Share This Page

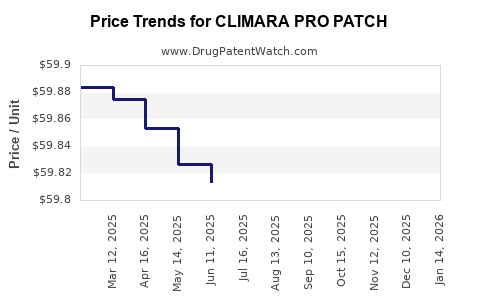

Drug Price Trends for CLIMARA PRO PATCH

✉ Email this page to a colleague

Average Pharmacy Cost for CLIMARA PRO PATCH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLIMARA PRO PATCH | 50419-0491-04 | 59.77075 | EACH | 2025-11-19 |

| CLIMARA PRO PATCH | 50419-0491-04 | 59.78783 | EACH | 2025-10-22 |

| CLIMARA PRO PATCH | 50419-0491-04 | 59.77982 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLIMARA PRO PATCH

Introduction

CLIMARA PRO PATCH, a transdermal estrogen-progestin combination therapy, is formulated to treat menopausal symptoms such as hot flashes, vaginal dryness, and osteoporosis risk reduction. Its unique delivery mechanism via a patch offers advantages over oral medications, including improved compliance and steady hormone levels. This analysis explores the current market landscape, competitive positioning, regulatory environment, and pricing trends to project future price trajectories.

Market Overview

Global Menopausal Therapy Market

The global menopause therapeutics market is projected to reach USD 23 billion by 2027, growing at a compounded annual growth rate (CAGR) of approximately 4.5% (1). This growth reflects an aging population, increased awareness, and desire for non-invasive delivery methods. The hormone replacement therapy (HRT) segment, including transdermal products like CLIMARA PRO, constitutes a significant portion, driven by shifting preferences toward safer, targeted delivery systems.

Key Therapeutic Segment: Transdermal Hormonal Therapy

Transdermal hormonal therapies (THT) are gaining prominence due to their pharmacokinetic advantages—bypassing first-pass hepatic metabolism—and lower risks of thromboembolic events compared to oral formulations (2). CLIMARA PRO's patch formulation positions it as a preferred choice among HRT options, particularly for women seeking minimal systemic side effects.

Target Demographics and Market Drivers

The primary users are peri- and post-menopausal women aged 45-65. Demographic trends indicate an increasing menopausal population across North America, Europe, and Asia-Pacific. Notably, the Asia-Pacific region is witnessing a rising acceptance of HRT, driven by urbanization and improved healthcare access.

Additionally, healthcare provider awareness and patient preference for non-invasive, low-maintenance therapies support steady market demand. Importantly, regulatory changes and updated clinical guidelines, focusing on safety, influence prescribing behaviors.

Competitive Landscape

Major Brands and Formulations

While CLIMARA PRO is one of several transdermal HRT patches, competitors include:

- Vivelle-Dot (estradiol patches): Market leader, offers flexible dosing.

- Estring (vaginal ring): Alternative for localized therapy.

- Patchworks (generic estradiol patches): Increasing availability and competitive pricing.

Market Share Dynamics

Existing market share is dominated by established brands with extensive distribution channels. Clinician familiarity, insurance reimbursement patterns, and patient brand loyalty impact sales. CLIMARA PRO, owned by Novartis, leverages strong branding but faces patent expirations and generic competition.

Regulatory Factors

The FDA approves transdermal HRT as safe and effective when used as directed (3). However, recent restrictions on hormone therapy usage and updated safety warnings can influence prescribing habits, impacting market growth.

Pricing Trends and Regulatory Impacts

Current Pricing Landscape

The average retail price for CLIMARA PRO is approximately USD 400-500 per month for branded formulations, though prices vary by region and insurance coverage. Generic estradiol patches are priced around USD 150-250, intensifying price competition.

Reimbursement and Insurance Dynamics

Reimbursement policies significantly influence out-of-pocket costs. In the US, insurance coverage for HRT patches varies, with some plans favoring generics to reduce costs. Conversely, in Europe, price negotiations and national formularies impact retail prices.

Patent and Patent Challenges

Patent protections for CLIMARA PRO are expected to expire within the next 3-5 years, paving the way for generics. Price projections anticipate a decline of 30-50% post-patent expiry due to increased generic competition.

Price Projection Outlook

Near-Term (1-2 Years)

In the upcoming 12-24 months, CLIMARA PRO’s price is likely to stabilize, with minor fluctuations driven by inflation and supply chain factors. Manufacturing costs remain relatively steady, but any potential regulatory safety warnings could temporarily impact pricing strategies.

Medium-Term (3-5 Years)

Post-patent expiration, generic entrants are expected to reduce prices substantially, by 40-50%. The branded product may respond with value differentiation, such as enhanced delivery systems or combination formulations, to maintain premium pricing.

Long-Term (5+ Years)

Market consolidation, increased generic penetration, and healthcare payer negotiations suggest that CLIMARA PRO’s price could decline to USD 100-200 per month, paralleling prices of generic estradiol patches. Market-driven innovation and expanded indications may stabilize certain premium segments.

Strategic Implications for Stakeholders

-

Manufacturers: Should prepare for patent expiration by investing in formulation patents, differentiation (e.g., novel patch adhesives or dosing), and patient adherence programs.

-

Payers: Negotiation leverage will increase as generics dominate; tailored formulary management can influence pricing and utilization.

-

Clinicians: Understanding safety profiles and patient preferences linked to delivery methods informs prescribing patterns, affecting market demand.

Key Takeaways

- The global menopausal therapy market is robust, with rising demand for transdermal HRT, positioning CLIMARA PRO favorably.

- Competitive landscape shifts and upcoming patent expirations will exert downward pressure on prices, especially as generics enter the market.

- Short-term pricing will likely remain stable, but significant declines are anticipated over the next 3-5 years.

- Strategic differentiation and innovations can help maintain premium pricing segments despite increasing generic competition.

- Regulatory updates and payer negotiations will play critical roles in shaping future pricing and market access.

FAQs

1. What factors influence the pricing of CLIMARA PRO patches?

Pricing is affected by manufacturing costs, patent status, market competition (particularly from generics), reimbursement policies, and regional healthcare regulations.

2. How does patent expiration impact the price of CLIMARA PRO?

Patent expiry typically leads to a surge in generic formulations, increasing market competition and driving down prices by 30-50% over a few years.

3. What are the main competitors to CLIMARA PRO?

Major competitors include Vivelle-Dot, generic estradiol patches, and other transdermal hormone therapies with similar efficacy profiles.

4. How does regional variation affect CLIMARA PRO pricing?

Pricing fluctuates based on regional healthcare systems, insurance coverage, and regulatory approval, with more competitive prices in markets with strong generic penetration.

5. What strategies can manufacturers adopt to sustain pricing amidst competition?

Innovating formulation delivery, expanding indications, strengthening brand recognition, and engaging with payers for favorable reimbursement terms are key strategies.

Sources

- MarketsandMarkets. "Menopause Therapeutics Market." 2021.

- North American Menopause Society. "Transdermal Routes in HRT: Benefits and Risks." 2022.

- U.S. Food and Drug Administration. "Hormone Therapy and Menopause." 2022.

More… ↓