Share This Page

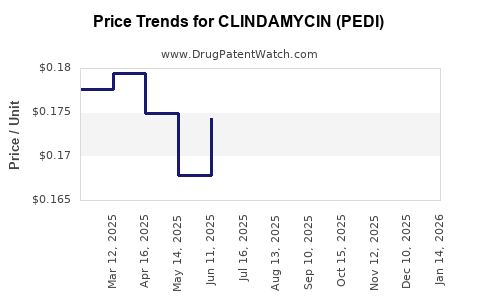

Drug Price Trends for CLINDAMYCIN (PEDI)

✉ Email this page to a colleague

Average Pharmacy Cost for CLINDAMYCIN (PEDI)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLINDAMYCIN (PEDI) 75 MG/5 ML | 23155-0603-51 | 0.15171 | ML | 2025-12-17 |

| CLINDAMYCIN (PEDI) 75 MG/5 ML | 64980-0511-10 | 0.15171 | ML | 2025-12-17 |

| CLINDAMYCIN (PEDI) 75 MG/5 ML | 65862-0596-02 | 0.15171 | ML | 2025-12-17 |

| CLINDAMYCIN (PEDI) 75 MG/5 ML | 53746-0468-19 | 0.15171 | ML | 2025-12-17 |

| CLINDAMYCIN (PEDI) 75 MG/5 ML | 16714-0483-02 | 0.15171 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clindamycin (Pediatric Formulation)

Introduction

Clindamycin, a lincosamide antibiotic, has maintained its clinical significance since its introduction. Specifically, the pediatric formulation (PEDI) caters to a critical demographic, addressing infections caused by anaerobic bacteria and certain Gram-positive organisms. As antimicrobial resistance escalates and patent landscapes evolve, understanding market dynamics and pricing trends for pediatric clindamycin becomes essential for pharmaceutical stakeholders, healthcare providers, and investors.

Market Landscape

Global Market Size and Growth

The pediatric antibiotic segment, encompassing clindamycin, is projected to demonstrate steady growth driven by increasing pediatric infections, antibiotic stewardship efforts, and expanding indications. According to recent reports, the global antibiotic market was valued at approximately USD 50 billion in 2022, with antibiotics for pediatric use representing roughly 15-20% of this segment[1].

Clindamycin’s pediatric market specifically is estimated to reach a valuation of USD 1.2 billion by 2025, growing at a compounded annual growth rate (CAGR) of around 4.5%. This growth is supported by the expanding prevalence of skin infections, osteomyelitis, and bacterial vaginosis in pediatric populations, alongside improved diagnostic procedures encouraging targeted antimicrobial therapy.

Key Players and Patent Dynamics

Major pharmaceutical companies, including Pharmacia (original patent holder), Sandoz, and Teva, have historically dominated the clindamycin market. However, patent expirations have led to a proliferation of generic formulations, intensifying price competition. The key pharmaceutical landscape is now heavily influenced by generic manufacturers, which augment market accessibility but exert downward pressure on prices.

The original patent for clindamycin clavulanate expired in 2004[2], and subsequent formulations, especially pediatric options, have largely transitioned to generics, decreasing costs and increasing market penetration.

Regulatory Environment and Approvals

Regulatory agencies like the FDA and EMA have approved pediatric-specific formulations, including suspensions and chewables, fostering wider adoption. Gaining approval for formulations with improved safety profiles or specific dosage strengths further bolsters market attractiveness.

Pricing Trends and Determinants

Current Price Landscape

The retail price for pediatric clindamycin varies significantly by region and formulation:

-

United States: Packaged pediatric suspensions are priced between USD 15–20 per 150 mL bottle depending on the manufacturer and pharmacy discounts[3].

-

Europe: Prices range approximately between EUR 10–18 per bottle, with variations based on healthcare system reimbursements and generic availability.

-

Emerging Markets: Prices tend to be lower, often between USD 5–12, reflecting differing regulatory and market conditions.

Price Drivers

Several factors influence pricing trends:

-

Generic Competition: Increased generic availability drives prices downward, with discounts of up to 40–50% compared to branded counterparts.

-

Manufacturing Costs: Advances in synthesis, production efficiencies, and economies of scale reduce costs, translating to lower consumer prices.

