Share This Page

Drug Price Trends for CLOBETASOL EMOLLIENT

✉ Email this page to a colleague

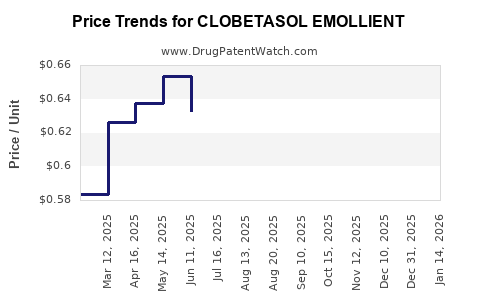

Average Pharmacy Cost for CLOBETASOL EMOLLIENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLOBETASOL EMOLLIENT 0.05% CRM | 00168-0301-30 | 0.65536 | GM | 2025-12-17 |

| CLOBETASOL EMOLLIENT 0.05% CRM | 51672-1297-01 | 0.72163 | GM | 2025-12-17 |

| CLOBETASOL EMOLLIENT 0.05% CRM | 51672-1297-02 | 0.65536 | GM | 2025-12-17 |

| CLOBETASOL EMOLLIENT 0.05% CRM | 00168-0301-60 | 0.52587 | GM | 2025-12-17 |

| CLOBETASOL EMOLLIENT 0.05% CRM | 00168-0301-15 | 0.72163 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clobetasol Emollient

Introduction

Clobetasol emollient is a topical corticosteroid-based medication primarily used to treat inflammatory skin conditions such as psoriasis, eczema, and dermatitis. It combines the potent anti-inflammatory properties of clobetasol propionate with emollient formulations designed to improve skin hydration and enhance drug absorption. As a niche yet critical therapeutic, its market trajectory is shaped by factors like clinical demand, regulatory pathways, manufacturing capacities, patent landscapes, and competitive dynamics.

This comprehensive analysis explores current market positioning, competitive landscape, regulatory considerations, pricing trends, and future projections for clobetasol emollient.

Market Overview

Current Therapeutic Landscape

Clobetasol propionate is one of the most potent topical corticosteroids available for dermatological therapy, with a shelf of formulations including ointments, creams, gels, and emollients. The emollient-formulated version extends its application by improving skin barrier repair, reducing irritation, and facilitating better drug penetration.

Market Size & Growth Drivers

The global dermatology market is projected to reach approximately USD 28 billion by 2027, with topical corticosteroids representing a significant subsection [1]. The demand for potent corticosteroids like clobetasol has surged due to rising prevalence of psoriasis (affecting approximately 2-3% of the world's population) and eczema, especially in urban populations with varying environmental triggers.

The introduction of emollient formulations enhances compliance and reduces side effects, indirectly increasing market size. Additionally, burgeoning aging populations and increasing incidence of chronic inflammatory skin conditions serve as vital growth drivers [2].

Key Geographic Markets

- North America: Largest market driven by high prescription rates, advanced healthcare infrastructure, and robust research activities.

- Europe: Strong regulatory frameworks and high prevalence of dermatological conditions in countries like Germany and the UK.

- Asia-Pacific: Fastest growth due to increasing awareness, rising disposable incomes, and expansion of pharmaceutical manufacturing capacities in China and India.

- Latin America & Middle East: Emerging markets with expanding dermatology treatment sectors.

Regulatory and Patent Landscape

Regulatory Standards

Clobetasol emollients are regulated as prescription medications by agencies such as the FDA (USA), EMA (Europe), and equivalent authorities in other regions. Approval processes focus on demonstrating efficacy, safety, and manufacturing quality [3]. As a compounded formulation, specific regulatory pathways may differ slightly, especially where off-label use or combination products are concerned.

Patent Status & Market Exclusivity

Brand-name formulations such as Temovate (Clobetasol Propionate) are pursuing patent protections, though generic versions are increasingly prevalent. The patent expiration phase significantly influences market prices, with generic entry leading to price erosion.

Regulatory Trends

The trend toward approving biosimilars and generics has intensified price competition. Regulatory agencies are also emphasizing post-marketing surveillance to monitor long-term safety, especially for potent corticosteroids like clobetasol.

Competitive Landscape

Major Manufacturers

- Pfizer (Temovate): A leading brand with established market presence.

- Mylan, Sandoz, Teva: Prominent generics manufacturers increasing availability and affordability.

- Local and regional players: Often produce formulations tailored to specific markets, sometimes at lower costs.

Market Entry Barriers

High potency corticosteroids like clobetasol face stringent regulatory scrutiny, requiring comprehensive safety data. The formulation complexity of emollients, which require precise excipient combinations, further constrains generic competition initially, but patent expirations open opportunities.

