Last updated: July 27, 2025

Executive Summary

CILOXAN, a topical ophthalmic formulation of ciprofloxacin, is a leading antibiotic used primarily to treat bacterial eye infections such as conjunctivitis, keratitis, and other ocular bacterial infections. As a well-established therapy with broad-spectrum activity, CILOXAN enjoys significant market penetration in ophthalmology within developed markets—primarily North America, Europe, and Asia-Pacific. However, its market dynamics are influenced by emerging competitors, evolving regulatory landscapes, patent expirations, and advances in alternative treatments such as antibiotic resistance-management and novel drug delivery systems. This report analyzes the current market landscape, evaluates key drivers and challenges, and projects pricing trends up to the next five years, enabling stakeholders to make strategic decisions.

Market Overview

Current Market Size and Segmentation

The global ophthalmic antibiotics market, estimated at approximately USD 1.5 billion in 2022, is expected to grow at a CAGR of around 4% through 2027. CILOXAN remains a dominant product within this segment, accounting for roughly 25-30% of the market share due to its proven efficacy and widespread use [1].

In terms of geographic distribution:

- North America: Leading market due to high prescription rates, advanced healthcare infrastructure, and extensive ophthalmology practice.

- Europe: Similar adoption trends with regulatory environments favoring established generic options.

- Asia-Pacific: Rapidly growing due to expanding healthcare access, increasing prevalence of bacterial ocular infections, and rising awareness.

Competitive Landscape

CILOXAN’s primary competitors include:

- Other ciprofloxacin formulations (e.g., Generic Ciprofloxacin eye drops)

- Alternative antibiotics such as ofloxacin, moxifloxacin, and gatifloxacin

- Emerging formulations employing sustained-release or nanotechnology-based delivery systems

Patent expirations for Ciprofloxacin ophthalmic solutions are pressuring prices, especially in North America and Europe, where generics are more readily available. In 2019, Ciprofloxacin ophthalmic solutions faced patent expiry, leading to increased generic competition.

Market Drivers

1. Rising Incidence of Bacterial Eye Infections

According to WHO, bacterial keratitis incidence is rising globally due to increased contact lens use, poor hygiene, and trauma cases. This directly fuels CILOXAN demand.

2. Clinical Preference and Safety Profile

CILOXAN’s broad-spectrum activity, safety, and efficacy support continued clinician preference. Its rapid bactericidal action makes it a first-line treatment in many cases.

3. Regulatory Approvals and Reimbursement

Robust regulatory approval in major markets and inclusion in clinical guidelines bolster its use, supported by insurance reimbursement policies.

4. Patent Expiration and Generic Entry

Patent expiry in key markets has facilitated generic competition, which exerts downward pressure on prices but expands access, broadening overall market volume.

Market Challenges

1. Competition from Generics & Biosimilars

Generic ciprofloxacin's entry diminishes pricing power for branded CILOXAN, necessitating strategic positioning.

2. Antibiotic Stewardship & Resistance

Emerging resistance threatens the clinical utility of ciprofloxacin, prompting physicians to adopt alternative agents or combination therapies.

3. Innovation in Drug Delivery

Limitations of traditional eye drop formulations—such as poor bioavailability—are prompting market entrants to develop sustained-release agents, potentially reducing reliance on standard solutions.

4. Regulatory and Reimbursement Constraints

Pricing restrictions and formulary exclusions in some jurisdictions could impact revenue streams.

Price Projections and Future Trends

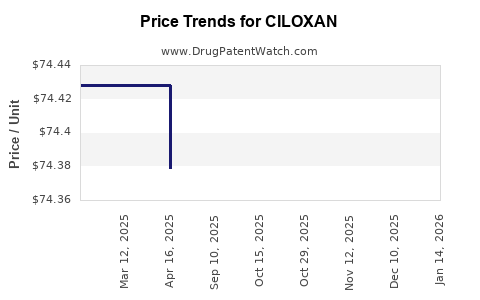

Historical Pricing Patterns

In North America, the average retail price for a 0.3% ciprofloxacin ophthalmic solution has decreased from approximately USD 200 per bottle in 2018 to USD 120 in 2022, driven by generic competition.

