Last updated: July 27, 2025

Introduction

Clindamycin, a lincosamide antibiotic, has played a pivotal role in treating bacterial infections since its approval in the 1960s. Its efficacy against various Gram-positive bacteria, anaerobic infections, and its utility in both oral and topical formulations make it a staple in infectious disease management. As antibiotic resistance rises and regulatory landscapes evolve, understanding the market dynamics and price trajectory for clindamycin becomes essential for pharmaceutical companies, healthcare providers, and investors.

This report offers a comprehensive market analysis and forecasts future pricing trends for clindamycin, considering factors such as demand-supply mechanisms, competitive landscape, regulatory influences, and technological advancements.

Market Overview

Global Market Size and Growth

The global antibiotics market was valued at approximately $49 billion in 2022, driven by increasing bacterial infections and rising antibiotic resistance. Clindamycin, which accounts for a significant secondary segment within this broad market, estimated to generate revenues between $800 million and $1 billion annually, represents a vital subset due to its specific clinical indications.

The compound annual growth rate (CAGR) for clindamycin-specific sales has been modest, around 2-4%, reflecting saturation in some markets and the influence of generic options. However, emerging markets and rising empirical use in outpatient settings are expected to support steady growth through 2030.

Key End-Users and Regions

- Hospitals and clinics dominate clindamycin usage for acute infections.

- dermatology and cosmetic markets utilize topical formulations extensively.

- The United States remains the largest market, accounting for approximately 40% of global sales, owing to high prescription rates and widespread insurance coverage.

- Europe and Asia-Pacific exhibit increasing demand, with Asia-Pacific expected to see the fastest growth rates due to expanding healthcare infrastructure and rising infection prevalence.

Market Drivers

- Escalating bacterial infections, particularly skin and soft tissue infections.

- Rising antimicrobial resistance prompting renewed clinical interest.

- Import substitution and local manufacturing capabilities reducing costs.

- Advances in formulation technology, including topical and injectable forms.

Market Challenges

- Availability of generics leading to price erosion.

- Safety concerns such as antibiotic-associated colitis.

- Stricter regulatory standards affecting approval and manufacturing.

- Antibiotic stewardship programs restricting overuse.

Competitive Landscape

Major Manufacturers and Market Share

Azithromycin and other macrolides hold significant market share alongside clindamycin. Leading producers include Pfizer, Actavis (Teva), Sandoz, and Medichem, offering both branded and generic formulations.

Generic competition dominates the market, driving prices downward. Patent expirations, notably in North America and Europe, have facilitated market entry of multiple generic manufacturers, reducing wholesale and retail prices.

Innovation and Pipeline Developments

While no major pharmaceutical companies currently plan high-profile R&D initiatives for new clindamycin formulations, niche innovations focus on:

- Extended-release formulations.

- Topical gel enhancements.

- Combination therapies to mitigate resistance.

These innovations aim to improve pharmacokinetics, patient adherence, and reduce resistance development.

Regulatory and Patent Landscape

Patent protections for clindamycin formulations generally expired in the early 2010s, leading to a proliferation of generics. Regulatory agencies like the FDA and EMA maintain strict guidelines for antimicrobial approval, emphasizing safety assessments.

Recent trends include:

- Label expansions for new indications.

- Reminder mandates for antimicrobial stewardship.

Regulatory hurdles for novel formulations are moderately high but manageable, influencing market entry strategies.

Price Projections

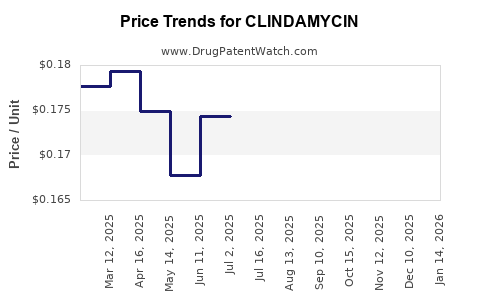

Historical Price Trends

From 2010 to 2020, the average retail price of branded clindamycin capsules declined by approximately 25-30%, primarily due to generic competition. In the United States, the average pharmacy retail price for a 300 mg capsule dropped from $4.00 in 2010 to around $2.50 in 2020.

