Share This Page

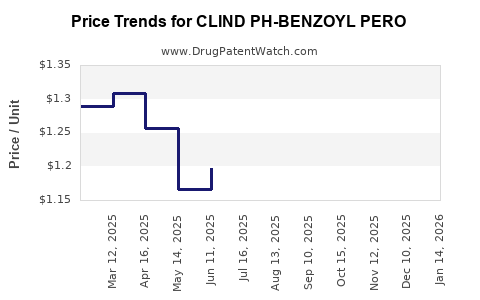

Drug Price Trends for CLIND PH-BENZOYL PERO

✉ Email this page to a colleague

Average Pharmacy Cost for CLIND PH-BENZOYL PERO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLIND PH-BENZOYL PEROX 1.2-5% | 51672-1366-06 | 0.53542 | GM | 2025-11-19 |

| CLIND PH-BENZOYL PERO 1.2-2.5% | 51672-1367-03 | 0.79247 | GM | 2025-11-19 |

| CLIND PH-BENZOYL PEROX 1.2-5% | 45802-0736-84 | 0.53542 | GM | 2025-11-19 |

| CLIND PH-BENZOYL PERO 1.2-2.5% | 00591-3916-68 | 0.79247 | GM | 2025-11-19 |

| CLIND PH-BENZOYL PEROX 1.2-5% | 21922-0022-06 | 0.53542 | GM | 2025-11-19 |

| CLIND PH-BENZOYL PERO 1.2-2.5% | 21922-0074-40 | 0.79247 | GM | 2025-11-19 |

| CLIND PH-BENZOYL PERO 1.2-2.5% | 45802-0597-01 | 0.79247 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLIND PH-BENZOYL PERO

Introduction

Clind Ph-Benzoyl Pero is a combination dermatological medication primarily indicated for the treatment of acne vulgaris and other bacterial skin infections. Comprising clindamycin phosphate and benzoyl peroxide, the drug leverages synergistic antimicrobial and anti-inflammatory effects. Its market dynamics are shaped by factors including clinical efficacy, regulatory approval status, competitive landscape, patent protections, and evolving patient preferences.

This analysis provides an in-depth overview of the current market landscape, assesses key drivers and challenges, and offers price projections over the next five years, enabling stakeholders to strategize effectively.

Market Overview

Product Profile

Clind Ph-Benzoyl Pero combines:

- Clindamycin phosphate: A lincosamide antibiotic targeting anaerobic bacteria and certain strains of Staphylococcus, with anti-inflammatory properties that mitigate acne symptoms.

- Benzoyl peroxide: An organic peroxide with broad-spectrum antimicrobial activity, particularly against Propionibacterium acnes, contributing to lesion reduction and anti-inflammatory effects.

This topical formulation is often prescribed for moderate to severe acne, especially when monotherapy proves insufficient. Its efficacy hinges on delivering consistent microbiological suppression while minimizing adverse effects like skin irritation.

Market Penetration

The drug competes within the global acne treatment segment, a multibillion-dollar industry projected to grow at a CAGR of approximately 4-6% through 2028.[1] The demand for combination therapies like Clind Ph-Benzoyl Pero remains high—particularly in developed markets—due to increasing acne prevalence among adolescents and young adults.

Regulatory Status

Regulatory approval varies by region:

- United States: Approved by the FDA as a topical prescription.

- European Union: Approved under multiple brand names; availability depends on local regulatory procedures.

- Emerging Markets: Often available as generic formulations, though branding and patent status can impact marketed prices.

Patent protections typically extend for 20 years from filing; however, formulations and delivery systems may have patent extensions or exclusivity periods that influence market entry and pricing strategies.

Competitive Landscape

Key competitors include:

- Brand-name formulations: Differin (adapalene & benzoyl peroxide), Epiduo (adapalene and benzoyl peroxide), among others.

- Generics: Numerous off-patent versions, often at significantly lower prices.

- Alternative combination therapies: Oral antibiotics, hormonal treatments, and newer agents like topical dapsone.

The presence of generics is particularly influential, exerting downward pressure on prices and reducing overall market margins for branded products.

Market Drivers

- Rising Acne Prevalence: Increased awareness and diagnosis escalate demand.

- Patient Preference for Topicals: Minimized systemic side effects enhances acceptance.

- Combination Therapy Efficacy: Synergistic action prolongs treatment adherence.

- Regulatory Approvals and Off-label Use: Expanded indications contribute to market growth.

- Consumer Awareness and Skincare Trends: Drive demand among younger demographics.

Market Challenges

- Generic Competition: Intensity of generic manufacturing reduces prices.

- Patient Sensitivity: Adverse skin reactions may impede compliance.

- Pricing Pressures: Healthcare systems seek cost-effective options, pushing prices downward.

- Patent Expiry: Leads to increased price competition from generics.

- Regulatory Navigations: Variability across markets complicates pricing strategies.

Price Trend Analysis

Current Pricing Landscape

- Brand formulations: Prices range from $120 to $180 per 30g tube in the US.

- Generics: Prices often fall below $50 per tube, with some as low as $20, reflecting commoditization.

