Share This Page

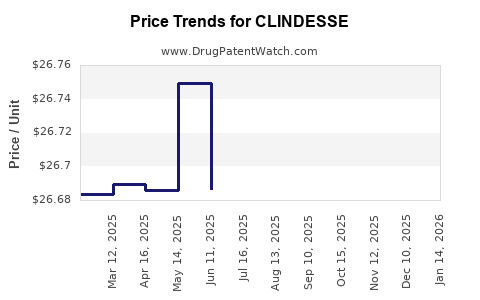

Drug Price Trends for CLINDESSE

✉ Email this page to a colleague

Average Pharmacy Cost for CLINDESSE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLINDESSE 2% VAGINAL CREAM | 45802-0042-01 | 26.70169 | GM | 2025-12-17 |

| CLINDESSE 2% VAGINAL CREAM | 45802-0042-01 | 26.70842 | GM | 2025-11-19 |

| CLINDESSE 2% VAGINAL CREAM | 45802-0042-01 | 26.71900 | GM | 2025-10-22 |

| CLINDESSE 2% VAGINAL CREAM | 45802-0042-01 | 26.73053 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clindesse

Overview of Clindesse

Clindesse is a prescription intravaginal cream containing clindamycin phosphate, indicated primarily for the treatment of bacterial vaginosis (BV). It is manufactured by Valeant Pharmaceuticals (now part of Bausch Health) and marketed under the brand name Clindesse. The drug’s proprietary formulation ensures targeted delivery, minimizing systemic absorption and associated systemic side effects, making it a preferred treatment modality in gynecological infections.

Market Landscape

Global and Regional Market Dynamics

The global market for bacterial vaginosis treatments, including topical agents like Clindesse, is witnessing consistent growth driven by increasing awareness of reproductive health, a rise in BV prevalence, and patient preference for localized therapy with fewer systemic side effects. The BV treatment segment is projected to grow at a CAGR of approximately 4-6% over the next five years, based on epidemiological trends and healthcare infrastructure improvements [1].

Regionally, North America leads, fueled by high diagnosis rates, favorable reimbursement policies, and widespread clinical acceptance. Europe follows, with a steady rise propelled by similar trends, while emerging markets in Asia-Pacific show potential driven by increasing healthcare access and population growth [2].

Competitive Landscape

Clindesse competes with various formulations: oral clindamycin, metronidazole gels, tablets, and other topical agents like Secnidazole (Zen Pepin). While oral options offer convenience for some, intravaginal preparations like Clindesse provide targeted therapy with superior local tolerability, maintaining a significant market share.

Top competitors include:

- MetroGel Vaginal (metronidazole)

- Flagyl (metronidazole oral)

- Clindacycl (clindamycin topical)

- Secnidazole (Sefel) - newer entry

The competitive landscape is also shaped by fluctuations in antibiotic resistance patterns, prescribing guidelines, and reimbursement policies.

Market Drivers and Challenges

Drivers

- Rising BV Incidence: BV affects approximately 29-30% of women of reproductive age globally, with higher prevalence in sexually active women aged 15-44 [3].

- Brand Recognition & Prescriber Loyalty: Clindesse's established efficacy, safety profile, and patient tolerability foster continued prescriber preference.

- Patient-Centric Treatment: Preference for localized treatment minimizes systemic side effects.

- Reimbursement & Insurance Coverage: Favorable coverage in developed markets ensures market penetration and sustained sales.

Challenges

- Antibiotic Resistance: Increasing resistance to clindamycin and other antibiotics jeopardizes treatment effectiveness.

- Pricing & Reimbursement Issues: Variability in drug reimbursement models limits access in certain markets.

- Generic Competition: The availability of generic clindamycin formulations pressures pricing and margins.

- Emerging Alternatives: Novel therapies, including probiotics and vaccines, could alter the treatment paradigm.

Pricing and Revenue Analysis

Current Pricing Landscape

In the United States, the average wholesale price (AWP) for Clindesse ranges from $200 to $250 per 14-gram tube, translating to approximately $14 to $18 per dose [4]. Insurance coverage and pharmacy discounts influence out-of-pocket costs, often lowering prices for patients.

