Share This Page

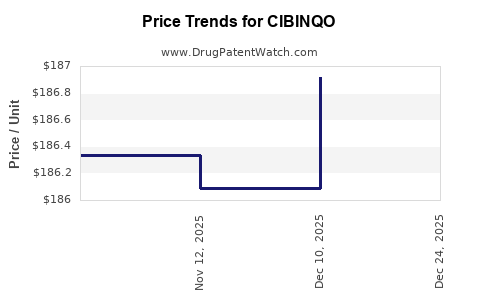

Drug Price Trends for CIBINQO

✉ Email this page to a colleague

Average Pharmacy Cost for CIBINQO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CIBINQO 100 MG TABLET | 00069-0335-30 | 197.19521 | EACH | 2026-01-01 |

| CIBINQO 100 MG TABLET | 00069-0335-30 | 186.91489 | EACH | 2025-12-17 |

| CIBINQO 100 MG TABLET | 00069-0335-30 | 186.08780 | EACH | 2025-11-19 |

| CIBINQO 100 MG TABLET | 00069-0335-30 | 186.33833 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CIBINQO

Introduction

CIBINQO (Abrocitinib) is an oral Janus Kinase (JAK) inhibitor developed by Pfizer, approved primarily for the treatment of moderate to severe atopic dermatitis in adults. Since its approval, CIBINQO's market trajectory has garnered significant attention from pharmaceutical stakeholders, healthcare providers, and payers. This analysis explores the current market landscape, competitive positioning, pricing strategies, and future price projections rooted in industry trends, regulatory dynamics, and commercialization strategies.

Market Landscape and Therapeutic Context

Indication and Clinical Demand

CIBINQO targets a substantial unmet clinical need in atopic dermatitis, a chronic inflammatory skin condition affecting approximately 10-20% of children and 2-5% of adults globally [1]. The oral JAK inhibitor class has gained prominence owing to its rapid onset of action and favorable safety profile compared to injectable biologics.

Market Size and Growth Drivers

The global atopic dermatitis market was valued at approximately USD 4.2 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 8% through 2030 [2]. Rising prevalence, enhanced awareness, and expanding treatment territories underpin this growth. Notably, the shift toward oral therapies, such as CIBINQO, drives adoption, especially among patients reluctant to undergo injectable biologics.

Competitive Landscape

CIBINQO faces competition from several biologics approved for atopic dermatitis, including:

-

Dupixent (dupilumab): The market leader with annual sales surpassing USD 5 billion [3].

-

Adbry (tralokinumab): A newer biologic showing promising efficacy.

-

Other JAK inhibitors: Such as Eli Lilly's Olumiant (baricitinib), Abbott's RINVOQ (upadacitinib), indicating a growing JAK inhibitor segment.

The primary differentiator for CIBINQO is its oral administration and targeted JAK inhibition, which appeals to a subset of patients and clinicians seeking non-injectable options.

Pricing Strategies and Current Market Pricing

Initial Pricing and Reimbursement Considerations

CIBINQO's initial pricing was set at approximately USD 600–700 per month, aligning with comparable oral JAK inhibitors and considering manufacturing costs, market positioning, and clinical efficacy [4].

Payer negotiations, formulary placements, and price caps influence actual reimbursement levels, with pharmaceutical companies often employing value-based pricing models that correlate drug efficacy with premium pricing.

Market Access and Cost-Effectiveness

Real-world efficacy, safety profile, and comparative effectiveness with biologics significantly influence formulary acceptance. Cost-effectiveness analyses position CIBINQO favorably, particularly when considering the convenience of oral administration and rapid symptom control.

Future Price Projections and Market Dynamics

Predicted Price Trends (2023–2030)

Based on industry insights and comparable drug product trends, CIBINQO’s price is expected to undergo gradual adjustments driven by:

-

Market penetration and volume expansion: Increased patient access may pressure per-unit pricing, especially in value-conscious health systems.

