Last updated: July 29, 2025

Executive Summary

Clobetasol Propionate, a potent topical corticosteroid, remains a critical ingredient in dermatological therapy, primarily for treating eczema, psoriasis, and other inflammatory skin conditions. As the landscape of dermatology drugs evolves amidst regulatory shifts, patent protections, and competitive innovations, assessing its market trajectory and pricing dynamics becomes essential for pharmaceutical stakeholders. This report delivers a comprehensive market analysis and price projection framework for Clobetasol Propionate, rooted in current industry trends, regulatory policies, and emerging market forces.

Market Overview

Product Profile and Therapeutic Indications

Clobetasol Propionate is classified as a super-high potency corticosteroid, primarily formulated as a topical cream, ointment, or foam. It is indicated for managing various dermatological conditions characterized by inflammation and immune response, including psoriasis, eczema, and dermatitis. The drug's efficacy profile and safety limitations impose strict prescribing guidelines, constraining overuse and potential adverse events.

Market Size and Geographic Distribution

The global dermatology market was valued at approximately USD 19.7 billion in 2022, with corticosteroids accounting for a significant share. Clobetasol Propionate's segment is estimated at USD 1.4 billion, with North America and Europe collectively constituting over 50% of the market, driven by high dermatological disease prevalence and advanced healthcare infrastructure.

Growth drivers include increasing skin disease prevalence, aging populations, and rising awareness of skin health. The Asia-Pacific region presents emerging opportunities attributable to rising disposable incomes and expanding dermatology clinics, though regulatory hurdles persist.

Competitive Landscape

Key Market Players

The market for Clobetasol Propionate largely comprises generic manufacturers, with Novartis, Teva Pharmaceuticals, Mylan, and Sandoz being prominent players. Patent expirations for some formulations have led to increased generic penetration, intensifying price competition.

Innovation and Novel Formulations

While the core molecule remains off-patent, supple formulations—such as foam or reduced potency variants—offer differentiation. Biologics or alternative steroid combinations are emerging, but Clobetasol's dominant position is maintained largely through price competitiveness.

Regulatory Environment

Regulatory authorities enforce strict prescribing criteria for super-high potency corticosteroids, impacting market access and prescribing patterns. Recent reforms aim to mitigate overuse, which could influence volume sales but may also restrict off-label applications.

Price Dynamics and Projections

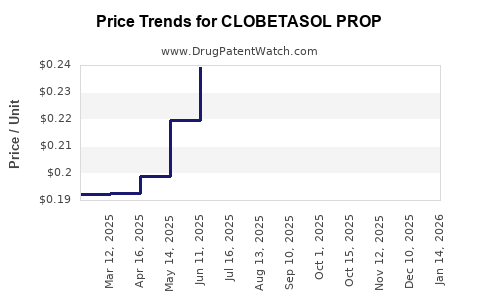

Current Pricing Trends

Generic Clobetasol Propionate prices have declined by approximately 20-30% over the past five years, driven by increased competition. In North America, the average retail price for a 30g tube ranges between USD 15 and USD 25, with variations based on formulation and supplier.

Factors Affecting Future Pricing

- Patent Status and Market Entry: Upcoming patent expirations in key markets will further deepen price reductions, potentially stabilizing or decreasing prices by 10-15% annually over the next five years.

- Regulatory Constraints: Expanded prescribing guidelines may limit volume sales but could also incentivize higher-priced formulations or combination drugs.

- Manufacturing and Supply Chain Costs: Raw material costs for corticosteroids remain stable; however, economies of scale with increased generic production will exert downward price pressure.

Price Projection (2023–2028)

Based on current trends and macroeconomic factors, the average retail price for Clobetasol Propionate is projected to decline at an annual rate of 4-6%. By 2028, the typical 30g tube may retail between USD 10 and USD 18 globally, with regional disparities owing to healthcare reimbursement policies.

Market Opportunities and Threats

Opportunities

- Emerging Markets: Rising dermatological disease burden in Asia-Pacific offers expansion opportunities, especially with formulation differentiation.