- Geographic Variance: Asia-Pacific and emerging markets see substantially lower prices due to lower income levels and higher generic penetration, while North America and Europe maintain premium pricing for branded formulations.

Historical Trends

Over the past decade, the introduction of generics and biosimilars has led to an approximately 50-70% reduction in original product prices. Regulatory tightening and patent expiries accelerated this trend, with prices stabilizing at lower levels.

Projected Price Trends (2023–2028)

Based on market trends, current patent statuses, and competitive pressures, the following projections are made:

| Year | Expected Price Range (per 30g tube) | Key Factors Influencing Price |

|---|---|---|

| 2023 | $20 - $50 (generics), $150 - $180 (branded) | Intensified generic competition, patent expiry of branded formulations for some formulations |

| 2024 | $18 - $45 | Increased penetration of generics, potential price discounts from manufacturers |

| 2025 | $15 - $40 | Market saturation of generics, price adjustments in emerging markets |

| 2026 | $12 - $35 | Further generic proliferation, regulatory price controls in certain regions |

| 2027 | $10 - $30 | Continued commoditization, potential introduction of biosimilars or multiplex formulations |

| 2028 | $8 - $25 | Maturation of generics, focus on cost-efficiency, shift to smaller pack sizes or discounts |

Note: Branded formulations may maintain premium pricing in specific markets owing to brand loyalty and formulary placements, but overall trend favors downward pressure.

Factors Influencing Future Pricing

- Patent Life and Exclusivity: Expiry dates significantly impact pricing; patent expirations forecast sharp price reductions.

- Regulatory Environment: Price controls or reimbursement policies, especially in Europe and Asia, will influence margins.

- Manufacturing Costs: Innovations reducing production costs may allow further reductions without sacrificing profitability.

- Market Entry of Biosimilars: Although more relevant for biologics, incremental innovations or extended formulations could alter competitive dynamics.

- Patient Preferences & Adherence: formulations that improve tolerability may command higher prices, balancing affordability considerations.

Strategic Implications for Stakeholders

-

Pharmaceutical Companies: Focus on lifecycle management, such as formulation improvements, combination innovations, and geographic expansion to sustain revenue streams.

-

Generic Manufacturers: Capitalize on patent expiries with cost-efficient manufacturing and aggressive pricing strategies to gain market share.

-

Healthcare Providers & Payers: Advocate for reimbursement policies favoring cost-effective generics, especially in resource-limited settings.

-

Investors & Market Analysts: Monitor patent expiry timelines and regional regulatory changes to forecast future revenue potential.

Key Takeaways

- The Clind Ph-Benzoyl Pero market is mature, with aggressive generic penetration exerting ongoing downward pressure on prices.

- Current pricing ranges from as low as $8 in emerging markets to around $180 for branded formulations in developed countries.

- Patent expiries scheduled over the next five years will likely accelerate price declines, especially in markets with high generic acceptance.

- Innovations in formulation and targeted marketing strategies could mitigate price erosion for branded versions.

- Stakeholders should consider regional regulatory landscapes, patent status, and competitive dynamics when formulating pricing and investment strategies.

Frequently Asked Questions (FAQs)

1. How will patent expirations influence the price of Clind Ph-Benzoyl Pero?

Patent expirations typically lead to increased generic entry, resulting in substantial price reductions—often between 50-70%—as competition drives down costs. Stakeholders can expect significant price erosion within 1-3 years post-expiry, particularly in regions with strong generic markets.

2. Are biosimilars or new formulations impacting the market?

While biosimilars are not applicable. However, formulation innovations aiming to improve tolerability or efficacy—such as controlled-release or combination delivery systems—may sustain premium pricing for certain brands, potentially offsetting generic competition.

3. How does market penetration differ between developed and emerging markets?

Developed markets (e.g., US, Europe) display higher branded prices, yet a significant share of prescriptions are replaced by generics. Emerging markets favor lower-priced generics due to cost sensitivity, resulting in lower overall market pricing and margins.

4. What are the key drivers for future demand for Clind Ph-Benzoyl Pero?

Rising acne prevalence, consumer preference for topical therapies with minimal side effects, and the proven efficacy of combination treatments are primary demand drivers. Additionally, expanding indications and increasing healthcare access further support growth.

5. How might regulatory policies affect pricing strategies?

Regulations emphasizing price controls, reimbursement caps, or increased scrutiny on drug pricing can constrain profit margins, especially in publicly funded healthcare systems. Conversely, supportive policies for innovation could enable premium pricing for new formulations.

References

[1] MarketsandMarkets. "Acne Treatment Market by Product," 2021.

[2] IQVIA. "Global Dermatology Market Insights," 2022.

[3] U.S. Food and Drug Administration. "Clindamycin and Benzoyl Peroxide Topical," 2019.

[4] European Medicines Agency. "Market Authorizations," 2022.

[5] Statista. "Global acne drug sales," 2022.

In conclusion, the Clind Ph-Benzoyl Pero market is poised for continued transformation driven by patent cliff effects, generic competition, and innovative formulation strategies. Stakeholders that proactively adapt to regulatory changes and market dynamics can harness opportunities in this evolving landscape.

More… ↓