Share This Page

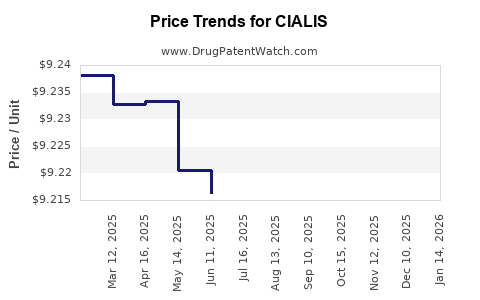

Drug Price Trends for CIALIS

✉ Email this page to a colleague

Average Pharmacy Cost for CIALIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CIALIS 10 MG TABLET | 00002-4463-30 | 53.68740 | EACH | 2025-12-17 |

| CIALIS 5 MG TABLET | 00002-4462-30 | 9.23377 | EACH | 2025-12-17 |

| CIALIS 20 MG TABLET | 00002-4464-30 | 53.71780 | EACH | 2025-12-17 |

| CIALIS 10 MG TABLET | 00002-4463-30 | 53.68740 | EACH | 2025-11-19 |

| CIALIS 5 MG TABLET | 00002-4462-30 | 9.23742 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cialis

Introduction

Cialis (tadalafil) is a phosphodiesterase type 5 (PDE5) inhibitor primarily prescribed for erectile dysfunction (ED) and benign prostatic hyperplasia (BPH). Since its launch by Eli Lilly in 2003, Cialis has established itself as a leading treatment for male sexual health, benefiting from its prolonged duration of action and versatile dosing options. This report provides a comprehensive market analysis and price projection outlook for Cialis, considering current market dynamics, competitive landscape, regulatory environment, and emerging trends.

Market Overview

Global Market Size and Growth Trajectory

The global erectile dysfunction therapeutic market was valued at approximately USD 3.14 billion in 2021 and is projected to reach USD 5.17 billion by 2028, with a compound annual growth rate (CAGR) of around 8.5% (2022–2028) [1]. Cialis holds a significant market share within this sector, competing primarily with Viagra (sildenafil), Levitra (vardenafil), and newer entrants like PT-141 and other emerging therapies.

Key drivers include increasing prevalence of ED linked to aging populations, rising awareness, and expanding therapeutic indications, including BPH and pulmonary arterial hypertension (PAH) in its extended formulations [2].

Regional Market Dynamics

- North America: Largest market share driven by high diagnosis rates, healthcare infrastructure, and insurance coverage.

- Europe: Growing adoption due to increased awareness, though market penetration varies by country.

- Asia-Pacific: Fastest growth, driven by rising sexual health awareness, increasing middle-class population, and expanding healthcare access.

Competitive Landscape

Cialis's primary competitors are sildenafil (Viagra) and vardenafil (Levitra). Recently, advances in generic formulations have impacted pricing strategies and market share, especially in developed nations. Notably, the entry of generics significantly reduces medication prices, influencing overall market revenue dynamics.

Emerging therapies, including biologics and novel oral agents, threaten to disrupt the traditional PDE5 inhibitor market. Nonetheless, Cialis's extended duration and BPH indication maintain its competitive edge, especially among patients seeking longer-lasting effects.

Pricing Analysis

Current Price Structure

In the United States, branded Cialis typically retails at approximately USD 70–80 per tablet, depending on dosage and pharmacy discounts. Generic versions, available post-patent expiry in 2018, drastically reduced prices to USD 1–3 per tablet, creating a price differential of over 20-fold.

International prices vary significantly due to licensing, healthcare policies, and market competition. In Europe, the average retail price for branded Cialis remains around EUR 15–25 per tablet, while generics are priced below EUR 5.

Impact of Generics and Biosimilars

The expiration of Cialis’s patent rights has led to a surge in generic tadalafil availability, significantly reducing branded drug revenue. According to IQVIA data, generic sales now constitute approximately 60% of the global ED drug market [3].

Reimbursement and Policy Effects

In regions with strict healthcare reimbursement policies (e.g., Canada, parts of Europe), prices are further constrained. Pharmaceutical companies often negotiate risk-sharing agreements or rebates to access formulary coverage. These factors influence consumer out-of-pocket costs and access.