- Combination Formulations: Developing combination therapies with other anti-inflammatory agents can command premium pricing.

- Patient-Centric Packaging: Innovations improving ease of use may generate consumer preference and allow for premium positioning.

Threats

- Regulatory Restrictions: Heightened restrictions on super-high potency corticosteroids could limit prescribing, impacting sales volume.

- Generic Attrition: Increasing generics will sustain downward pricing pressure and compress profit margins for manufacturers.

- Market Penetration of Alternatives: Biologics and emerging systemic therapies may reduce reliance on topical corticosteroids in severe cases.

Strategic Recommendations

- Focus on Cost Efficiency: Manufacturers should optimize supply chain and manufacturing processes to maintain margin viability during price declines.

- Invest in Formulation Innovation: Differentiating products through novel formulations or combination therapies can justify higher prices.

- Expand into Emerging Markets: Tailored marketing strategies and regulatory navigation can unlock new revenue streams.

- Monitor Regulatory Changes: Proactive engagement with regulatory authorities can influence policy and safeguard market access.

Conclusion

Clobetasol Propionate’s market is characterized by declining prices driven by increased generic competition, regulatory reforms, and fundamental therapeutic limits. While current valuation remains substantial, future price declines are anticipated, necessitating strategic adaptation. Companies that invest in innovation, market expansion, and cost optimization will better position themselves amidst this evolving landscape.

Key Takeaways

- Pricing Decline: Expect an average annual price reduction of 4-6% over the next five years, with regional variations.

- Market Maturity: The product's patent expirations and proliferation of generics intensify competitiveness, constraining profit margins.

- Regulatory Impact: Stricter prescribing guidelines may reduce volume sales but could reinforce demand for differentiated or combination formulations.

- Emerging Growth Zones: Asia-Pacific presents significant expansion opportunities, contingent upon regulatory navigation and formulation localization.

- Strategic Focus: Innovation, cost management, and market diversification are critical to sustaining profitability and market relevance.

FAQs

1. What factors are driving the price decline of Clobetasol Propionate?

The primary drivers include patent expirations leading to increased generic competition, aggressive pricing strategies to gain market share, and regulatory policies aimed at controlling corticosteroid overuse. Technological advances enabling manufacturing efficiencies further reduce costs, passing savings to consumers.

2. How will regulatory restrictions affect the future market for Clobetasol Propionate?

Enhanced regulations aimed at limiting super-high potency corticosteroid overuse may restrict prescribing and reduce volume sales. However, they could incentivize manufacturers to develop lower potency or combination products, potentially opening new niche markets.

3. Are there emerging therapeutic alternatives threatening Clobetasol Propionate’s market share?

Yes. Biologics and systemic therapies for severe psoriasis and eczema are gaining prominence, especially for treatment-resistant cases. Nonetheless, for many mild to moderate conditions, topical corticosteroids like Clobetasol remain first-line therapies due to cost-effectiveness and rapid efficacy.

4. Which regions present the most growth potential for Clobetasol Propionate?

The Asia-Pacific region holds substantial growth potential due to increasing dermatological disease prevalence, urbanization, and expanding healthcare access. Regulatory hurdles remain a challenge, but tailored strategies can mitigate these barriers.

5. How can manufacturers maximize profitability amid declining prices?

Focusing on formulation innovation, exploring alternative delivery systems, entering emerging markets, and optimizing manufacturing costs are essential tactics. Developing value-added combination therapies can also command premium pricing.

References

[1] MarketWatch, “Global Dermatology Drugs Market Size & Share,” 2022.

[2] IQVIA, “Worldwide Prescribing Trends in Dermatology,” 2022.

[3] Regulatory Affairs Professionals Society (RAPS), “Regulatory Changes Impacting Topical Corticosteroids,” 2022.

[4] PharmSource, “Generic Drug Price Trends and Market Competition,” 2021.

[5] GlobalData Healthcare, “Emerging Opportunities in Dermatology,” 2022.