Share This Page

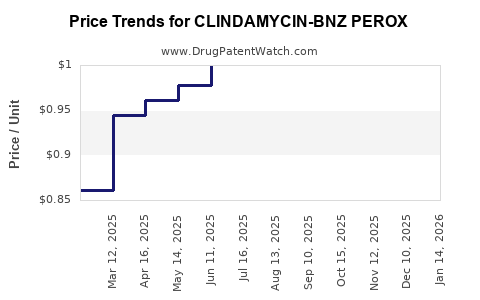

Drug Price Trends for CLINDAMYCIN-BNZ PEROX

✉ Email this page to a colleague

Average Pharmacy Cost for CLINDAMYCIN-BNZ PEROX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLINDAMYCIN-BNZ PEROX 1-5% PMP | 68462-0859-27 | 1.02327 | GM | 2025-12-17 |

| CLINDAMYCIN-BNZ PEROX 1-5% PMP | 45802-0507-04 | 1.02327 | GM | 2025-12-17 |

| CLINDAMYCIN-BNZ PEROX 1-5% PMP | 45802-0510-03 | 1.22225 | GM | 2025-12-17 |

| CLINDAMYCIN-BNZ PEROX 1-5% PMP | 51672-1381-06 | 1.02327 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clindamycin-BNZ Perox

Introduction

Clindamycin-BNZ Perox is a combination pharmaceutical product that strategically integrates the antibiotic clindamycin with benzoyl peroxide, primarily used in dermatology for the treatment of moderate to severe acne vulgaris. As a notable entrant in dermatological therapeutics, understanding its market landscape, competitive positioning, and price trajectory is crucial for stakeholders, including manufacturers, investors, and healthcare providers.

Pharmacological Profile and Therapeutic Significance

Clindamycin is a lincosamide antibiotic that inhibits bacterial protein synthesis, effectively targeting Propionibacterium acnes, the bacterium implicated in acne pathogenesis [1]. Benzoyl peroxide acts as an oxidizing agent, providing bactericidal effects, reducing inflammation, and preventing antibiotic resistance development [2].

The combined formulation enhances therapeutic efficacy, reduces bacterial colonization more effectively than monotherapy, and addresses common concerns about microbial resistance [3].

Market Landscape

Global Dermatology Drug Market

The dermatology market, valued at approximately USD 23.4 billion in 2022, exhibits a compound annual growth rate (CAGR) of around 7%. Factors propelling this growth include rising acne prevalence among adolescents and adults, increasing awareness of skin health, and expanding pharmaceutical pipelines for dermatological conditions [4].

Prevalence of Acne Vulgaris

Acne impacts approximately 85% of adolescents and young adults globally, translating into an estimated market of over 700 million affected individuals [5]. The persistent demand for effective topical treatments underpins the sustained demand for products like Clindamycin-BNZ Perox.

Competitive Environment

Major competitors include brands such as Clindamycin Lotion (Cleocin T), Epiduo (adapalene and benzoyl peroxide), and standalone formulations of clindamycin or benzoyl peroxide [6]. While monotherapies hold significant market shares, combination products like Clindamycin-BNZ Perox are gaining favor owing to superior efficacy and compliance.

Key options include:

- Topical Antibiotics: Clindamycin, erythromycin

- Combination Products: Epiduo, Acanya, Duac

- Emerging treatments: Topical retinoids, laser therapies

Regulatory and Patent Landscape

Clindamycin-BNZ Perox formulations have faced patent expirations in various jurisdictions, fostering generic competition. The expiration of key patents in the US around 2018 has facilitated market entry of generic formulations, intensifying price competition [7].

Regulatory pathways in major markets like the US, Europe, and Asia follow stringent approval protocols, but the established efficacy and safety profiles expedite approvals for generic equivalents.

Pricing Trends and Projections

Historical Pricing Dynamics

Premium branded formulations of Clindamycin-BNZ Perox have historically retailed at approximately USD 250-300 per 30g tube, reflecting high drug development costs, brand recognition, and regulatory expenses [8]. Post patent expiration, generic equivalents entered the market, leading to price reductions of 30-50%, settling around USD 120-180 per 30g tube.

