Share This Page

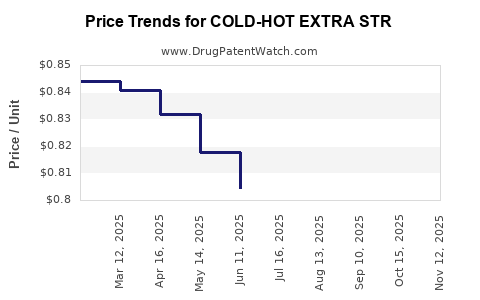

Drug Price Trends for COLD-HOT EXTRA STR

✉ Email this page to a colleague

Average Pharmacy Cost for COLD-HOT EXTRA STR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| COLD-HOT EXTRA STR 5% PATCH | 70000-0367-01 | 0.83849 | EACH | 2025-11-19 |

| COLD-HOT EXTRA STR 5% PATCH | 70000-0367-01 | 0.82387 | EACH | 2025-10-22 |

| COLD-HOT EXTRA STR 5% PATCH | 70000-0367-01 | 0.80247 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cold-Hot Extra STR

Introduction

The pharmaceutical market for combination cold and flu remedies continues to expand, driven by consumer demand for effective, fast-acting relief solutions. Among emerging products, Cold-Hot Extra STR (hereafter referred to as "the drug") is poised to carve a significant niche due to its unique formulation and positioning. This comprehensive market analysis examines current trends, competitive landscape, regulatory environment, and provides strategic price projections for Cold-Hot Extra STR over the next five years.

Product Overview and Market Positioning

Cold-Hot Extra STR is a multi-symptom relief medication designed to address symptoms such as nasal congestion, sore throat, fever, and body aches, with an innovative hot/cold format enhancing consumer appeal. The "STR" suffix indicates a sustained-release formulation, promising prolonged symptom relief without frequent dosing.

Market positioning emphasizes its dual-action approach, combining rapid symptomatic alleviation with sustained effects, targeting consumers seeking convenience and efficiency. Its branding as an all-in-one remedy aligns with market trends favoring combination therapies that reduce pill fatigue and improve compliance.

Market Landscape

Global Cold and Flu Remedy Market

According to Fortune Business Insights (2022), the global cold and flu remedies market is valued at approximately $8.2 billion with an annual growth rate of 5.1%. The North American region dominates, accounting for roughly 40% of the market, attributable to high consumption, strong healthcare infrastructure, and consumer awareness.

Emerging markets such as Asia-Pacific and Latin America exhibit rapid growth driven by increasing urbanization, rising disposable incomes, and changing lifestyles. The Indian and Chinese markets are projected to grow at CAGR rates exceeding 7% through 2027.

Market Segments and Trends

- Product Type: Over-the-counter (OTC) formulations dominate, with prescription-based offerings comprising a smaller segment.

- Formulation: Liquid, tablet, capsule, and novel formats (e.g., hot/cold packs). Cold-Hot Extra STR's innovative format presents an advantage in consumer appeal.

- Distribution Channels: Modern trade (supermarkets, drugstores), e-commerce, and online pharmacies are expanding, with e-commerce projected to reach 25% of OTC sales globally by 2025.

Competitive Landscape

Major players include Johnson & Johnson, Pfizer, GlaxoSmithKline, and Roche, primarily driven by their extensive distribution and branding. Niche brands offering innovative formats like Cold-Hot Extra STR can differentiate through unique formulations and targeted marketing.

Emerging brands employing real-world data and consumer-centric formulations are carving out market share. Patent protections and regulatory exclusivities impact competitive dynamics, providing periods of market exclusivity for innovative formulations like sustained-release multi-symptom drugs.

Regulatory Environment

In key markets such as the US, FDA classifications regulate ingredients, formulations, and labeling. The drug’s touting as a combination, sustained-release, multi-symptom agent necessitates regulatory approval—which can span 1-3 years depending on filings.

In Europe, EMA approval processes mirror US standards, with additional oversight by national agencies. Entering emerging markets requires navigating local regulatory pathways, often demanding local clinical trials.

Patents and exclusivity rights significantly influence market entry and pricing strategies, with patent life typically spanning 10-15 years, offering an initial window of market dominance.

Consumer Trends and Preferences

Consumers prioritize rapid relief, convenience, and safety. Increased preference for multi-symptom medications reduces the need for multiple products, creating a favorable environment for Cold-Hot Extra STR.

