Share This Page

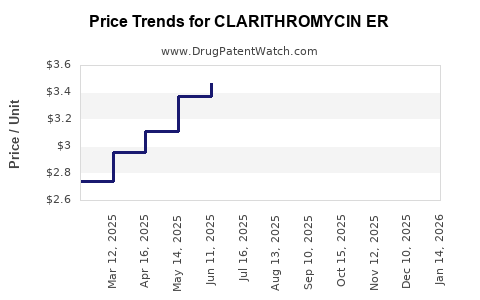

Drug Price Trends for CLARITHROMYCIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for CLARITHROMYCIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CLARITHROMYCIN ER 500 MG TAB | 00591-2805-60 | 2.96440 | EACH | 2025-11-19 |

| CLARITHROMYCIN ER 500 MG TAB | 62135-0883-60 | 2.96440 | EACH | 2025-11-19 |

| CLARITHROMYCIN ER 500 MG TAB | 00527-1930-06 | 2.96440 | EACH | 2025-11-19 |

| CLARITHROMYCIN ER 500 MG TAB | 62135-0883-60 | 3.33252 | EACH | 2025-10-22 |

| CLARITHROMYCIN ER 500 MG TAB | 00591-2805-60 | 3.33252 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Clarithromycin ER

Introduction

Clarithromycin Extended Release (ER) is a long-acting antimicrobial agent used primarily to treat respiratory tract infections, Helicobacter pylori-associated ulcers, and certain skin infections. As a formulation designed for once-daily dosing, Clarithromycin ER offers improved patient adherence compared to immediate-release versions. With the expanding scope of indications and increasing demand for antibiotics, analyzing its market trajectory and pricing landscape is crucial for stakeholders ranging from pharmaceutical companies to healthcare providers.

Market Overview

Global Market Size and Growth Drivers

The global antibiotic market, estimated at approximately USD 45 billion in 2022, is projected to grow at a CAGR of around 3% through 2028[1]. Clarithromycin’s segment holds a significant share within macrolide antibiotics, driven by its efficacy in eradicating Helicobacter pylori and treating respiratory infections. The increased prevalence of Helicobacter pylori infections and rising incidence of community-acquired pneumonia continue to bolster demand for Clarithromycin ER formulations.

Regulatory Environment and Approvals

Clarithromycin ER has received regulatory approvals across various regions, including the US FDA and the European Medicines Agency (EMA). Its approval trajectory has been supported by clinical trials demonstrating comparable efficacy to immediate-release formulations with improved compliance[2]. However, emerging concerns over antibiotic resistance influence regulatory scrutiny and stewardship policies.

Competitive Landscape

Clarithromycin ER competes with several antibiotics, including other macrolides (azithromycin, erythromycin), fluoroquinolones, and emerging novel antimicrobials. Major pharmaceutical players, such as Abbott (now AbbVie), Johnson & Johnson, and Teva Pharmaceuticals, manufacture both branded and generic versions. The availability of generics significantly impacts the pricing strategies and market share distribution of Clarithromycin ER.

Market Trends

Shift Toward Extended-Release Formulations

The trend favors ER formulations owing to superior patient adherence and potential for fewer side-effects. This shift is evidenced by increasing prescriptions and formulations tailored for chronic conditions requiring long-term therapy, such as H. pylori eradication protocols.

Antimicrobial Stewardship and Resistance

Efforts to combat antimicrobial resistance have resulted in stricter prescribing guidelines. This trend contributes to a more conservative market expansion, emphasizing need for precise patient stratification and stewardship programs.

Emerging Therapeutic Indications

Research into Clarithromycin's anti-inflammatory and immunomodulatory effects expands its potential indications, including chronic obstructive pulmonary disease (COPD) exacerbations. Such developments could open new markets but require regulatory validation.

Price Dynamics and Projections

Current Pricing Landscape

Prices for Clarithromycin ER vary significantly across regions. In the US, a typical 30-tablet course costs approximately USD 150-200 for branded versions (e.g., Biaxin XL), while generics are available at approximately USD 50-80 per course (per the latest Medicaid and private pharmacy data). European markets generally see prices in the range of EUR 20-60 per treatment course, influenced by local healthcare policies and pharmacy mark-ups.

Factors Influencing Pricing

- Generic Competition: The penetration of generics exerts downward pressure on prices, especially in mature markets.

