Last updated: July 27, 2025

Introduction

Ciclopirox is a broad-spectrum antifungal agent primarily used in topical formulations to treat superficial fungal infections such as athlete’s foot, onychomycosis, candidiasis, and other dermatophyte infections. Recognized for its unique mechanism of disrupting fungal cell membrane functions, ciclopirox has maintained a steady presence in dermatological therapeutics. This report analyzes the current market landscape, forecasts future demand, evaluates competitive dynamics, and projects pricing trends for ciclopirox over the next five years.

Market Overview

The global antifungal drug market was valued at approximately USD 13.4 billion in 2021 and is projected to grow at a compounded annual growth rate (CAGR) of around 5% through 2028 [1]. Within this market, topical antifungals represent a significant segment, with drugs like terbinafine, clotrimazole, and ciclopirox leading the therapeutic options. Ciclopirox’s efficacy, safety profile, and approval for various formulations sustain its relevance, particularly in dermatology clinics and over-the-counter (OTC) channels.

Current Market Dynamics

Geographical Distribution

North America, Europe, and Asia-Pacific dominate the ciclopirox market, driven by rising prevalence of fungal infections, increasing awareness, and expanding dermatological healthcare infrastructure. North America accounts for approximately 40% of global sales, leveraging high diagnosis rates and OTC availability. Europe follows closely, with substantial growth observed in Eastern European markets. The Asia-Pacific region is expected to see the highest CAGR (~7%), fueled by rising urbanization, increased healthcare access, and expanding manufacturing capabilities [2].

Key Players and Competitive Landscape

Major pharmaceutical companies manufacturing ciclopirox formulations include Valeant Pharmaceuticals (now part of Bausch Health), Perrigo, and Sun Pharmaceutical Industries. Generic formulations are prevalent, driving price competition. Patent expirations, such as for branded ciclopirox products, have facilitated generic entry, further intensifying market competition and exerting downward pricing pressure.

Regulatory Environment

Ciclopirox enjoys regulatory approval in multiple countries, including the U.S., European Union, and Asian markets. The approval of OTC products facilitates broad access and consumer convenience, impacting market penetration positively. However, regulations around labeling and formulations vary, influencing market strategies.

Market Demand Drivers

- Increasing Incidence of Fungal Infections: Rising prevalence of athlete’s foot, onychomycosis, and candidiasis, especially among aging populations and immunocompromised individuals, sustains demand [3].

- Lifestyle and Urbanization: Changes in hygiene practices and lifestyle choices have contributed to higher infection rates.

- Limited Resistance Development: Unlike some systemic antifungals, resistance to ciclopirox remains relatively low, maintaining its therapeutic relevance.

- Product Availability: The OTC status in many regions boosts sales volume, particularly through retail pharmacies.

Market Challenges

- Competition from Other Topicals: Drugs like terbinafine and clotrimazole are often preferred due to fast onset and higher market share.

- Pricing Pressures: The availability of generics diminishes profit margins for manufacturers.

- Patient Compliance: Extended treatment durations for onychomycosis hinder compliance, affecting market growth.

Price Trends and Projections

Current Pricing Landscape

- Brand-Name Formulations: Topical ciclopirox in cream or solution ranges from USD 15 to USD 25 per tube (15-30g), depending on region and brand premium.

- Generic Products: Prices for generic ciclopirox formulations are generally lower, approximately USD 8 to USD 15 per unit, creating price-sensitive market dynamics.

- OTC vs. Prescription: OTC products tend to be less expensive, often priced around USD 10–USD 20 per unit, while prescription formulations may cost higher depending on healthcare coverage.

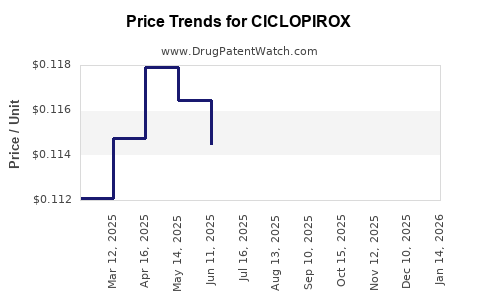

Forecasted Price Trends (2023–2028)

Based on historical trends, market entrants, and regulatory developments, the following projections are anticipated:

-

Stabilization of Generic Pricing

As patent expirations stabilize and generics dominate, price points for ciclopirox formulations are expected to decline marginally by approximately 3–5% annually. The widespread availability of generics in mature markets will suppress prices further while maintaining volume sales [4].