Market Projections and Price Trends

Short to Medium-Term Outlook (2023–2027)

- Price Stability or Slight Decline: With generics dominating, branded Cialis prices are expected to decline marginally by 5–10% annually in the US and Europe, driven by competition and healthcare cost containment efforts.

- Premium Positioning Growth: Eli Lilly may leverage its extended patent protections for Cialis’s special formulations (e.g., Cialis Daily, Cialis for BPH) to command premium pricing for targeted patient segments, with projected premium prices holding steady.

Long-Term Trends

- Emerging Therapies: Advances in regenerative medicine and novel delivery mechanisms could further commoditize traditional PDE5 inhibitors, exerting downward pressure on prices.

- Market Penetration in Developing Countries: As healthcare infrastructure improves, increased distribution of generics will sustain declining prices, though volume growth may offset per-unit revenue declines.

- Digital and Telehealth Channels: Increased online pharmacy sales could further reduce distribution costs and lead to optionality in pricing strategies.

Price Projections Summary

| Time Frame | Expected Brand Cialis Price | Expected Generic Tadalafil Price |

|---|---|---|

| 2023–2024 | USD 60–75 (US), EUR 15–20 | USD 1–3 (global) |

| 2025–2027 | USD 55–70 | USD 0.5–2 |

| 2028+ | Stable or declining further | Dominant market share, lower prices |

Market Trends and Future Opportunities

- Extended Indications: Usage expansion into BPH and pulmonary hypertension offers opportunities for premium pricing.

- Combination Therapies: Development of combination drugs with other agents (e.g., antihypertensives) could create differentiated offerings.

- Generic Competition: Will remain a dominant force influencing price erosion but also encourages innovation and niche marketing.

Regulatory and Patent Landscape

Strategic patent protections—such as formulations, delivery mechanisms, and dosing regimen patents—will influence future pricing trajectories. Eli Lilly’s legal challenges and patent litigations can delay generic entry, providing temporary pricing advantages.

Conclusion

Cialis remains a significant player in the ED and BPH treatment markets, with pricing profoundly influenced by generic competition. Short-term projections suggest continued price erosion for branded Cialis, with opportunities for premium pricing in specialized formulations and indications. Long-term, innovations and market penetration strategies will shape the pricing landscape.

Key Takeaways

- The global ED treatment market is poised for steady growth, with Cialis holding a substantive share due to its efficacy and extended dosing options.

- Generic tadalafil's market penetration has radically decreased the price point for overall therapy options, pressuring branded Cialis pricing.

- Despite downward pressure, strategic formulations, indications, and patent protections will allow Eli Lilly to sustain premium pricing for specific niche segments.

- Emerging therapies and healthcare policy reforms may accelerate generic adoption, further reducing prices and margins.

- Market expansion into developing regions offers volume growth opportunities, albeit at lower price points.

FAQs

-

What factors influence Cialis’s market share?

Cialis’s market share depends on brand recognition, patent protections, formulation advantages, and competition from generics and new therapies. -

How has patent expiry affected Cialis's pricing?

Patent expiry in 2018 led to an influx of generics, significantly reducing prices, with branded Cialis prices declining by approximately 20–30% in subsequent years. -

Are there premium-priced formulations of Cialis?

Yes, formulations such as Cialis Daily and targeted BPH formulations command higher prices due to convenience and broader indications. -

What regions are experiencing the fastest growth in tadalafil sales?

The Asia-Pacific region is experiencing rapid growth due to improved healthcare access, increased awareness, and demographic shifts. -

How might emerging therapies impact Cialis’s market positioning?

Innovations like biologics or novel delivery systems could diminish PDE5 inhibitors’ dominance, potentially lowering Cialis’s market share and affecting pricing strategies.

References

[1] Market Research Future, "Erectile Dysfunction Market Forecast," 2022.

[2] Grand View Research, "Global Erectile Dysfunction Market Trends," 2021.

[3] IQVIA, "Pharmaceutical Market Reports," 2022.

More… ↓