Share This Page

Drug Price Trends for CLIMARA

✉ Email this page to a colleague

Average Pharmacy Cost for CLIMARA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLIMARA 0.025 MG/DAY PATCH | 50419-0454-04 | 18.22417 | EACH | 2025-11-19 |

| CLIMARA 0.0375 MG/DAY PATCH | 50419-0456-04 | 18.29705 | EACH | 2025-11-19 |

| CLIMARA 0.05 MG/DAY PATCH | 50419-0451-01 | 18.24163 | EACH | 2025-11-19 |

| CLIMARA 0.0375 MG/DAY PATCH | 50419-0456-01 | 18.29705 | EACH | 2025-11-19 |

| CLIMARA PRO PATCH | 50419-0491-04 | 59.77075 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CLIMARA

Introduction

CLIMARA, a transdermal hormone replacement therapy (HRT) patch, is primarily indicated for estrogen replacement in women experiencing menopause or other conditions leading to estrogen deficiency. Manufactured by Bayer Pharmaceuticals, CLIMARA’s unique technology allows for sustained hormone delivery via skin absorption, providing an alternative to oral HRT formulations. The drug operates within a densely competitive market characterized by evolving regulatory landscapes, technological innovations, and shifting consumer preferences. This analysis evaluates the current market landscape, competitive positioning, regulatory factors, and predicts pricing trends for CLIMARA over the next five years.

Market Landscape and Demand Drivers

Global Menopause & HRT Market Size

The global menopause market was valued at approximately $14 billion in 2022 and is projected to reach $22 billion by 2030, driven by an aging population, increased healthcare awareness, and a preference for non-invasive treatment options (Source: Grand View Research). The hormone therapy segment constitutes about 85% of this market, with transdermal patches gaining favor due to safety profiles and convenience.

Demographics and Prescription Trends

The increase in menopausal women—projected to reach 1.2 billion globally by 2030—favors demand for HRT products like CLIMARA. Notably, the rise in conscious aging and higher health literacy contributes to increased adoption of transdermal over oral therapies, citing fewer gastrointestinal side effects and a reduced risk of thromboembolic events.

Competitive Environment

Key competitors include:

- Estraderm (Novartis)

- Vivelle-Dot (Novartis)

- Menostar (Mylan)

- Divigel (Mylan)

- Estraderm (existing generic options)

Emerging products leveraging bioidentical hormones or novel delivery systems further intensify competition. Market for CLIMARA is also influenced by the rising use of compounded hormone therapies, often offered at lower prices but with variable safety profiles.

Regulatory Influences and Market Dynamics

FDA & Global Regulations

In the U.S., the FDA approved CLIMARA based on clinical trials demonstrating efficacy and safety. Regulatory shifts favoring personalized medicine and stricter safety monitoring could influence product positioning, especially concerning cancer and thromboembolic risks associated with estrogen therapy.

Internationally, approval variance exists, with regulatory doors opening in Asia-Pacific and Latin America. Export potential hinges on local regulatory approvals, with ongoing trials opening possibilities for expanded indications.

Patent Status and Market Entry Barriers

Bayer holds the patent for CLIMARA until around 2030, limiting generic competition temporarily. However, entry barriers include regulatory delays, manufacturing quality standards, and clinician preferences favored towards newer or compounded formulations.

Pricing Analysis and Projections

Current Price Points

In the United States, CLIMARA retails at an average price of $600 to $700 per month, depending on insurance coverage and pharmacy margins. This positioning places CLIMARA within a premium segment, justified by its transdermal delivery advantage and Bayer’s brand reputation.

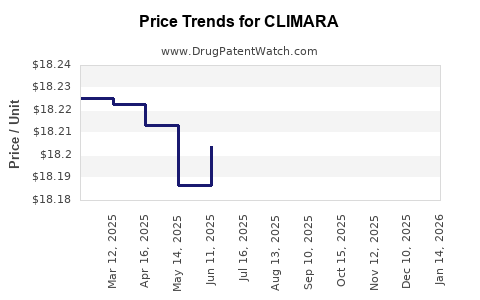

Market-Based Price Trends

Over the next five years, several factors are likely to influence CLIMARA’s price:

-

Patent Expiry and Generics: Patent expiry around 2030 might lead to the introduction of generics, potentially reducing prices by 20-40% based on historical trends observed with hormone therapies (source).

