Share This Page

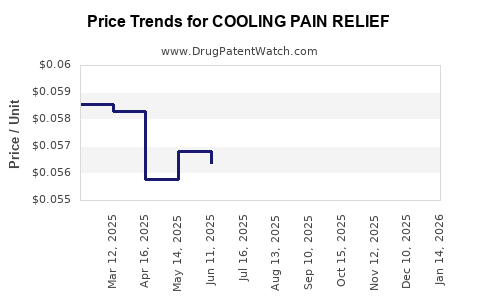

Drug Price Trends for COOLING PAIN RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for COOLING PAIN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COOLING PAIN RELIEF 4% GEL | 70000-0618-01 | 0.05665 | ML | 2025-12-17 |

| COOLING PAIN RELIEF 4% GEL | 70000-0617-01 | 0.06529 | ML | 2025-12-17 |

| COOLING PAIN RELIEF 4% GEL | 70000-0618-01 | 0.05741 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cooling Pain Relief

Introduction

Cooling pain relief products, encompassing topical analgesics such as cooling gels, creams, patches, and sprays, have gained significant market traction owing to their rapid onset of action and perceived safety profile. The demand stems from increasing prevalence of musculoskeletal disorders, sports injuries, and chronic pain conditions, alongside consumer preference for non-systemic pain management solutions. This report offers a comprehensive market analysis and price projection for Cooling Pain Relief, underpinned by current industry trends, competitive dynamics, regulatory influences, and market drivers.

Market Overview

Market Size and Growth Trajectory

The global topical analgesics market, including cooling pain relief products, was valued at approximately USD 4.2 billion in 2022.[1] It is projected to expand at a compound annual growth rate (CAGR) of around 7.8% through 2028.[2] The growth is fueled by increasing awareness of non-opioid pain management options, rising chronic pain prevalence, and expanding usage among athletes and the elderly.

Segment Breakdown and Key Players

The cooling pain relief segment comprises:

- Product Types: Gels, creams, patches, sprays

- Distribution Channels: Pharmacy chains, online platforms, supermarkets, healthcare providers

- Ingredients: Menthol, camphor, eucalyptus oil, and emerging phytochemicals

Major players include Johnson & Johnson (BenGay), Walgreens Boots Alliance (Icy Hot), Generic Pharma companies, and emerging brands leveraging natural ingredients.

Market Drivers and Challenges

Drivers

- Rising Chronic Musculoskeletal Pain: Global surveys indicate a surge in conditions like osteoarthritis, back pain, and sports injuries.[3]

- Shift Toward Non-Opioid Pain Therapies: Regulatory and societal concerns over opioid misuse drive demand for topical analgesics.[4]

- Consumer Preference for Non-Invasive, Fast-Acting Solutions: Immediate relief offered by cooling products aligns with consumer needs.

Challenges

- Regulatory Barriers: Stringent approval processes for new ingredients may hinder innovation.

- Market Saturation: Proliferation of products leads to intense competition, impacting pricing strategies.

- Efficacy Variability and Consumer Perception: Efficacy perceptions influence repeat purchase rates.

Regulatory Landscape

Global Regulatory Frameworks

In the US, the FDA categorizes topical analgesics as over-the-counter (OTC) drugs, requiring monograph compliance or New Drug Application (NDA) approval.[5] Similar frameworks exist in Europe and Asia, with evolving standards emphasizing safety, efficacy, and transparency.

Impact on Market Dynamics

Regulatory approval delays and requirements for clinical data can both restrain and stimulate innovation, influencing pricing strategies for novel formulations.

Competitive Landscape

Innovation in natural, organic cooling agents, and combination formulations with anti-inflammatory properties, is gaining prominence. This shift influences pricing, as premium natural products command higher prices. Established brands benefit from brand loyalty and distribution channels, while newer entrants leverage differentiation and natural formulations.

Price Analysis and Projections

Current Price Points

- Standard Cooling Gels/Creams: USD 5 – USD 15 per 100g tube

- Patches: USD 10 – USD 25 per pack of 4–8 patches

- Sprays: USD 8 – USD 20 per 100ml can

Prices vary based on brand positioning, ingredients, and distribution channel. Natural and organic products tend to carry a premium of approximately 20-30% over conventional formulations.