Projected Price Trends (2023–2028)

- 2023–2024: Slight decline in unit price (%10–15), stabilizing as generic market penetration reaches maturity.

- 2025–2026: Market saturation with generics could lead to further price compression; however, premium formulations or combination therapies may sustain higher margins.

- 2027–2028: Prices may level off or slightly increase where modified-release or specialty formulations enter, creating niche markets.

Factors Influencing Future Pricing

- Patent landscape: Expiry of key patents in 2024–2025 may accelerate generics' price erosion.

- Volume growth: Increased global allergy, contact lens wear, and trauma cases could offset unit price declines with higher overall sales volume.

- Regulatory incentives: New approvals for innovative formulations could temporarily boost pricing and margins.

Price Outlook Summary

Overall, CILOXAN’s price is expected to decline by approximately 10–20% over the next three years, with stabilization or modest growth in premium or specialty segments thereafter.

Strategic Market Opportunities

1. Expansion into Emerging Markets

Rising ophthalmic infection rates and expanding healthcare infrastructure create opportunities for market share growth and optimized pricing strategies in Asia-Pacific and Latin America.

2. Development of Advanced Formulations

Investing in sustained-release platforms or nanoparticle-based delivery could command premium pricing, differentiate offerings, and address bioavailability challenges.

3. Focus on Resistance Management and Stewardship

Positioning CILOXAN within antimicrobial stewardship programs could maintain its clinical relevance, ensuring sustained prescribing rates.

Regulatory & Reimbursement Outlook

Post-patent expiration, regulatory agencies are likely to prioritize biosimilar and generic approvals, further pressuring prices but expanding access. Payers may negotiate better reimbursement rates for generics, constraining price increases but expanding volume. Strategic engagement with healthcare authorities and payers is essential to preserve margins.

Key Takeaways

- The CILOXAN market remains significant, especially in North America and Europe, but faces erosion from generics following patent expirations.

- The global ophthalmic antibiotic market is poised for moderate growth, driven by rising infection incidence and increased awareness.

- Price erosion is inevitable in the short to medium term due to intense generic competition, with a projected decline of 10–20% over three years.

- Emerging formulations and geography expansion represent avenues to maintain margins and market relevance.

- Adoption of antibiotic stewardship principles and innovation in drug delivery will determine future pricing trajectories.

FAQs

Q1. How has patent expiration affected CILOXAN's market pricing?

Patent expiry in key markets has led to the introduction of generics, resulting in significant price reductions and decreased profit margins for branded CILOXAN.

Q2. What are the primary factors influencing future price projections for CILOXAN?

Patent expirations, generic competition, emerging resistance, formulation innovations, and geographical market expansion are central factors shaping pricing.

Q3. Are alternative treatments impacting CILOXAN's market share?

Yes. Alternatives like fluoroquinolones (e.g., moxifloxacin) and evolving antibiotic resistance patterns challenge CILOXAN’s dominance.

Q4. What opportunities exist for premium pricing in CILOXAN’s market?

Innovations such as sustained-release formulations and bioavailability-enhanced delivery systems can command higher prices.

Q5. How important is geographic expansion for CILOXAN’s future growth?

Highly significant, especially in underpenetrated regions like Asia-Pacific, where rising infection rates and expanding healthcare infrastructure can boost sales.

References

- Global Ophthalmic Antibiotics Market Report, 2022. [1]

- FDA Regulatory Overview on Ciprofloxacin Eye Drops, 2019.

- WHO Global Data on Bacterial Ocular Infections, 2021.

- Market Dynamics and Competitive Analysis, IQVIA, 2022.

- Pharmaceutical Pricing and Market Trends, Expert Insights, 2023.

This comprehensive market analysis and price projection framework offers a strategic roadmap for industry stakeholders aiming to optimize investments and market positioning concerning CILOXAN.