Projected Price Trajectory (2023-2030)

Considering market saturation, increased generic penetration, and evolving demand:

-

Short-term (2023-2025): Prices are expected to stabilize or decline marginally, averaging $2.00 to $2.50 per capsule in developed markets. Generic competition will continue to exert downward pressure, but formulations with improved features may command a slight premium.

-

Medium-term (2026-2030): Price erosion may plateau; however, in emerging markets, prices could remain higher due to localized manufacturing and higher procurement costs, averaging $1.50 to $2.00 per capsule.

-

Topical formulations: Due to niche markets and patent protections, prices may remain relatively stable, with premium products retailing at $50-$70 per tube, though mainstream options will see price reductions similar to oral forms.

Influencing Factors

- Regulatory policies: Strict antimicrobial stewardship and cost-containment initiatives may suppress prices further.

- Supply chain disruptions: Raw material shortages could temporarily inflate costs.

- Emerging resistance: Will influence clinical use patterns and, consequently, pricing strategies.

- Market segmentation: High-margin niche formulations could sustain higher prices.

Future Outlook and Market Opportunities

-

Expansion in emerging markets: As healthcare infrastructure improves, increased demand for affordable antibiotics could boost sales volume, potentially stabilizing or mildly increasing prices in these regions.

-

Formulation innovation: Introducing sustained-release oral forms or improved topical applications could command higher price points and market share.

-

Combination therapies: Synergistic combinations with other antibiotics may open new therapeutic areas, influencing pricing structures.

-

Resistance management: Development of stewardship programs and rapid diagnostic tools will influence clinical prescription patterns, affecting overall demand and pricing.

-

Regulatory landscape adaptation: Companies that adapt swiftly to evolving regulations concerning antibiotic use and safety will maintain competitive pricing strategies.

Conclusion

The clindamycin market remains moderately mature with consistent demand driven by bacterial infections and niche dermatologic applications. Price erosion continuous in generic segments exerts downward pressure, with average prices diminishing steadily over time. However, opportunities persist in emerging markets, innovative formulations, and combination therapies that could moderate price declines or foster premium pricing.

Pharmaceutical stakeholders should prioritize strategic positioning within emerging markets and invest in formulation advancements that sustain therapeutic relevance amid evolving resistance landscapes and regulatory standards.

Key Takeaways

-

Market stability: Clindamycin's global sales are expected to remain steady, supported by clinical demand and expanding applications in dermatology and resistant infections.

-

Pricing trends: Prices are likely to decline marginally in mature markets due to generic competition, with stabilization possible in niche formulations.

-

Growth opportunities: Emerging markets and formulation innovations present avenues for revenue growth and competitive differentiation.

-

Competitive pressures: Generic proliferation will continue to drive prices downward, requiring strategic marketing and innovation.

-

Regulatory impact: Enhanced safety and stewardship policies will influence prescribing behaviors and, consequently, market dynamics.

FAQs

1. What factors primarily influence the price of clindamycin?

Generic competition, manufacturing costs, regulatory standards, demand-supply balance, and regional healthcare policies significantly impact clindamycin pricing.

2. How will antimicrobial resistance affect the clindamycin market?

Rising resistance may restrict clinical use, potentially reducing demand and exerting downward pressure on prices, unless new formulations or indications emerge.

3. Are there prospects for innovative formulations to alter market prices?

Yes. Sustained-release, combination therapies, and topical enhancements can command premium prices, offsetting declines in traditional formulations.

4. Which regions are expected to see the highest growth in clindamycin demand?

Emerging markets in Asia-Pacific and parts of Latin America are poised for rapid demand growth, driven by expanding healthcare infrastructure and prevalence of infections.

5. What strategies should companies adopt to maintain competitiveness?

Investing in formulation innovation, expanding into untapped markets, complying with evolving regulations, and implementing stewardship programs are vital strategies.

Sources

[1] MarketsandMarkets. "Antibiotics Market Analysis & Trends." 2023.

[2] IQVIA. "Global Antibiotic Sales and Market Data." 2022.

[3] FDA. "Guidelines for Antibiotic Approval and Labeling." 2021.

[4] WHO. "Antimicrobial Resistance and Global Action Plan." 2020.

[5] ReportLinker. "Pharmaceutical Price Trends and Forecasts." 2023.