Pricing Trends and Factors

- Market Penetration and Competition: Competitive markets push prices downward, especially in mass retail channels.

- Premium Segments: Natural and organic variants maintain higher pricing, leveraged by consumer willingness to pay more for perceived safety and natural efficacy.

- Regulatory Costs: New ingredient approvals or patent protections increase costs, impacting final retail pricing.

Projection (2023–2028)

Considering current market dynamics, product innovation, and consumer trends:

- Average Retail Price per Unit: Expected to increase modestly at a CAGR of ~3.5%, reaching USD 8 – USD 18 for standard products by 2028.

- Premium Natural Products: Anticipated to grow at a faster CAGR of ~5.2%, with prices reaching USD 25 – USD 35 per pack.

This growth is driven by premiumization trends and increased consumer focus on natural health products.

Regional Price and Market Variations

- North America: Highest per-unit prices (~USD 12–USD 25), driven by brand dominance, high consumer awareness, and regulatory environment.

- Europe: Slightly lower prices (~USD 10–USD 20), with growth influenced by natural product trends.

- Asia-Pacific: Competitive pricing (~USD 5–USD 15), driven by mass-market products and emerging natural formulations.

Emerging Trends Impacting Pricing

- Personalized Formulations: Customized cooling products, including CBD-infused options, are entering the market, potentially commanding higher prices.

- E-commerce Shift: Online platforms enable direct-to-consumer sales with competitive pricing, alongside premium offerings.

- Sustainability and Natural Ingredients: Eco-friendly packaging and organic ingredients serve as differentiators allowing premium pricing.

Conclusion and Strategic Insights

The Cooling Pain Relief market presents a sound growth outlook, with increasing consumer demand and product innovation shaping pricing strategies. Manufacturers leveraging natural ingredients and differentiation through efficacy claims will sustain higher price points. Conversely, commoditized, mass-market products face downward pricing pressure amidst intense competition.

Pricing projections underscore a moderate upward trend, particularly for premium natural options, aligning with consumer preferences for safer, natural pain relief solutions. Companies should capitalize on innovations, regulatory clarity, and channel diversification to optimize pricing and market share.

Key Takeaways

- The global cooling pain relief market is projected to grow at a CAGR of approximately 7.8% through 2028, driven by rising chronic pain prevalence and consumer preference for non-invasive solutions.

- Current retail prices range from USD 5 to USD 25 per product, with premium natural formulations commanding higher margins.

- Price projections indicate a steady increase, especially for organic and natural variants, with expected CAGR of about 3.5% overall and 5.2% for premium products.

- Regulatory environments significantly influence product development costs, impacting retail pricing strategies.

- Innovation, natural ingredients, and channel expansion are critical to maintaining premium pricing power amidst market saturation.

FAQs

1. How does consumer perception influence pricing in the cooling pain relief market?

Consumer perception of product efficacy, safety, and natural health benefits drives willingness to pay higher prices for premium formulations, especially natural and organic options.

2. What are the main factors impacting the price of cooling pain relief products?

Ingredients used, brand reputation, product innovation, regulatory compliance costs, distribution channels, and natural or organic certifications significantly impact pricing.

3. How does regulatory approval impact market entry and pricing strategies?

Regulatory hurdles increase development costs and time, elevating product prices. Conversely, clear, expedited pathways can allow for more competitive pricing and quicker market penetration.

4. Which regions are expected to see the highest growth in cooling pain relief prices?

North America and Europe will likely see higher premium pricing due to consumer awareness and preferences, with Asia-Pacific following as markets expand and natural formulations gain popularity.

5. What trends could reshape the future pricing landscape?

Personalized formulations, CBD-infused products, eco-friendly packaging, and direct e-commerce sales are trends likely to create new pricing tiers and strategic opportunities.

References

[1] MarketWatch. "Topical Analgesics Market Size & Share Analysis," 2022.

[2] ResearchAndMarkets. "Global Topical Pain Relief Market Forecast," 2023-2028.

[3] WHO. "Musculoskeletal Conditions," 2021.

[4] National Institute on Drug Abuse. "The Opioid Crisis," 2022.

[5] U.S. Food and Drug Administration. "Over-the-Counter Drug Monograph," 2023.

More… ↓