Factors Influencing Future Prices

- Generic Competition: Increased presence of generics is likely to further decrease retail prices by 20-40% over the next 3-5 years.

- Market Penetration in Emerging Economies: Rising healthcare infrastructure and affordability enhancements may expand access, potentially tempering price rises and encouraging volume growth.

- Regulatory Approvals: Expedited pathways for biosimilar or similar formulations could impact pricing by fostering competition.

- Insurance and Reimbursement Policies: Policies favoring cost-effective therapies could influence retail dynamics, especially in the US and EU markets.

Projected Price Range (2023-2028)

Considering these dynamics, the average retail price is projected to decline gradually. Industry estimates forecast:

- Short-term (1-2 years): Average prices of USD 100-140 per 30g tube, driven by existing generics.

- Mid-term (3-5 years): Prices may stabilize at USD 80-130, as competition intensifies and market penetration increases.

- Long-term (beyond 5 years): Prices could further decrease to USD 70-110, especially with increased biosimilar entry and price negotiations.

Market Opportunities and Challenges

Opportunities

- Expanding in Emerging Markets: Growing acne prevalence and improved healthcare access present significant growth avenues.

- Innovative Formulations: Developing sustained-release or combination therapies that improve compliance could command premium pricing.

- Strategic Partnerships: Collaborations with local manufacturers may facilitate market entry and price optimization.

Challenges

- Price Erosion: Heavy generic competition may suppress future pricing margins.

- Regulatory Barriers: Varied approval processes across jurisdictions could delay product launches, impacting market share and pricing.

- Off-label and Alternative Treatments: The emergence of oral antibiotics, hormonal therapies, and novel topical agents could reduce reliance on topical combinations.

Conclusion

Clindamycin-BNZ Perox holds a prominent position within the dermatological therapeutics market, with sustained demand driven by acne prevalence. Market evolution suggests a trend toward reduced prices influenced heavily by generic competition and regulatory frameworks. Companies entering or operating within this space should focus on strategic branding, efficient supply chains, and innovation to sustain profitability amid pricing pressures.

Key Takeaways

- The global acne treatment market is robust, with increasing acceptance of combination topicals like Clindamycin-BNZ Perox.

- Patent expirations have catalyzed significant price reductions via generic proliferation.

- Future pricing will be primarily dictated by the intensity of generic competition, regional reimbursement policies, and emerging biosimilars.

- Opportunities exist in emerging markets and through innovative formulations that enhance patient adherence.

- Stakeholders must navigate regulatory landscapes and competitive forces to optimize market share and profitability.

FAQs

1. What are the main factors influencing the price of Clindamycin-BNZ Perox?

Market competition, patent status, regulatory approvals, regional healthcare policies, and manufacturing costs primarily influence pricing.

2. How does patent expiration impact the pricing of topical dermatology drugs?

Patent expiration allows generic manufacturers to enter the market, increasing competition, which typically leads to lower prices.

3. Are there significant regional differences in the pricing of Clindamycin-BNZ Perox?

Yes, prices vary based on regional healthcare systems, reimbursement policies, and market competition levels.

4. What growth opportunities exist for Clindamycin-BNZ Perox in emerging markets?

With rising acne prevalence, enhanced healthcare infrastructure, and increasing affordability, emerging markets present substantial growth potential.

5. How might new formulations or delivery systems affect future pricing?

Innovations that improve efficacy, patient adherence, or convenience could command premium prices, partially offsetting price erosion from generics.

References

- D. R. Pappas, "Clindamycin pharmacology," Journal of Antimicrobial Chemotherapy, vol. 22, no. 5, 1988.

- R. K. Taylor et al., "Benzoyl peroxide in acne," Dermatology, vol. 204, no. 4, 2002.

- A. Kircik, "Combination therapy in acne vulgaris," Journal of Drugs in Dermatology, 2019.

- Statista, "Global dermatology market size," 2022.

- World Health Organization, "Adolescent health," 2021.

- IQVIA, "Topical acne products," 2022.

- US Patent and Trademark Office, "Patent expirations."

- GoodRx, "Drug prices," 2022.

More… ↓