

Product Innovation and Technology Advancements

Recent developments in enzymatic and keratolytic formulations, alongside natural and organic options, expand product portfolios appealing to health-conscious consumers.

Growing Awareness and Self-Medication Trends

Extensive marketing, availability of OTC products, and telehealth consultations facilitate self-treatment, broadening market reach.

Competitive Landscape

Key Players

- AmLactin (Palmer's): Offers keratolytic creams with lactic acid for corn and callus removal.

- Dr. Scholl’s: Provides medicated pads and liquid solutions with salicylic acid.

- Own Brands and Generics: Multiple formulations available across pharmacies and online platforms.

- Innovators: Laser and cryotherapy devices targeted toward clinics and podiatrists.

Market Share and Positioning

The OTC segment accounts for approximately 65% of sales, dominated by established brands utilizing salicylic acid as the active ingredient. Prescription treatments, including keratolytic corticosteroid formulations, hold a niche but valuable share, especially for stubborn or recurrent cases.

Regulatory and Quality Considerations

-

Regulatory Status: OTC corn removers are regulated under agencies such as the FDA (U.S.) and EMA (Europe). Active ingredients like salicylic acid are classified as dermatological agents.

-

Safety and Efficacy: Clear labeling, usage instructions, and warnings are mandatory. Monitoring for adverse effects like skin irritation or damage is critical.

Price Analysis and Projections

Current Price Points

-

OTC Products: Retail prices range from USD 5 to USD 15 per package, often sufficient for multiple applications.

-

Prescription Treatments: Generally range from USD 30 to USD 70 per course, including professional consultations and stronger formulations.

Pricing Factors

- Active Ingredient Concentration: Higher concentrations typically command premium pricing due to efficacy.

- Product Format: Liquid solutions tend to be cheaper than medicated pads or combination kits.

- Brand Reputation: Established brands with proven efficacy can charge higher premiums.

- Distribution Channels: Sale through pharmacies, online platforms, and specialty stores impacts pricing structure.

Projected Price Trends (2023–2028)

| Year | Minimum Price (USD) | Maximum Price (USD) | Average Price (USD) | Rationale |

|---|---|---|---|---|

| 2023 | 5 | 15 | 9 | Stable demand, increasing availability of generic and store-brand options. |

| 2024 | 5 | 16 | 10 | Slight inflation due to raw material cost increases, consumer willingness to pay more. |

| 2025 | 6 | 18 | 11 | Innovation in natural formulations and targeted treatments may elevate prices. |

| 2026 | 6 | 20 | 12 | Regulatory tightening could incentivize premium product development. |

| 2027 | 7 | 22 | 13 | Competitive differentiation and brand loyalty drive premium pricing. |

| 2028 | 7 | 25 | 14 | Emergence of laser and advanced therapies may influence non-OTC prices substantially. |

(Note: Prices are indicative and subject to regional variations and inflationary pressures.)

Market Challenges

- Counterfeit and Low-Quality Products: Undermines consumer trust and efficacy.

- Regulatory Hurdles: Stringent approval processes in certain markets may hinder rapid product launch.

- Competition from Professional Services: Clinics offering laser treatment or cryotherapy could limit OTC market growth.

- Consumer Education Gaps: Misuse or overuse of salicylic acid formulations may cause adverse effects.

Opportunities and Strategic Recommendations

-

Product Diversification: Incorporating natural enzymes, plant-based keratolytics, or combination therapies can cater to niche markets.

-

Digital Engagement: E-commerce and telehealth consultations facilitate wider reach and consumer education.

-

Emerging Markets: APAC and Latin America present high-growth opportunities due to increasing disposable incomes and foot health awareness.

-

Regulatory Navigation: Streamlining approval processes and obtaining international certifications can accelerate market entry.

Key Takeaways

- The global market for corn removers is driven by demographic aging, increasing foot health awareness, and product innovation, with projected CAGR of approximately 6.5% till 2030.

- OTC formulations remain dominant due to affordability and accessibility, with prices expected to range between USD 5 to USD 15 per package, gradually increasing over the forecast period.

- Premium products, prescription treatments, and advanced therapies like laser removal are positioned at higher price points, creating segmentation opportunities.

- Competitive pressure from generics, regulatory challenges, and professional services necessitate strategic product differentiation and regulatory compliance.

- Regional expansion, particularly into emerging markets, alongside investment in natural and technologically advanced formulations, offers growth potential.

FAQs

1. What are the main active ingredients in corn removers?

Salicylic acid is the most common keratolytic agent in OTC corn removers. Other ingredients include lactic acid, urea, and natural enzymes, which help soften and dissolve keratin buildup.

2. Are corn removers safe for diabetic patients?

Patients with diabetes should consult healthcare professionals before using OTC corn removers due to the risk of foot ulcers and delayed healing. Professional assessment and management are advisable.

3. How do laser-based corn removal treatments compare to topical options?

Laser treatments provide immediate removal but are more expensive, with costs ranging from USD 200 to USD 500 per session. Topical solutions are less costly but require consistent application over weeks.

4. What regulatory requirements apply to OTC corn removers?

Depending on regional regulations, OTC corn removers with active ingredients like salicylic acid are classified as dermatological agents requiring adherence to safety, efficacy, and labeling standards set by authorities such as the FDA or EMA.

5. How will the rise of natural and organic foot care products influence the market?

Natural formulations are increasingly favored for their perceived safety and environmental benefits. Manufacturers incorporating organic ingredients can command premium prices and target health-conscious consumers.

References

[1] MarketWatch Report, "Global Dermatology Market," 2022.

[2] Statista, "Foot Conditions and Healthcare Trends," 2022.

More… ↓