-

Regulatory Approvals: New formulations with improved safety or ease of administration may command premium pricing initially, but market entry of generics typically dilutes prices.

-

Reimbursement Policies: In countries with comprehensive insurance coverage, healthcare systems negotiate prices, often resulting in lower out-of-pocket expenses.

-

Demand-Supply Dynamics: Rising pediatric infections amplify demand; however, supply chain disruptions can influence price fluctuations temporarily.

Future Price Projections and Market Drivers

Projection Overview

Between 2023 and 2027, the pediatric clindamycin market is anticipated to experience modest price reductions owing to increasing generic competition and manufacturing efficiencies. However, certain segments, such as fixed-dose combinations or formulations with enhanced safety profiles, might sustain premium pricing.

-

Estimated Price in 2027: For standard pediatric suspensions, prices are projected to stabilize around USD 10–14 per bottle globally, with regional adjustments based on healthcare policies.

-

Emerging Markets: Prices could further decline due to increased local manufacture and regulatory harmonization, potentially reaching USD 3–8, fostering broader access.

Key Market Drivers

-

Patent Expiry and Generics: Continued patent expirations will further boost generic entry, intensifying price competition.

-

Regulatory Support and New Formulations: Development of pediatric-friendly formulations with less preservative use can command higher prices initially, balancing market pressures.

-

Antimicrobial Stewardship: Initiatives promoting appropriate antibiotic use may temper demand growth, influencing pricing strategies.

-

Shifts in Disease Epidemiology: Rising pediatric skin and respiratory infections sustained by resistant strains could maintain or elevate demand, supporting stable pricing.

Challenges and Market Risks

-

Antimicrobial Resistance (AMR): Increasing resistance among key pathogens may reduce clinical utility, impacting future market size and price stability.

-

Regulatory Hurdles: Variability in regulatory pathways across regions can delay new formulations approvals, influencing early pricing.

-

Competitive Innovation: Development of alternative antibiotics with broader spectrums or improved safety profiles could displace clindamycin, affecting pricing and market share.

Conclusion

The pediatric clindamycin market remains a niche yet vital segment within the broader antibiotic landscape. While current prices are influenced heavily by generic availability and regional factors, future trends suggest stabilization and potential modest reductions in unit prices. Market growth will hinge on evolving resistance patterns, regulatory developments, and formulation innovations. Stakeholders should remain vigilant to these dynamics to optimize market positioning and pricing strategies.

Key Takeaways

- The global pediatric clindamycin market is projected to grow modestly, buoyed by increasing indications and expanding generic entries.

- Prices are trending downward due to generic competition but remain sensitive to regional healthcare policies.

- New formulation developments with improved safety profiles could sustain premium prices temporarily.

- Antimicrobial resistance poses both a challenge and an opportunity—resistance may limit utility but also encourage innovation.

- Regional market differentiation necessitates tailored pricing and access strategies, particularly in emerging markets.

FAQs

1. What factors are driving the growth of pediatric clindamycin in global markets?

Increasing pediatric infection rates, expanding indications, regulatory approvals for pediatric formulations, and the availability of generics drive market growth.

2. How does patent expiration influence clindamycin pricing?

Patent expiry leads to increased generic competition, which typically results in significantly lower prices and broader access.

3. Are there any upcoming formulations that might impact the pediatric clindamycin market?

Yes, formulations with improved safety profiles, taste-masking, or fixed-dose combinations are under development, potentially commanding higher prices initially but increasing overall market attractiveness.

4. What impact does antimicrobial resistance have on the future of pediatric clindamycin?

Rising resistance among target pathogens may diminish clinical efficacy, reducing demand, and pressuring prices further, emphasizing the need for stewardship and innovation.

5. How do regional healthcare policies affect pediatric clindamycin pricing?

Reimbursement rates, regulatory procedures, and local manufacturing influence regional prices, with developed countries often exhibiting higher prices due to regulatory costs and patent protections.

References

[1] Persistence Market Research. "Antibiotic Market Overview," 2022.

[2] U.S. Food and Drug Administration. "Patents Expiry for Clindamycin," 2004.

[3] GoodRx. "Current Pediatric Clindamycin Prices," 2023.

More… ↓