-

Premium Formulations and Novel Delivery Systems

Development of novel formulations enhances patient adherence and efficacy. These advanced products, such as ciclopirox-based nail lacquers or foam formulations, are likely to command a premium price—anticipated to increase by 2–4% annually—due to value-added features and patent protection, where applicable.

-

Regional Variations

- North America and Europe will see consolidated pricing due to established regulatory and healthcare frameworks, with minimal fluctuations.

- In emerging markets like India and Southeast Asia, prices are projected to decrease by 5–7% annually, driven by increased generic competition and price sensitivity.

-

Impact of Market Share Shifts

If ciclopirox gains market share through increased clinical use or formulary inclusion, manufacturers may maintain or slightly elevate prices in select segments to optimize margins. Conversely, intensified competition will persistently pressure prices downward.

Future Market Opportunities and Risks

Opportunities

- Expansion of Indications: Approvals for additional fungal or microbial infections could expand market size.

- Formulation Innovations: Liposomal or sustained-release formulations could command higher prices and improve efficacy, justifying premium pricing.

- Strategic Partnerships: Collaborations with dermatological clinics and pharmacies can increase market penetration.

Risks

- Market Saturation: High penetration of generics could limit pricing potential.

- Competitive Substitution: Emerging antifungals with superior efficacy or shorter treatment courses may replace ciclopirox.

- Regulatory Changes: Stringent regulations or restrictions on OTC sales could influence price trajectory.

Conclusion

The ciclopirox market, buoyed by its broad-spectrum antifungal activity and regulatory approval, is poised for modest growth over the next five years, mainly driven by regional expansion and formulation innovations. Price projections suggest a downward trend in generic formulations owing to market saturation but with pockets of premium pricing through advanced delivery systems and expanded indications. Stakeholders should prioritize differentiated formulations, strategic geographic expansion, and maintaining cost competitiveness to sustain profitability amid evolving market pressures.

Key Takeaways

- The global ciclopirox market is expected to grow at a CAGR of approximately 4–6% through 2028, predominantly in emerging markets.

- Price declines for generic formulations will occur, averaging 3–5% annually, while innovative formulations may command higher prices.

- Regional disparities significantly influence pricing dynamics, with mature markets experiencing more stable pricing, while emerging markets face further reductions.

- Formulation innovation and geographical expansion are critical to capturing future market share and profitability.

- Competitive pressures necessitate strategic brand positioning and cost management to maintain margins.

FAQs

1. What are the primary factors influencing ciclopirox pricing in the next five years?

Pricing will be influenced by generic competition, formulation innovations, regional market dynamics, and potential expansion into new indications. Patent expirations and regulatory pathways for advanced formulations will also play significant roles.

2. How does the availability of generic ciclopirox products impact market pricing?

The proliferation of generics drives prices downward due to increased competition, especially in mature markets, leading to a decline of around 3–5% annually for standard formulations.

3. Are there emerging formulations that could alter ciclopirox’s market position?

Yes, novel delivery systems such as nail lacquers, foam-based applications, or liposomal formulations could command premium pricing and significantly impact market dynamics.

4. Which regions offer the most promising growth prospects for ciclopirox?

Emerging markets in Asia-Pacific and Latin America present substantial growth opportunities driven by rising fungal infection prevalence and expanding healthcare access, despite price sensitivities.

5. What strategies should manufacturers adopt to remain competitive in the ciclopirox market?

Focusing on formulation innovation, geographic expansion, strategic partnerships, cost efficiency, and patient adherence initiatives will be essential to maintaining competitiveness and profit margins.

Sources

[1] MarketsandMarkets, "Antifungal Drugs Market," 2022.

[2] Research and Markets, "Global Dermatological Market," 2023.

[3] WHO, "Fungal Infections and Public Health," 2021.

[4] IQVIA, "Generic Drug Market Trends," 2022.