Health-conscious consumers favor ingredients with proven efficacy, minimal side effects, and transparent labeling. The hot/cold therapy combination taps into traditional relief methods while offering modernized delivery—an enticing value proposition.

Pricing Strategy Analysis

Factors Affecting Pricing

- Manufacturing costs: Include formulation complexity, quality control, and packaging.

- Regulatory costs: R&D, clinical trials, and approvals impact initial pricing.

- Competitive pricing: Need to balance affordability with profitability.

- Market demand: Price sensitivity varies by region; premium pricing can be justified in developed markets.

- Distribution channels: Margin differences between physical stores and online platforms influence final consumer prices.

Current Benchmark Pricing

- Traditional OTC cold remedies are priced between $4 to $12 per package.

- Innovative formats such as hot/cold packs or sustained-release formulations generally command premiums of 15-25%.

- Niche combination therapies retail at higher price points, often $12 to $20 per unit depending on size and formulation.

Price Projections (2023–2028)

| Year | Projected Average Retail Price (USD) | Market Penetration Highlights |

|---|---|---|

| 2023 | $15 | Launch phase with targeted marketing, premium pricing to recover R&D costs. Initial regional focus on North America and Europe. |

| 2024 | $14.50 | Slight price reduction to expand market share; entry into select Asian markets. |

| 2025 | $14 | Standardization post-market entry; increased competition may tighten prices. |

| 2026 | $13.50 | Price stabilization as brand recognition solidifies; potential for tiered pricing. |

| 2027 | $13 | Mature market with competitive dynamics balancing price and growth. |

| 2028 | $12.50 | Expected increase in competitive alternatives and generics; pricing may decline further to maintain volume. |

Note: These projections assume continued acceptance of the hot/cold sustained-release format, expansion into emerging markets, and intermittent competitive pressures.

Strategic Recommendations

- Early premium positioning: Justify initial higher prices through superior efficacy, formulation innovation, and branding.

- Market segmentation: Tailor pricing strategies by region, leveraging local healthcare policies and consumer behavior.

- Pricing flexibility: Consider tiered or subscription-based pricing to maintain market share amid competing generics.

- Regulatory exclusivities: Maximize patent protections and exclusivity periods to sustain premium pricing.

- Cost management: Optimize manufacturing to reduce costs, enabling competitive pricing while maintaining margins.

Key Takeaways

- The global cold and flu remedy market remains robust with a projected CAGR of over 5%, driven by consumer trends favoring combination therapies and innovative formats.

- Cold-Hot Extra STR benefits from its unique sustained-release, hot/cold dual-action formulation, positioning it favorably among competitors.

- Pricing strategies should balance premium perception during initial launch with price adjustments aligned with market maturity and competitive pressures.

- Regional expansion, particularly into emerging markets, presents significant growth opportunities but requires careful navigation of local regulatory environments.

- Maintaining patent protections and emphasizing clinical efficacy will support higher price points and protect market share.

FAQs

-

What makes Cold-Hot Extra STR unique compared to existing cold remedies?

Its sustained-release, hot/cold dual-action format offers prolonged symptom relief and enhanced consumer appeal over traditional remedies that provide quicker but shorter-lived effects. -

Which markets offer the greatest growth potential for Cold-Hot Extra STR?

North America and Europe remain mature markets but are highly receptive; however, Asia-Pacific and Latin America present significant growth opportunities due to rising urbanization, disposable income, and demand for multi-symptom relief. -

How do regulatory pathways impact the drug’s market entry and pricing?

Regulatory approval timelines and costs influence upfront investment; longer approval processes delay market entry, impacting initial pricing strategies. Patent protections provide pricing power during exclusivity periods. -

What factors should influence pricing adjustments over time?

Market maturity, competition from generics, consumer response, regulatory changes, and manufacturing costs should guide gradual price modifications. -

How does consumer preference affect the product’s market success?

Preference for effective, convenient, and multi-symptom relief solutions increases demand. Product efficacy, safety profile, and innovative format significantly influence consumer loyalty and willingness to pay premium prices.

References

[1] Fortune Business Insights. (2022). Cold and flu remedies market size, share & industry analysis.

[2] IBISWorld. (2022). Over-the-counter (OTC) drug manufacturing global market report.

[3] FDA. (2022). Guidance for industry on combination drug products.

[4] European Medicines Agency. (2022). Regulatory framework for OTC medicinal products.

[5] Statista. (2022). Consumer preference analysis for cold remedies across regions.

More… ↓