Last updated: July 27, 2025

Introduction

Clotrim, a well-established topical antifungal medication, is primarily utilized for the treatment of fungal infections such as athlete’s foot, candidiasis, and tinea corporis. Known chemically as clotrimazole, it has gained widespread acceptance due to its efficacy, safety profile, and OTC availability in many regions. This analysis explores the current market landscape for Clotrim, evaluates key factors influencing its pricing, and offers price projection insights through 2028.

Market Overview

Global Market Size and Segmentation

The antifungal market was valued at approximately USD 11.5 billion in 2022, with topical formulations constituting about 45% of this value, owing to their ease of use and favorable safety profile [[1]]. Clotrim, as a leading OTC topical antifungal, commands a significant market share within this segment.

The demographic distribution of Clotrim use spans:

- Age: Predominantly used across all age groups, especially in adults aged 20-50.

- Geography: Dominant in North America, Europe, and Asia-Pacific due to high prevalence of fungal infections and OTC accessibility.

Key Players and Competition

Clotrim's market is characterized by intense competition from generic manufacturers, major pharmaceutical companies, and alternative antifungal agents like terbinafine, miconazole, and ketoconazole. Notable brands include Lotrimin, Mycelex, and Canesten.

The proliferation of generics has significantly driven down prices over the past decade, intensifying competitive pressures.

Regulatory and Patent Landscape

Clotrim, being a generic with expired patents, faces minimal patent barriers. Its widespread OTC status in multiple jurisdictions further accelerates market penetration.

However, emerging formulations, such as long-acting or combination products, pose potential competitive threats, possibly influencing pricing strategies.

Market Drivers & Barriers

Drivers

- High prevalence of superficial fungal infections: Estimated global prevalence ranges from 20-25%, with increased incidences due to urbanization, climate change, and lifestyle factors [[2]].

- Consumer preference for OTC medications: Facilitates rapid market expansion and higher sales volumes.

- Product efficacy and safety: Recognized as an effective first-line treatment.

Barriers

- Pricing pressures: Widespread generics lead to decreased profit margins.

- Regulatory changes: Stricter quality controls and regulations in emerging markets could impact supply and costs.

- Emergence of resistance: Although rare, microbial resistance could impact efficacy perceptions and demand.

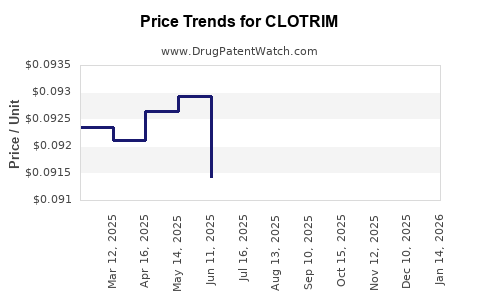

Historical Price Trends

Over the past five years, Clotrim prices have declined, primarily driven by generic proliferation and market saturation:

| Year |

Average OTC Price per Pack (USD) |

Notable Trends |

| 2018 |

$8 – $12 |

Rising generic entries decreased prices. |

| 2020 |

$5 – $9 |

Pandemic-driven supply chain constraints. |

| 2022 |

$4 – $8 |

Increased market competition, patent expirations. |

This trend underscores the price elasticity typical of generic topical antifungals subjected to competitive pressures.

Forecasting Price Trends (2023-2028)

Based on current market trends, patent status, and competitive landscape, the following projections are derived:

Scenario 1: Continued Competition and Price Decline

- Annual reduction rate: Approximately 4-6%

- Projected Price Range (2028): $2.50 – $5.00 per pack

Rationale: Saturation of the OTC market, persistent generic competition, and minimal brand differentiation will sustain downward pressure.

Scenario 2: Price Stabilization due to Manufacturing or Regulatory Factors

- Annual change: 0-2% increase or stabilization

- Projected Price Range (2028): $4.00 – $6.00 per pack

Rationale: Introduction of value-added formulations or supply chain disruptions could curtail aggressive price declines.

Potential Market Opportunities and Risks

Opportunities:

- Expansion into emerging markets: Growth potential in Asia, Africa, and Latin America due to rising infection rates.

- Development of combination products: Combining Clotrim with other agents may command premium pricing.

- Educational campaigns: Increasing awareness can broaden consumer base.

Risks:

- Pricing undercutting: New entrants employing aggressive pricing could further depress prices.

- Regulatory hurdles in certain jurisdictions: Impacting market entry or product formulations.

- Market saturation: Limiting growth prospects.

Strategic Recommendations

- Price Sensitivity Monitoring: Regular tracking of competitor pricing to adjust strategies.

- Value Differentiation: Emphasize safety profile and efficacy in marketing.

- Market Expansion: Target emerging markets with tailored affordability strategies.

- Innovation: Explore combination therapies or improved formulations to justify premium pricing where feasible.

Key Takeaways

- Clotrim's global market remains substantial owing to high infection prevalence and OTC accessibility.

- The relentless proliferation of generics has driven prices downward, with forecasts indicating further declines or stabilization depending on competitive and regulatory dynamics.

- The price trajectory from 2023 to 2028 suggests a range of approximately $2.50 to $6.00 per pack, impacted by regional factors and market strategies.

- Companies should focus on market differentiation, emerging market expansion, and innovation to sustain profitability.

- Continuous market surveillance and strategic agility are essential to navigate the evolving antifungal landscape.

FAQs

1. What factors most significantly influence Clotrim's market pricing?

Market competition, patent status, regulatory environment, and consumer demand are primary factors affecting Clotrim's pricing dynamics.

2. How does the rise of generic versions impact Clotrim's price and market share?

Generic competition exerts downward pressure on prices and increases market share, leading to more accessible pricing for consumers but reduced margins for manufacturers.

3. Are there emerging opportunities to command premium pricing for Clotrim?

Yes, through developing combination therapies, innovative formulations with enhanced efficacy, or by targeting high-end markets with trusted OTC branding.

4. How might regulatory changes affect Clotrim's market?

Tighter regulations regarding manufacturing quality, approval processes, or labeling could increase costs or restrict certain formulations, impacting prices.

5. What regions present the most growth potential for Clotrim?

Emerging economies in Asia-Pacific, Latin America, and Africa show the highest growth potential due to rising fungal infection rates and expanding OTC markets.

References

- MarketWatch. (2023). “Global Antifungal Market Size & Share.”

- World Health Organization. (2020). “Prevalence of Fungal Infections.”