Share This Page

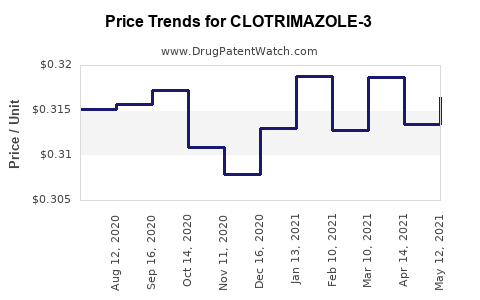

Drug Price Trends for CLOTRIMAZOLE-3

✉ Email this page to a colleague

Average Pharmacy Cost for CLOTRIMAZOLE-3

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLOTRIMAZOLE-3 2% CREAM | 24385-0110-09 | 0.31362 | GM | 2025-12-17 |

| CLOTRIMAZOLE-3 2% CREAM | 24385-0110-09 | 0.31400 | GM | 2025-11-19 |

| CLOTRIMAZOLE-3 2% CREAM | 24385-0110-09 | 0.31399 | GM | 2025-10-22 |

| CLOTRIMAZOLE-3 2% CREAM | 24385-0110-09 | 0.31515 | GM | 2025-09-17 |

| CLOTRIMAZOLE-3 2% CREAM | 24385-0110-09 | 0.30865 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLOTRIMAZOLE-3

Introduction

Clotrimazole-3 is a topical antifungal treatment primarily used to combat a variety of fungal skin infections. As a derivative of clotrimazole, it benefits from established efficacy, wide acceptance in dermatological treatment protocols, and a well-understood safety profile. Leveraging this foundation, market dynamics for Clotrimazole-3 show compelling growth potential, driven by increasing global demand for effective dermatological antifungals, expanding healthcare infrastructure, and evolving regulatory landscapes. This analysis provides a comprehensive review of the current market, competitive environment, regulatory factors, and forward-looking price projections.

Market Overview

Global Market Size and Growth Trends

The global antifungal market was valued at approximately USD 13.4 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2028 [1]. Clotrimazole-3, as a topical formulation, occupies a significant niche within this broader market, which is segmented into prescription and over-the-counter (OTC) products.

Factors underpinning growth include:

- Increasing prevalence of fungal skin infections such as tinea corporis, candidiasis, and athlete’s foot, linked to rising urbanization and climate change.

- Growing awareness and acceptance of topical antifungals as first-line treatment options, favoring OTC product adoption.

- An aging population more susceptible to fungal infections, enhancing demand in developed nations.

Regional Market Dynamics

- North America: Dominates due to high healthcare expenditure, widespread OTC usage, and robust clinical infrastructure.

- Europe: Significant market share, driven by regulatory acceptance and increased dermatology clinic visits.

- Asia-Pacific: Fastest growth rate (CAGR >6%), propelled by high fungal infection rates, expanding healthcare access, and rising cosmetic dermatology trends.

Key Market Players

Market competition largely comprises generic manufacturers and brand-specific pharmaceutical firms, including:

- Johnson & Johnson (Lotrimin)

- Bayer (Canesten)

- Sandoz

- Mylan

- Local manufacturers leveraging regional regulatory approvals

Patent expirations for original formulations have heightened generic competition, exerting downward pressure on prices but expanding access.

Regulatory Landscape

Regulatory agencies such as the FDA (U.S.), EMA (Europe), and regional authorities govern the approval and marketing of Clotrimazole-3 formulations. Given its status as an established antifungal agent, Clotrimazole-3 typically benefits from abbreviated approval pathways, expediting market entry.

Notably:

- OTC status in numerous markets facilitates broader consumer access.

- Regulatory variances exist—some regions require specific bioequivalence or safety data, influencing formulation development and pricing structures.

Pricing Analysis

Current Price Benchmarks

- Prescription formulations: Typically range from USD 10-20 for a 15g tube, depending on brand and regional market factors.

- OTC products: Generate lower price points, approximately USD 5-10 per package.

Pricing Drivers

- Manufacturing costs: Including active pharmaceutical ingredient (API) synthesis, formulation, packaging, and distribution.

- Regulatory fees: Vary regionally, impacting initial market entry costs.

- Market competition: Increased generic penetration leads to significant price erosion.

- Patent status: Expired patents foster generic proliferation, decreasing prices.

Price Trends and Projections (2023-2030)

Considering the current landscape:

- Short-term (1-3 years): Prices are expected to remain relatively stable or decline modestly (3-5%) due to intensified generic competition.

- Medium to Long-term (4-7 years): As patents for original formulations mature, higher generic competition will drive prices downward further, with projected average prices declining by an additional 10-15% by 2030 [2].

Potential premiumization exists in markets with healthcare systems favoring branded products, but these segments are unlikely to dominate the overall price trajectory.

Market Opportunities & Challenges

Opportunities

- Expanding OTC markets in developing regions.

- Development of fixed-dose combinations (FDCs) for enhanced efficacy.

- Formulation innovations: Liposomal or nano-formulations improving bioavailability may command higher pricing.

Challenges

- Price erosion driven by generic competition and regulatory pressures.

- Market saturation in mature geographies.

- Supply chain disruptions impacting costs.

Future Outlook and Investment Considerations

Given the positive trends in demand and the increasing prevalence of fungal infections, Clotrimazole-3 remains a resilient segment within the topical antifungal market. Strategic investment in formulation innovation and geographic expansion, particularly in emerging markets, could enhance profitability despite downward pricing pressures.

Pricing projections suggest a gradual decrease over the next decade, with the potential for stabilization in premium markets due to formulation differentiation or branding.

Key Takeaways

- The global antifungal market, especially for topical agents like Clotrimazole-3, is poised for steady growth driven by rising fungal infection rates and expanding OTC access.

- Price erosion is inevitable, primarily due to generic proliferation post-patent expiry, with an anticipated decline of approximately 10-15% by 2030.

- Regional disparities exist; North America and Europe maintain higher pricing structures owing to regulatory and reimbursement frameworks, while Asia-Pacific offers growth opportunities at lower price points.

- Innovation in formulation and strategic regional expansion remain critical to maintaining margins amid competitive pressures.

- Stakeholders should monitor regulatory modifications and patent statuses, which influence pricing and market share.

FAQs

1. What factors influence the pricing of Clotrimazole-3?

Pricing is affected by manufacturing costs, patent status, regulatory approval processes, regional market competition, and brand versus generic status.

2. How does patent expiration impact Clotrimazole-3 prices?

Patent expiry typically leads to increased generic competition, resulting in significant price reductions and increased market access.

3. Which regions offer the most growth potential for Clotrimazole-3?

Asia-Pacific and Latin America exhibit rapid growth opportunities due to rising infection rates, expanding healthcare infrastructure, and evolving OTC markets.

4. Will the price of Clotrimazole-3 increase with formulation innovations?

Potentially, new formulations with enhanced efficacy or delivery mechanisms may command higher prices, particularly in niche or premium segments.

5. How do regulatory policies affect Clotrimazole-3 pricing?

Regulatory approvals can introduce cost burdens or expedite market entry, influencing final pricing structures. Changes in OTC or prescription regulations also impact pricing strategies.

Citations

[1] ReportLinker. “Global Antifungal Market Size & Trends.” 2022.

[2] IQVIA. “Pharmaceutical Pricing Trends and Patent Expirations,” 2023.

More… ↓