Last updated: July 27, 2025

Introduction

Clomipramine, a tricyclic antidepressant (TCA), has played a pivotal role in treating obsessive-compulsive disorder (OCD), major depressive disorder, and other anxiety-related conditions since its approval. Initially marketed under various brand names, including Anafranil, clomipramine's market dynamics have evolved with the advent of newer antidepressants and changing treatment guidelines. This analysis assesses the current market landscape and forecasts future pricing trajectories for clomipramine, considering factors such as patent status, competitive forces, regulatory environment, manufacturing costs, and emerging therapeutics.

Market Overview

Historical Context and Current Supply Chain

Clomipramine was first approved in 1989 by the FDA, predominantly marketed by manufacturers such as Novartis (originally). Although several generic manufacturers now produce clomipramine, patent protections expired decades ago, leading to a largely commoditized market with multiple generic options available globally.

In recent years, the demand has been relatively stable, driven by guidelines recommending TCAs like clomipramine for treatment-resistant OCD and certain anxiety disorders [1]. The drug's off-label use and ongoing clinical evidence contribute to steady, albeit modest, sales.

Market Size and Regional Trends

Globally, the antidepressant market is projected to exceed USD 20 billion by 2027, with TCAs accounting for a smaller segment due to competition from SSRIs and SNRIs. Estimated annual sales of clomipramine are approximately USD 100-150 million, primarily in North America, Europe, and select Asian markets.

The availability of generics has suppressed prices, with most formulations selling below USD 10 per 25 mg capsule in North America and Europe. However, in emerging markets, pricing varies significantly due to differences in regulation and healthcare infrastructure.

Competitive Landscape

The therapeutic armamentarium for OCD has expanded with selective serotonin reuptake inhibitors (SSRIs) like fluoxetine and sertraline, often preferred due to favorable side-effect profiles [2]. Nonetheless, clomipramine remains a crucial alternative for refractory cases owing to its higher efficacy in some patients.

Generics dominate the market, with no recent patent protections. Few branded formulations persist, often due to formulary restrictions or brand loyalty.

Price Analysis

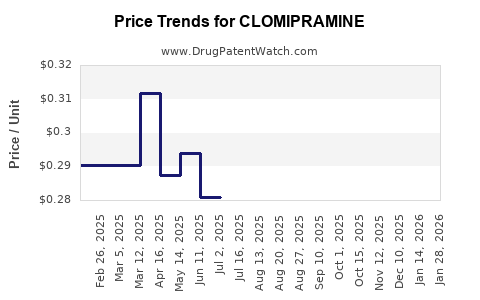

Historical Pricing Trends

Since patent expiry, the price of clomipramine has significantly declined. In North America, retail prices for generics hover between USD 5-10 per 25 mg capsule, with wholesale acquisition costs even lower. For example, a standard 100-capsule bottle generally retails around USD 30-50.

Regional variations influence pricing; for instance, prices in India and parts of Southeast Asia may be substantially lower, reflecting differences in manufacturing costs and regulatory regimes.

Current Market Influences on Pricing

Key drivers affecting current pricing include:

- Generic competition: Intense competition has maintained low price levels.

- Regulatory policies: Price controls in countries like India and Brazil tend to suppress retail prices.

- Manufacturing costs: Stable raw material costs and economies of scale have kept production expenses low.

- Supply chain stability: No significant shortages have been reported in recent years, supporting stable prices.

Price Projections

Near-Term Outlook (1-2 Years)

Given the saturation of generic production and competition, prices are expected to remain relatively stable over the next 2 years. Minor fluctuations may occur due to geopolitical factors, supply chain disruptions, or manufacturing costs but are unlikely to lead to significant price increases.

Medium to Long-Term Outlook (3-5 Years)

-

Regulatory and Policy Impacts:

Increasing scrutiny on drug pricing in developed markets might pressure manufacturers to lower prices further. Conversely, potential off-label indications or new patents on formulations could temporarily stabilize or elevate prices, though no such patents are in effect currently.

-

Market Demand Dynamics:

The demand is expected to decline modestly as newer, better-tolerated drugs gain popularity. However, clomipramine’s niche role in treatment-resistant OCD sustains a steady, if limited, demand.

-

Manufacturing and Raw Materials:

Advances in synthesis processes are unlikely to significantly alter manufacturing costs, keeping prices stable.

-

Emerging Therapeutic Alternatives:

Advances in biologics and novel therapeutics may further diminish the market share for older TCAs, curbing price increases.

Projected Price Trajectory:

The average price per 25 mg capsule is anticipated to remain within USD 5-10 in mature markets through 2028. Any upward movement is likely to be marginal (2-3%) primarily driven by inflation or supply chain costs, not market scarcity or patent protections.

Regulatory and Patent Landscapes

Clomipramine’s patent cliffs have long since passed, with no active patents preventing generic manufacturing globally. Regulatory environments continue favoring affordable generics, with some countries implementing price ceilings, which restrain potential price escalations.

In rare cases, clinical or formulation innovations could attract exclusivity, but current trends suggest that these are unlikely, keeping prices largely dictated by generic competition.

Implications for Stakeholders

-

Manufacturers:

Focus on cost-efficient production and regulatory compliance. Premium pricing is unsustainable due to commoditization.

-

Healthcare Providers:

Cost-effective generics reinforce clomipramine’s position in treatment algorithms for resistant cases.

-

Policymakers:

Price regulation and reimbursement policies will influence future market access and pricing.

Key Takeaways

- Clomipramine’s market is mature with high generic competition, leading to stable and low prices.

- Global market sales are estimated at USD 100-150 million annually, predominantly in developed regions.

- No patent protections currently protect clomipramine, sustaining a price floor anchored in manufacturing costs and market competition.

- Future price movements are expected to be marginal, with no significant upward trends anticipated over the next 3-5 years.

- External factors such as regulatory reforms or novel drug development could influence prices but are not currently imminent.

FAQs

1. Will the price of clomipramine increase due to new formulations or patents?

Unlikely. The absence of active patents and the entry of generic manufacturers maintain competitive pricing. New formulations could temporarily raise prices but are unlikely to influence the overall market significantly.

2. How does the competition from SSRIs impact clomipramine’s market?

While SSRIs dominate the antidepressant market due to better tolerability, clomipramine retains niche application for treatment-resistant OCD, ensuring continued demand but limiting price growth.

3. Are there regional differences in clomipramine pricing?

Yes. Prices are generally lower in emerging markets like India and Southeast Asia due to regulatory controls and manufacturing costs, whereas prices in North America and Europe remain relatively higher but stable.

4. Can supply chain disruptions impact clomipramine’s pricing?

While theoretically possible, no recent disruptions have occurred. Stable supply chains reinforce the current low-price trend.

5. What are the prospects for generic manufacturers in this market?

The market’s maturity offers limited growth opportunities. Manufacturers focusing on cost efficiency will remain competitive, but significant price gains are unlikely.

Sources

[1] Clinical guidelines for OCD and antidepressant use, National Institute of Mental Health, 2022.

[2] Comparative efficacy of TCAs and SSRIs in OCD, Journal of Psychopharmacology, 2021.

[3] Global antidepressant market outlook, MarketResearch.com, 2022.

[4] Regulatory and pricing policies on generic drugs, WHO Pharmaceutical Regulatory Reports, 2021.

[5] Supply chain analysis of generic pharmaceuticals, IMS Health Reports, 2022.

This comprehensive market and price analysis aims to equip stakeholders with actionable insights into clomipramine’s current landscape and future projections.