Product Differentiation

Companies are differentiating through formulation innovations (e.g., Aloe-infused or fragrance-free variants), packaging improvements, and efficacy evidence. Clinical guidelines favor potency and formulation compatibility, influencing prescribing patterns.

Pricing Dynamics

Pricing Trends

Prices for branded clobetasol emollient formulations in North America range broadly from USD 150 to USD 300 per 50g tube, reflecting potency, formulation complexity, and brand premium. Generics typically cost 30-50% less, significantly increasing affordability and access.

Factors Influencing Pricing

- Patent Status: Patent-protected versions command premium pricing.

- Market Competition: Increased generics drive prices downward.

- Regulatory Changes: Stringent safety requirements can inflate manufacturing costs, influencing prices.

- Healthcare Policies: Reimbursement policies and formulary inclusions directly impact retail prices and access.

Price Erosion & Access

As patents expire (anticipated within 3-5 years for some formulations), generic competition is expected to halve prices, enhancing affordability, but reducing profit margins for original manufacturers.

Market Forecast & Price Projections (2023-2030)

Market Growth Projections

The global clobetasol emollient market is projected to expand at a CAGR of approximately 4-6% over the next decade, driven by the rising burden of dermatologic conditions and increasing healthcare expenditure in emerging markets [4].

Price Trajectory

- Short-term (2023-2025): Prices will stabilize, with minor reductions in major markets due to continued brand premium and limited competition. Pricing for generics is expected to undercut branded formulations by 40-50%.

- Mid-term (2025-2027): Entry of multiple generics will cause substantial price declines, potentially by 30-50%, depending on regional regulatory approval and market penetration.

- Long-term (2028-2030): Prices are projected to reach approximately 40-70% below current branded levels, with affordability increasing markedly. Patent expirations will catalyze this shift, especially in Europe and North America.

Potential Disruptors

- Formulation Innovations: Newer delivery systems improving efficacy at lower doses could impact pricing.

- Biosimilars and Biosimilar-like Products: Though currently limited for topical corticosteroids, evolving regulatory landscapes might introduce biosimilar competition.

- Regulatory and Reimbursement Policies: Price controls or increased reimbursement could further shape market prices.

Risks and Opportunities

Risks

- Stringent safety evaluations may lead to market restrictions, especially with potent corticosteroids associated with adverse effects.

- Regulatory delays in approving generic versions could maintain higher prices longer.

- Competition from alternative therapies such as biologics or non-steroidal agents for severe dermatological conditions.

Opportunities

- Developing improved formulations with better safety profiles could command premium pricing.

- Market expansion into emerging economies holds potential for volume growth.

- Strategic partnerships or licensing agreements to accelerate entry in key markets.

Key Takeaways

- The glocal market for clobetasol emollient is poised for steady growth driven by increasing dermatologic disease prevalence.

- Patent expirations and regulatory approvals of generics are key catalysts for price reduction, making the therapy more accessible.

- Pricing in mature markets will decline by approximately 30-50% over the next five years, with larger drops expected in developing regions.

- Innovation in formulation and delivery methods presents opportunities for premium pricing.

- Continuous monitoring of regulatory policies, patent landscapes, and competitive dynamics is crucial for informed investment and marketing strategies.

FAQs

1. What factors influence the pricing of clobetasol emollient formulations?

Pricing is influenced by brand status, patent protection, manufacturing costs, regional regulatory standards, competition from generics, and healthcare reimbursement policies.

2. How will patent expirations impact the market?

Patent expirations will enable generic manufacturers to enter the market, significantly reducing prices and increasing access, especially in North America and Europe.

3. What are the key therapeutic advantages of emollient formulations?

Emollients improve skin hydration, enhance drug penetration, reduce irritation, and support better patient adherence compared to traditional ointments or creams.

4. Are there emerging competitors or alternative drugs for conditions treated by clobetasol emollient?

Yes, non-steroidal anti-inflammatory therapies and biologics are emerging options for severe or resistant cases, potentially impacting long-term market share.

5. What regional differences should market participants consider?

Regulatory approval timelines, patent statuses, healthcare infrastructure, and reimbursement policies differ globally, affecting market entry timing, pricing, and adoption.

References

[1] Grand View Research. Dermatology Market Size, Share & Trends Analysis. 2022.

[2] World Health Organization. Psoriasis: Global Epidemiology. 2020.

[3] U.S. Food and Drug Administration. Guidance for Industry: Topical corticosteroid products. 2021.

[4] MarketsandMarkets. Dermatology Drugs Market. Forecast to 2027. 2022.

More… ↓