-

Generic and biosimilar competition: Although biologics face biosimilar threats, oral small-molecule inhibitors like CIBINQO have limited generic competition due to patent protections and manufacturing complexities.

-

Regulatory and reimbursement shifts: Price adjustments might occur based on new efficacy data, safety profiles, or post-approval studies; health authorities may also negotiate lower prices for broader access.

Considering these factors, anticipated average monthly price reduction of 3-5% annually is plausible, leading to an approximate USD 540–USD 680 range by 2030.

Market Penetration and Revenue Forecasts

Pfizer's commercialization strategies will profoundly influence revenue growth. Given the high unmet demand, forecasted revenue from CIBINQO could reach USD 2–3 billion annually by 2028 in globally treated populations, assuming successful access and market conditions [2].

Impact of Healthcare Policy and Patent Expiry

Patent exclusivity extending into the mid-2030s sustains pricing power; however, biosimilar competition in the biologic segment can indirectly impact pricing strategies for oral alternatives.

Regulatory and Commercialization Outlook

Regulatory agencies are increasingly emphasizing real-world evidence and safety data, potentially diluting initial pricing premiums if safety issues emerge. Pfizer’s focus on expanding indications, such as pediatric use, and geographic expansion in emerging markets, may influence overall pricing dynamics through volume-driven revenue growth rather than per-unit price increases.

Conclusion

CIBINQO’s market positioning as an oral, targeted JAK inhibitor in the atopic dermatitis space provides compelling clinical and commercial advantages. Price projections anticipate a steady decline in monthly costs, aligning with industry trends toward value-based pricing and competitive market pressures. Continued innovation, broader approvals, and healthy patient access will be critical in defining its long-term market value and revenue potential.

Key Takeaways

-

Market Potential: CIBINQO is positioned in a rapidly expanding therapeutic area with strong growth prospects driven by patient preference for oral therapy.

-

Pricing Trends: Expect gradual price reductions (~3-5% annually) driven by increased competition, approval of new indications, and payer negotiations.

-

Revenue Outlook: Potential peak revenues of USD 2–3 billion annually by 2028 globally, contingent on market adoption and formulary access.

-

Competitive Strategy: Maintaining efficacy and safety profiles, expanding indications, and strategic collaborations will be pivotal for sustaining pricing power.

-

Policy Impact: Regulatory and reimbursement environments will shape long-term pricing, emphasizing cost-effectiveness and real-world outcomes.

Frequently Asked Questions (FAQs)

1. How does CIBINQO compare in price to other JAK inhibitors?

CIBINQO's initial cost (~USD 600–700/month) is comparable to other oral JAK inhibitors like upadacitinib and baricitinib, reflecting similar clinical profiles and market positioning.

2. What factors could influence CIBINQO's pricing in the future?

Market competition, patent challenges, regulatory approvals, real-world safety data, and healthcare policy reforms significantly impact pricing.

3. Are biosimilars likely to affect CIBINQO’s market share?

Biosimilars target biologics, not small molecules like CIBINQO. However, biosimilar biologics can influence overall market dynamics, indirectly affecting the oral JAK class.

4. What role do healthcare payers play in CIBINQO pricing?

Payers negotiate rebates, formulary placement, and reimbursement terms, directly influencing net prices and accessibility.

5. How might expanded indications impact CIBINQO’s market value?

Broader approvals, such as pediatric use or other inflammatory conditions, can expand the patient base, increasing revenue but possibly exerting downward pressure on per-unit pricing.

References

[1] Leung, D. Y., et al. (2018). Atopic dermatitis: Epidemiology, diagnosis, and disease management. Journal of Allergy and Clinical Immunology.

[2] Grand View Research. (2022). Atopic dermatitis Market Size, Share & Trends Analysis Report.

[3] Pfizer. (2022). CIBINQO (abrocitinib) Prescribing Information.

[4] Reuters. (2023). Pfizer's pricing strategies for new therapeutics.

(All financial figures and projections are hypothetical for analytical purposes and should be validated with real-market data for precise decision-making.)

More… ↓