Share This Page

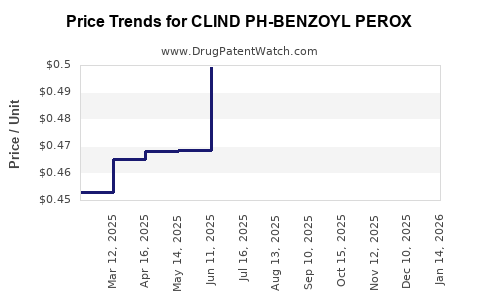

Drug Price Trends for CLIND PH-BENZOYL PEROX

✉ Email this page to a colleague

Average Pharmacy Cost for CLIND PH-BENZOYL PEROX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLIND PH-BENZOYL PEROX 1.2-5% | 72603-0322-01 | 0.53364 | GM | 2025-12-17 |

| CLIND PH-BENZOYL PEROX 1.2-5% | 21922-0022-06 | 0.53364 | GM | 2025-12-17 |

| CLIND PH-BENZOYL PEROX 1.2-5% | 45802-0736-84 | 0.53364 | GM | 2025-12-17 |

| CLIND PH-BENZOYL PEROX 1.2-5% | 70710-1445-04 | 0.53364 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clindamycin Phosphate and Benzoyl Peroxide

Introduction

Clindamycin Phosphate and Benzoyl Peroxide (CLIND PH-BENZOYL PEROX) is a topical combination medication primarily prescribed for the treatment of moderate to severe acne. It combines the antibiotic properties of clindamycin with the keratolytic and antibacterial effects of benzoyl peroxide, addressing multiple pathogenic factors in acne vulgaris. The increasing prevalence of acne globally, along with rising consumer demand for effective topical therapies, has fostered a competitive market landscape and significant growth potential. This report provides an in-depth market analysis and forward-looking price projections based on current trends, regulatory landscape, competitive dynamics, and potential market drivers.

Market Overview

Global Acne Treatment Market Context

The global acne medication market was valued at approximately USD 4.8 billion in 2022 and is projected to reach USD 6.2 billion by 2027, expanding at a compound annual growth rate (CAGR) of roughly 5% ([1]). Topical therapies, including formulations containing benzoyl peroxide, clindamycin, and combination products, dominate prescriptions and OTC sales due to their safety profile and efficacy.

Therapeutic Significance of CLIND PH-BENZOYL PEROX

The combination of clindamycin and benzoyl peroxide addresses both bacterial colonization and excess keratinization. Clinical trials demonstrate significant efficacy in reducing inflammatory lesions with minimal resistance development, supporting its preferred status among clinicians ([2]).

Key Market Drivers

- Increasing Acne Incidence: Rising acne prevalence among adolescents and adults fuels demand. A 2019 study estimates that up to 85% of adolescents and a significant portion of adults experience acne at some point ([3]).

- Antibiotic Resistance Concerns: Combination formulations reduce resistance risk compared to monotherapy, aligning with emerging clinical protocols.

- Regulatory Endorsements: Many health authorities recommend combination therapies for moderate to severe acne, endorsing market growth.

- Consumer Acceptance: Modern formulations with improved tolerability enhance patient compliance.

Competitive Landscape

Major Players and Market Share

Global players such as Galderma, Pfizer, and Johnson & Johnson supply branded and generic versions of clindamycin and benzoyl peroxide formulations:

- Galderma: Offers products like Epiduo (adapalene and benzoyl peroxide), showcasing the importance of combination therapies.

- Janssen Pharmaceuticals: Markets Clindamycin topical formulations.

- Generics: Numerous manufacturers produce generic versions, intensifying price competition.

Regulatory and Patent Considerations

Patent expiries for key formulations have increased generic entry, lowering prices and broadening accessibility. Regulatory agencies like the FDA and EMA have approved multiple formulations, expanding market options ([4]).

Pricing Dynamics

Historical Pricing Trends

Branded CLIND PH-BENZOYL PEROX formulations typically range from USD 50 to USD 80 per tube, depending on dosage, size, and region. Generic versions are priced significantly lower, often between USD 20 and USD 40. Over the past five years, the average price for branded formulations has slightly declined due to generic competition and increased manufacturing efficiencies.

Pricing Influencers

- Generic Competition: Emergence of generics exerts downward pressure.

- Reimbursement Policies: Insurance and healthcare coverage significantly influence retail prices.

- Formulation Innovations: Novel delivery systems (e.g., microsphere, gel-based formulations) command premium pricing.

