Last updated: July 27, 2025

Introduction

CINACALCET HCL (calcimimetic agent) is a prescription medication predominantly used for secondary hyperparathyroidism in patients with chronic kidney disease (CKD) on dialysis and for managing parathyroid carcinoma. Approved by the FDA in 2017, Cinacalcet’s market positioning, competitive landscape, regulatory environment, and emerging pricing dynamics are critical factors influencing its commercial trajectory. This analysis delineates current market forces, anticipated price trends, and strategic insights relevant to stakeholders.

Market Overview

Therapeutic Indication and Patient Demographics

Cinacalcet’s core indication—secondary hyperparathyroidism in CKD patients—primarily targets a vulnerable population with complex treatment needs. The global CKD population exceeds 850 million, with approximately 35% progressing to end-stage renal disease (ESRD) requiring dialysis or transplantation [1]. The high prevalence of secondary hyperparathyroidism (SHPT)—affecting up to 80% of dialysis patients—ensures a substantial patient base for cinacalcet.

Market Penetration and Adoption Trends

Since its launch, cinacalcet has experienced steady adoption, driven by clinical guidelines favoring calcimimetics over older therapies such as vitamin D analogs. Market penetration remains robust within developed economies, notably the U.S., Europe, and Japan. Yet, its adoption is subject to competition from newer agents, generic options, and shifting treatment paradigms emphasizing personalized medicine.

Competitive Landscape

The primary competitor remains etelcalcetide, another calcimimetic agent administered intravenously. Generic versions of cinacalcet are limited but anticipated, given patent expirations. Additionally, emerging treatments, including novel calcimimetic or parathyroid hormone modulating agents, threaten to disrupt market share.

Regulatory and Reimbursement Environment

Pricing Regulations

Pricing is influenced by regulatory policies, geographic Reimbursement models, and healthcare payer strategies. In the U.S., Medicare and private insurers negotiate drug prices, with substantial impact from the Inflation Reduction Act and drug pricing reforms.

Market Access

Coverage expansions and formulary placements significantly impact sales volume. Elevated drug prices often meet resistance, particularly amidst increased scrutiny over healthcare costs, making affordability and real-world effectiveness key factors for sustained market success.

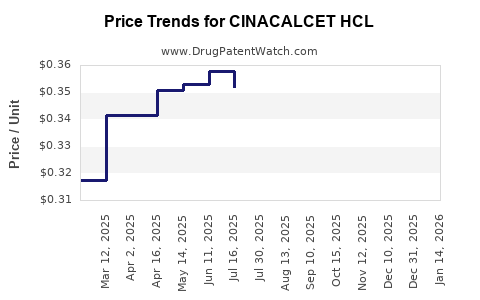

Current Pricing Landscape

Pricing Benchmarks

As of the latest data, the average wholesale price (AWP) for branded cinacalcet (Sensipar/Mimpara) hovers around $700–$800 per month per patient. These prices substantially influence reimbursement costs in endemic regions like the U.S.

Impact of Patent Status and Generics

Patent protections, expiring in the U.S. and Europe, open avenues for generic manufacturing, with early generic entries expected within 2–3 years. Generics could reduce prices by 60–80%, significantly impacting revenue streams for originator brands.

Reimbursed Prices and Out-of-Pocket Costs

In the U.S., insurers typically reimburse close to the list price, though patient copayments vary. High medication costs impose economic burdens on healthcare providers and patients, incentivizing payers to favor generics or alternative therapies.

Price Projection Scenarios

Short-Term (1–2 Years)

- Stability in branded drug pricing due to patent protections, with prices remaining around $700–$800/month.

- Potential price erosion of up to 10–15% if payers negotiate discounts or shift to alternative therapies.

- Limited generic competition emergence expected, maintaining margins for the innovator.

Mid-Term (3–5 Years)

- Entry of generics following patent cliff, likely resulting in a 40–70% reduction in list prices.

- Potential tiered pricing strategies by manufacturers to retain market share, possibly incorporating value-based pricing or patient assistance programs.

- Market consolidation and payer pressure could further drive down prices.

Long-Term (5+ Years)

- Widespread generic availability will place significant downward pressure on prices.

- Innovation-driven value propositions—such as improved formulations or combination therapies—could sustain premium pricing for optimized delivery or specific patient subsets.

- Emerging therapies or biosimilars could influence the price landscape, further intensifying competition.

Factors Influencing Future Pricing Dynamics

- Patent Expiry Timeline: The key patent expiration for cinacalcet falls around 2024–2025; generics' entry is anticipated thereafter.

- Regulatory Landscape: Policies promoting biosimilar and generic proliferation will accelerate price erosion.

- Market Demand & Reimbursement Policies: Value-based pricing models may support sustained premium prices for novel formulations.

- Competitive Innovations: Advanced therapies that demonstrate superior efficacy or safety could shift market preferences, impacting pricing strategies.

Strategic Insights

- Premium Positioning: For manufacturers, maintaining differential advantages—such as administration convenience or superior side-effect profiles—may justify premium pricing.

- Generic Market Entry Preparedness: Companies must strategize inventory, supply chain, and marketing to maximize revenue pre-patent expiry.

- Regulatory Engagement: Active participation in reimbursement discussions aids positioning for favorable coverage decisions.

- Investment in Value Demonstration: Robust real-world evidence substantiating cost-savings or improved clinical outcomes can justify sustained or increased pricing in competitive environments.

Key Takeaways

- High initial prices: As of 2023, branded cinacalcet commands a retail price of approximately $700–$800/month, supported by patent exclusivity.

- Patent expiration imminent: Entry of generics within the next 2-3 years is poised to reduce prices substantially, by up to 70%.

- Market proliferation of generics: Significant price erosion expected post-patent expiry, transforming revenue streams and prompting strategic adaptation.

- Regulatory shifts: Healthcare policies emphasizing affordability and value-based care will influence pricing, reimbursement, and formulary placements.

- Competitive innovations: Future therapies and biosimilars could further reshape price dynamics, emphasizing the importance of continuous market intelligence and adaptive strategies.

FAQs

1. When will generic cinacalcet likely enter the market?

Generic versions are expected within 2–3 years following patent expiration, likely around 2024–2025, pending regulatory and patent litigation outcomes [2].

2. How will the entry of generics impact the market?

Generics typically decrease prices by 60–80%, significantly reducing revenue for originator manufacturers and compelling strategic shifts towards cost containment, value demonstration, and differentiated offerings.

3. Are there emerging therapies that could replace cinacalcet?

Yes, novel calcimimetics, once-daily formulations, or alternative phosphate management agents are under investigation, which might influence future market dynamics and pricing strategies.

4. How does reimbursement influence cinaccalet pricing?

In systems like the U.S., insurer negotiations and formulary placements heavily influence effective patient costs and manufacturer revenue, often aligning prices with perceived value and negotiated discounts.

5. What strategic measures can manufacturers adopt in anticipation of price declines?

Investing in real-world evidence to establish value, exploring formulation innovations, expanding therapeutic indications, and engaging with payers early can mitigate revenue impacts and sustain market relevance.

References

[1] International Society of Nephrology. “Global CKD Epidemiology and Statistics.” 2022.

[2] U.S. Food & Drug Administration. “Patent Status and Market Exclusivity Data for Cinacalcet.” 2023.