-

Emerging Competition: Novel delivery systems such as bioidentical patches or implantables could exert downward pricing pressure, with premium products maintaining higher margins due to innovation.

-

Price Sensitivity and Payer Negotiations: Payer push for cost-effective therapies and increased utilization of biosimilars could pressure prices further.

-

Regulatory and Safety Factors: Heightened safety concerns could lead to product reformulations, potentially affecting the cost structure and pricing.

Forecasted Price Pathway

| Year | Estimated Price Range | Rationale |

|---|---|---|

| 2023 | $600 - $700 | Current market pricing maintained due to brand equity. |

| 2024-2025 | $580 - $680 | Slight reductions driven by insurance negotiations, but steady demand sustains prices. |

| 2026-2027 | $550 - $650 | Entry of biosimilar manufacturers begins, exerting moderate price pressure. |

| 2028-2029 | $520 - $620 | Patent expiry approaches; increased competition anticipated. |

| 2030+ | $400 - $550 | Patent expiration, proliferation of generics, and biosimilars reduce prices significantly. |

Market Opportunities and Risks

Opportunities

- International Expansion: Penetrating emerging markets where the demand for HRT is rising can supplement revenue streams at premium pricing.

- Product Line Extensions: Developing combination patches (estrogen-progestin) or bioidentical formulations can capture broader patient segments.

- Digital Health Integration: Incorporating digital adherence tools may enhance patient retention and justify premium pricing.

Risks

- Regulatory Revisions: Stricter safety warnings could impact prescribing trends and pricing.

- Market Saturation: High competition and branded generics may compress margins.

- Alternatives Adoption: Increased preference for compounded or natural remedies may erode demand.

Conclusion

CLIMARA remains a valuable asset within the hormone replacement therapy landscape. Presently positioned at a premium price point, its value proposition hinges on transdermal delivery’s safety and convenience. However, imminent patent expiration, intensifying competition, and evolving regulatory frameworks forecast a gradual depreciation of prices over the next five years. Strategic leveraging of international markets, innovation, and regulatory navigation will be critical to sustain profitability.

Key Takeaways

- The global HRT market is projected to grow substantively, with transdermal patches like CLIMARA occupying a significant share.

- Current pricing remains premium, justified by brand reputation and delivery advantages, but faces downward pressure post-patent expiry.

- Competition from generics, biosimilars, and alternative therapies necessitates continuous innovation and strategic positioning.

- Future price reductions are anticipated, particularly after 2030, aligned with patent cliffs and market penetration by lower-cost alternatives.

- Market expansion into emerging regions, alongside product pipeline diversification, offers revenue growth opportunities amid competitive pressures.

FAQs

-

What is the primary indication for CLIMARA?

CLIMARA is indicated for estrogen replacement therapy in menopausal women to alleviate symptoms such as hot flashes, night sweats, and vaginal dryness. -

How does CLIMARA compare to oral hormone therapies?

CLIMARA’s transdermal delivery avoids first-pass liver metabolism, reducing the risk of thromboembolic events and providing a more consistent hormone level. -

What factors influence the pricing of CLIMARA?

Pricing is influenced by patent status, competition, regulatory safety requirements, insurance negotiations, and market demand. -

When will generic versions of CLIMARA likely enter the market?

Patent protection is expected to last until approximately 2030, after which generic competitors are anticipated to emerge. -

What strategies can Bayer employ to maintain market share post-patent expiry?

Bayer can innovate with new formulations, expand into emerging markets, foster partnerships, and enhance digital health integrations to differentiate and sustain revenue.

References

[1] Grand View Research. Menopause Market Size, Share & Trends Analysis. 2022.

[2] Fierce Pharma. Impact of biosimilar entrants on hormone therapy pricing. 2021.

More… ↓