In Europe, pricing is generally lower due to healthcare system negotiations, with typical retail prices around €150-200 per tube. In emerging markets, retail prices vary significantly based on import tariffs, local taxes, and distribution costs.

Revenue Generation and Market Penetration

Given its niche but vital role, Clindesse's global annual sales are estimated in the range of $100-150 million, primarily driven by North American markets, which account for roughly 70% of revenues. Price elasticity is limited by prescriber familiarity and reimbursement policies, but increased competition and patent expiration may lead to price erosion over time.

Future Price Projections

Influence of Patent Status and Generics

Clindesse's patent protection has expired or is nearing expiration in several jurisdictions, opening pathways for generic formulations. Generic clindamycin creams are priced approximately 30-50% lower than branded versions, signaling potential downward pressure on the brand’s pricing.

Impact of Market and Regulatory Dynamics

- Increased competition and price erosion are anticipated as generics gain market share, with projected per-unit prices declining by 10-15% annually post-patent expiry.

- Regulatory incentives may encourage the development of biosimilars or alternative therapies, influencing the drug's pricing trajectory.

- Healthcare policies emphasizing cost containment and antibiotic stewardship could further suppress prices, especially in public healthcare systems.

Forecasted Pricing Trends (Next 5 Years)

| Year | Estimated Price Range (US Dollars per Tube) | Comments |

|---|---|---|

| 2023 | $190 - $230 | Current market price |

| 2024 | $170 - $210 | Beginning patent expiry effects |

| 2025 | $150 - $200 | Increased generic market penetration |

| 2026 | $130 - $180 | Potential biosimilar entry |

| 2027 | $120 - $170 | Stabilization with generic competition |

These projections assume no major regulatory barriers or disruptive innovations and depend heavily on regional market dynamics.

Strategic Implications for Stakeholders

- Pharmaceutical companies should monitor patent cliffs and prepare for generic competition by optimizing manufacturing efficiencies and diversifying portfolios.

- Healthcare payers should evaluate cost-effective alternatives to sustain therapy affordability.

- Investors may find growth opportunities in emerging markets where price sensitivity creates openings for revenues, despite generics' presence.

Key Takeaways

- The global BV treatment market, including Clindesse, is set to grow modestly at 4-6% driven by increased prevalence and patient preference for localized therapy.

- Clindesse’s current brand positioning benefits from established prescriber loyalty, though impending patent expiry presents price erosion risks.

- The advent of generics will likely lead to significant price reductions (~30-50%), impacting revenue streams.

- Regional pricing varies widely, with North America leading, followed by Europe and emerging markets with potential for expansion.

- Market competitiveness will intensify with the entry of biosimilars and novel therapies, necessitating strategic adaptation by manufacturers.

FAQs

1. What is the primary clinical advantage of Clindesse over oral clindamycin?

Clindesse offers targeted intravaginal delivery, resulting in high local drug concentrations with minimal systemic absorption. This reduces systemic side effects and drug interactions, improving patient tolerability and compliance.

2. How soon are generic formulations of Clindesse expected to enter the market?

Patent expirations are approaching or occurring in multiple jurisdictions, with generics expected within 1-3 years, depending on regional patent law and regulatory approvals.

3. Will prices of Clindesse decrease significantly with generic entry?

Yes, generic competition typically reduces branded drug prices by 30-50%, impacting revenue margins and influencing prescribing patterns.

4. Are there intense regulatory barriers to launching generics in this segment?

Generally, bioequivalence and safety data suffice for generic approval; however, local regulatory processes may vary, influencing launch timelines.

5. What emerging therapies could impact Clindesse’s market share?

Novel treatments like probiotic-based therapies, vaccines, and alternative topical agents could challenge Clindesse, especially if they demonstrate superior efficacy or safety profiles.

References

[1] MarketsandMarkets. "Bacterial Vaginosis Treatment Market by Product, Route of Administration, and Region," 2022.

[2] Research and Markets. "Global Gynecological Infection Therapeutics Market Outlook," 2021.

[3] Centers for Disease Control and Prevention. "Bacterial Vaginosis Statistics," 2020.

[4] GoodRx.com. "Clindesse pricing," accessed 2023.

More… ↓