Share This Page

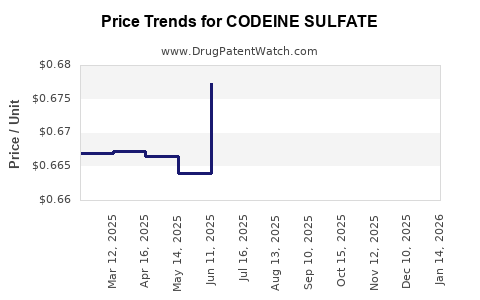

Drug Price Trends for CODEINE SULFATE

✉ Email this page to a colleague

Average Pharmacy Cost for CODEINE SULFATE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CODEINE SULFATE 30 MG TABLET | 00054-0244-25 | 0.67132 | EACH | 2025-11-19 |

| CODEINE SULFATE 30 MG TABLET | 00054-0244-24 | 0.67132 | EACH | 2025-11-19 |

| CODEINE SULFATE 15 MG TABLET | 00054-0243-24 | 0.68457 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Codeine Sulfate

Introduction

Codeine sulfate, a widely prescribed opioid analgesic and antitussive, has long played a pivotal role in pain management and cough suppression. As a Schedule II or III controlled substance in many jurisdictions, its market dynamics are influenced by regulatory changes, patent statuses, manufacturing capacities, and evolving medical guidelines. This report offers a comprehensive analysis of the current market landscape for codeine sulfate and provides forward-looking price projections, empowering stakeholders to make informed decisions.

Market Overview

Historical Context and Market Demand

Historically, codeine sulfate has been a staple in pharmaceutical formulations globally, particularly in combination products for pain relief and cough remedies. Its relatively lower potency compared to other opioids has made it accessible across various healthcare settings, from prescription-based treatment to over-the-counter (OTC) formulations in some regions.

According to IQVIA data and industry reports, worldwide demand for codeine-containing products has ranged between 25,000 to 35,000 metric tons annually over the past five years. The U.S. market alone accounts for approximately 10-15% of global consumption, driven by its widespread use in combination analgesics and cough syrups.

Regulatory Landscape and Impact

Regulatory measures significantly shape the availability and pricing of codeine sulfate. Several countries have tightened controls, limiting OTC sales and imposing stricter prescribing rules. For instance:

- United States: The Drug Enforcement Administration (DEA) classifies combination products containing less than 90mg of codeine per dosage unit as Schedule III and above, reducing illicit diversion and unsupervised consumption.

- European Union: Some countries, like the UK, reclassified codeine-containing products as pharmacy-only or prescription-only, contributing to a decline in OTC sales.

- Australia and Canada: Stricter regulations have led to decreased OTC availability, influencing overall market demand.

These regulatory trends tend to restrict supply and diversify procurement channels, affecting pricing dynamics.

Manufacturing and Supply Chain Considerations

Codeine sulfate synthesis involves plant-derived precursors, often from opium poppies, making supply vulnerable to agricultural and geopolitical factors. Manufacturers operate in a limited number of countries, predominantly China and India, which collectively account for over 70% of global production capacities. Supply chain disruptions, such as those caused by COVID-19 or crop yield fluctuations, have historically led to price volatility.

Market Drivers and Challenges

Factors Driving Market Growth

- Growing Global Pain Management Needs: The rising prevalence of chronic pain conditions and post-surgical pain sustains demand.

- Expansion into Emerging Markets: Increasing healthcare access in countries like India, Brazil, and Southeast Asian nations expands the customer base.

- Combination Products: The continued formulation of codeine in combination medications enhances its therapeutic utility.

Market Challenges

- Regulatory Restrictions: Heightened controls on opioids aim to curb misuse but also limit legitimate access, driving demand shifts toward illicit markets.

- Public Health Initiatives: Initiatives against opioid abuse affect prescribing patterns and demand.

- Introduction of Alternatives: Non-opioid analgesics and abuse-deterrent formulations threaten market share.

Competitive Landscape

Global production is concentrated among a few key players, including Mallinckrodt, Sun Pharmaceutical, and Hetero Labs. These manufacturers have invested in quality assurance and compliance to meet stringent regulatory standards, often resulting in premium pricing, especially for pharmaceutical-grade grade codeine sulfate.

Private label and generic producers further influence pricing by competing on cost efficiencies. The geographic distribution of manufacturing and regional regulation cause variation in available formulations and pricing.