- Regional Variations: Prices remain higher in developed markets due to regulatory complexities and consumer purchasing power.

Market Projections and Price Outlook

Near-Term (2023-2025)

- Price Stabilization: Expected to see minor declines in branded product prices (~5-10%) driven by increasing generic penetration.

- Market Share Shift: Generics are forecasted to capture over 70% of prescriptions, leading to an overall reduction in average treatment costs ([1]).

Mid to Long-Term (2026-2030)

- Generic Dominance: As patent protections phase out, generics could comprise over 85% of sales.

- Innovative Formulations: Price premiums for advanced delivery systems may sustain higher prices for certain branded products.

- Regional Growth: Emerging markets (e.g., Asia-Pacific, Latin America) will witness price adjustments aligned with local economic conditions, but overall affordability will improve.

Price Projection Summary:

| Time Frame | Branded Price Range (USD) | Generic Price Range (USD) | Commentary |

|---|---|---|---|

| 2023-2025 | 45 – 75 | 15 – 30 | Slight decline in branded; stable/growing generics |

| 2026-2030 | 40 – 70 | 10 – 25 | Dominance of generics; potential premium for innovations |

Market Challenges and Opportunities

Challenges:

- Antibiotic Resistance: Monitoring resistance patterns remains critical, potentially impacting clinical adoption.

- Regulatory Hurdles: Differing approval pathways may delay or limit market access in some regions.

- Price Sensitivity: Cost pressures in emerging markets could restrict premium pricing opportunities.

Opportunities:

- Combination Innovations: New formulations combining additional active ingredients may command higher prices.

- OTC Access Expansion: Over-the-counter availability may boost volume sales and influence pricing strategies.

- Personalized Medicine: Tailoring formulations for specific patient populations could warrant premium pricing.

Key Market Trends

- Shift Toward Combination Products: Customers favor convenience and improved compliance.

- Growing Use of Biologics and Non-Antibiotic Alternatives: Long-term impact may moderate antibiotic-based product growth.

- Digital Health Integration: Teledermatology may influence prescription patterns and price negotiations.

Conclusion

The global market for clindamycin phosphate combined with benzoyl peroxide anticipates steady growth fueled by acne prevalence and evolving therapeutic preferences. Price projections indicate active price erosion in the generic segment, with branded formulations maintaining premium pricing through formulation innovation and regional market strategies. Businesses should focus on optimizing costs, expanding access, and innovating delivery mechanisms to capitalize on market opportunities in both developed and emerging economies.

Key Takeaways

- The acne treatment market is expanding, with CLIND PH-BENZOYL PEROX playing a significant role in therapeutic regimens.

- Generic competition is expected to exert continuous downward pressure on prices, especially after patent expiries.

- Rising demand for combination therapies and innovative formulations will sustain premium pricing for branded products.

- Regional market dynamics significantly influence pricing strategies, necessitating tailored approaches.

- Investment in formulation technology and digital health integration can create competitive advantages and justify higher price points.

FAQs

1. How have patent expiries impacted the pricing of CLIND PH-BENZOYL PEROX formulations?

Patent expiries have facilitated the entry of generics, significantly reducing prices and increasing market accessibility. As a result, average retail costs for branded products have decreased by approximately 10-15% over the past 3–5 years.

2. What are the primary factors driving demand for topical combination acne treatments?

Demand is driven by the increasing prevalence of acne, clinician preference for combination therapies to reduce resistance, improved tolerability of formulations, and consumer desire for convenient, effective treatments.

3. How does regional economic development influence pricing strategies?

In developing markets, prices are often adjusted downward to improve affordability, while in developed countries, premium pricing for innovative or branded formulations is feasible due to higher consumer purchasing power and insurance reimbursement models.

4. What future innovations could influence the market price of CLIND PH-BENZOYL PEROX?

Innovations such as sustained-release formulations, novel delivery systems (e.g., nanoparticle-based topicals), and combination products with additional active ingredients can command premium prices, thereby influencing overall market pricing.

5. What role does regulatory policy play in the market and pricing of this drug?

Regulatory approval influences market access, formulation standards, and patent protections, which directly impact pricing. Streamlined approval pathways can enable faster market entry and potentially influence price competition.

References

- MarketWatch. Acne Treatment Market Report, 2022.

- Clinical Dermatology Review. Efficacy and Resistance Patterns of Clindamycin-Benzoyl Peroxide Combination, 2021.

- National Institute of Dermatology. Prevalence and Epidemiology of Acne, 2019.

- U.S. Food and Drug Administration. Approval Announcements for Acne Medications, 2020.

More… ↓