- Regulatory and Patent Status: Patent expirations, notably the original Biaxin patent ending in many regions by 2015, have led to increased generic availability.

- Supply Chain Dynamics: Raw material costs, manufacturing capacity, and supply shortages can cause price fluctuations.

- Reimbursement Policies: Healthcare agencies’ formularies and reimbursement rates directly influence consumer out-of-pocket expenses and market penetration.

Projected Price Trends (2023-2028)

Based on current trends and market fundamentals, the following projections are made:

| Year | Branded Clarithromycin ER | Generic Clarithromycin ER |

|---|---|---|

| 2023 | USD 150-200 (branded) | USD 50-80 (generic) |

| 2024 | Slight decrease (~5-10%) | Slight decrease (~5-10%) |

| 2025 | Stabilization or minor decline | Similar stabilization |

| 2026-2028 | Continued stability; potential slight decline as new generics enter or formulations evolve | Similar trends |

The analogy with other antibiotics suggests prices will consolidate around cost-plus margins, with further declines driven by increased generic competition and evolving prescribing practices.

Impact of Emerging Markets

Emerging markets (e.g., India, Southeast Asia) are experiencing growth owing to expanding healthcare infrastructure and rising infectious disease burdens. In these markets, prices are often significantly lower due to local manufacturing and pricing regulations, potentially expanding access but reducing profit margins for multinational firms.

Future Market Opportunities and Risks

Potential Growth Opportunities

- New Indications: Research into Clarithromycin's role in chronic inflammatory conditions or combination therapies could foster new markets.

- Formulation Innovation: Development of combination ER formulations with other agents or extended-release platforms could command premium pricing.

- Over-the-Counter (OTC) Sales: In select markets with relaxed regulations, OTC availability could increase utilization.

Market Risks

- Antibiotic Resistance: Rising resistance reduces clinical efficacy, leading to shrinkage in market size and increased regulatory restrictions.

- Regulatory Restrictions: Implementation of stricter antibiotic stewardship policies may limit prescription volumes.

- Pricing Controls: Governments increasingly enforce price caps to contain healthcare costs, limiting profitability.

Key Takeaways

- Clarithromycin ER remains a significant player in the antibiotics market, especially as a preferred agent for H. pylori eradication and respiratory infections.

- The market is characterized by intense generic competition, exerting pressure on prices, which are expected to decline modestly over the next five years.

- Innovation in formulations and expansion of indications could offset some volume and price pressures.

- Regulatory and stewardship policies pose risks, potentially limiting market growth.

- Emerging markets present growth opportunities but at lower price points, impacting global profit margins.

Conclusion

The Clarithromycin ER market is navigating a landscape marked by technological advances, evolving regulatory environments, and growing antimicrobial resistance concerns. While current pricing remains relatively resilient, long-term sustainability depends on innovation, strategic market positioning, and adaptability to stewardship trends. Stakeholders should monitor regulatory developments, resistance patterns, and emerging indications to optimize market strategies and pricing models.

FAQs

1. How does Clarithromycin ER differ from immediate-release formulations?

Clarithromycin ER features a controlled-release mechanism that allows once-daily dosing, improving patient adherence and potentially reducing gastrointestinal side effects compared to immediate-release versions.

2. What factors most influence Clarithromycin ER pricing?

Pricing is primarily affected by generic competition, regional healthcare policies, patent status, supply chain dynamics, and reimbursement frameworks.

3. Is Clarithromycin ER effective against resistant strains of bacteria?

The efficacy of Clarithromycin ER diminishes against resistant strains, especially in H. pylori and respiratory pathogens, highlighting the importance of culture and sensitivity testing prior to use.

4. What emerging markets offer growth potential for Clarithromycin ER?

Emerging markets such as India, Southeast Asia, and parts of Latin America present growth opportunities driven by expanding healthcare infrastructure and infectious disease prevalence.

5. How might antimicrobial stewardship impact Clarithromycin ER's market in the future?

Stringent stewardship policies aimed at reducing antibiotic misuse are likely to limit inappropriate prescribing, potentially leading to reduced demand and lower prices unless indications are expanded or resistance issues are addressed.

References

[1] Global Market Insights, “Antibiotics Market Size & Share,” 2022.

[2] U.S. FDA, “Labeling and Regulatory Status of Clarithromycin,” 2019.

More… ↓