Price Analysis and Projections

Current Pricing Trends

As of Q1 2023, wholesale prices for pharmaceutical-grade codeine sulfate ranges from $150 to $250 per kilogram, influenced by purity, quantity, and supply constraints. Retail prices are substantially higher due to distribution margins, with codesine-containing products retailing at approximately $2 to $4 per 100ml in OTC formulations where permitted, and upwards of $15 to $25 per 100ml in prescription formulations.

Factors Affecting Price Fluctuations

- Supply Chain Disruptions: COVID-19's impact on raw material flow led to temporary price spikes by approximately 15-20% globally.

- Regulatory Changes: Stricter controls in key markets like the UK and US have reduced OTC volume, potentially increasing gross prices for legitimate supply.

- Raw Material Costs: Poppy cultivation costs have witnessed modest increases (~5-10%) reflecting seasonal and geopolitical influences.

- Quality and Purity Standards: Higher purity formulations command premium prices, especially for pharmaceutical use.

Forecasted Price Trajectory (2023-2028)

Based on current trends, regulatory developments, and supply chain forecasts, the price of pharmaceutical-grade codeine sulfate is projected to follow a moderate upward trend:

| Year | Wholesale Price Range ($/kg) | Estimated Retail Price (per 100ml) |

|---|---|---|

| 2023 | 150 - 250 | 2.00 - 4.00 |

| 2024 | 160 - 270 | 2.20 - 4.40 |

| 2025 | 170 - 290 | 2.40 - 4.80 |

| 2026 | 180 - 310 | 2.60 - 5.20 |

| 2027 | 190 - 330 | 2.80 - 5.60 |

| 2028 | 200 - 350 | 3.00 - 6.00 |

This projection assumes continued regulatory tightening in certain markets without significant supply disruptions from primary manufacturing regions.

Influences on Future Prices

- Regulatory Environment: Stricter controls are likely to sustain elevated prices by constraining supply and increasing procurement costs.

- Market Demand in Emerging Economies: A rise in demand may offset supply limitations, supporting higher prices.

- Supply Chain Resilience: Investments in diversification of sourcing and manufacturing capacity may stabilize or moderate prices.

- Patent and Formulation Innovations: While generic formulations dominate, innovations that improve bioavailability or abuse-deterrent features may command premium prices.

Conclusion

The global market for codeine sulfate is characterized by consistent demand, supply concentration, and evolving regulatory controls. Prices are influenced by supply chain vulnerabilities, regional regulations, and medicinal demand. Short-term forecasts project a modest upward trend, driven by geopolitical factors and tightening controls, with potential for stabilization through diversified sourcing and technological adaptations.

Stakeholders should monitor legislative trends and raw material costs to navigate market fluctuations effectively. Given the global opioid landscape’s complexities, strategic procurement, and diversification will be prudent for manufacturers and distributors aiming for price stability.

Key Takeaways

- Demand stability persists in pain management and cough suppression markets, sustaining codeine sulfate’s relevance.

- Regulatory tightening in key jurisdictions is expected to constrain OTC availability, affecting pricing and procurement strategies.

- Supply chain vulnerabilities caused by geopolitical and agricultural factors influence market prices, with potential for fluctuations.

- Price projections indicate a moderate increase (~4-6% annually), contingent on geopolitical stability and regulatory environment.

- Diversification and innovation in formulations and sourcing are crucial for maintaining cost efficiency and supply security.

FAQs

1. How do regulatory policies affect the global market for codeine sulfate?

Regulatory restrictions, such as scheduling and sales limits, directly reduce supply availability and elevate procurement costs, thereby influencing market pricing and demand patterns.

2. What are the main raw material risks for codeine sulfate manufacturing?

Dependence on opium poppy cultivation exposes manufacturers to agricultural yields, geopolitical tensions, and supply disruptions, which can cause price spikes and shortages.

3. Are there emerging alternatives to codeine sulfate in pain management?

Yes, non-opioid analgesics like NSAIDs, acetaminophen, and newer formulations such as tramadol or tapentadol are increasingly used, impacting demand for traditional codeine products.

4. How significant is geographic diversification for stabilizing codeine sulfate prices?

Highly significant; diversifying sourcing from multiple regions reduces dependence on a single supply chain, mitigating risks related to regional disruptions.

5. What impact will technological innovations have on future pricing?

Innovations, especially abuse-deterrent formulations or more bioavailable versions, may command premium prices but could also enhance market stability through increased demand and reduced misuse.

Sources

[1] IQVIA, Global Pain Management Market Data, 2022

[2] U.S. DEA, Scheduling and Regulations, 2023

[3] European Medicines Agency, Opioid Regulations, 2022

[4] Industry Reports on Opioid Market Dynamics, 2023

[5] World Poppy Cultivation Data, FAO, 2022

More… ↓