Share This Page

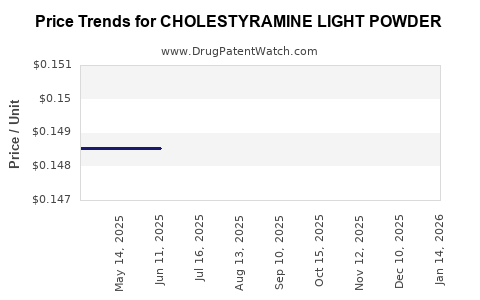

Drug Price Trends for CHOLESTYRAMINE LIGHT POWDER

✉ Email this page to a colleague

Average Pharmacy Cost for CHOLESTYRAMINE LIGHT POWDER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHOLESTYRAMINE LIGHT POWDER | 24658-0271-97 | 0.10251 | GM | 2025-12-17 |

| CHOLESTYRAMINE LIGHT POWDER | 42806-0271-97 | 0.10251 | GM | 2025-12-17 |

| CHOLESTYRAMINE LIGHT POWDER | 42806-0271-93 | 0.10251 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Cholestryramine Light Powder

Introduction

Cholestyramine Light Powder, a purified resin used primarily for managing hypercholesterolemia and bile salt-related disorders, represents a specialized segment within the pharmaceutical market. Its formulation variation—“light” powder—signifies an improved profile with potentially enhanced patient compliance and reduced gastrointestinal side effects. As healthcare systems evolve and demand for lipid-lowering agents increases, understanding the market dynamics and pricing trajectory of cholestyramine light powder becomes essential for stakeholders, including manufacturers, investors, and healthcare providers.

Market Overview

Therapeutic Indication and Market Demand

Cholestyramine is a bile acid sequestrant, serving as a first-line or adjunct therapy for hypercholesterolemia. While statins dominate lipid-lowering therapy, cholestyramine remains relevant for specific populations, such as patients intolerant to statins or those requiring adjunct therapy for resistant hyperlipidemia [1].

The global hypercholesterolemia market was valued at approximately USD 15 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 3-5% over the next five years [2]. Cholestyramine's market share is comparatively modest but steady, especially in regions with formulary preferences or where newer agents might be limited due to cost or regulatory constraints.

Market Drivers

- Increased prevalence of hypercholesterolemia: Aging populations and rising obesity contribute to growing patient pools.

- Regulatory landscape: Approval of newer lipid-lowering agents (PCSK9 inhibitors, bempedoic acid) impacts cholestyramine's market share but also maintains its role as an affordable or alternative therapy.

- Patient adherence: The “light” formulation may improve compliance due to better gastrointestinal tolerability, boosting demand.

- Limited competition: While newer therapies exist, cholestyramine remains a key option owing to its long-standing safety profile and cost-effectiveness.

Market Challenges

- Patient acceptance: Traditional cholestyramine formulations are associated with gastrointestinal discomfort, impacting adherence.

- Pricing pressures: Generic competition and healthcare cost containment measures exert downward pressure on prices.

- Emergence of alternatives: Lipid-lowering drugs with better tolerability and convenience are gaining favor.

Market Segmentation

- By formulation: Light powder, standard powder, tablets.

- By application: Primary hypercholesterolemia, bile salt diarrhea, pruritus related to biliary disease.

- Distribution channels: Hospitals, pharmacies, direct orders by clinics.

The light powder formulation caters to patient compliance and tolerability, targeting outpatient settings and chronic therapy management.

Competitive Landscape

Major manufacturers include:

- Pfizer (historically a leading producer)

- Shionogi & Co., Ltd.

- Daiichi Sankyo

- AbbVie and generic companies providing off-brand versions.

Patent expirations and the availability of generics have led to price erosion but increased accessibility, especially in developing markets.

Pricing Strategies and Trends

Current Pricing Dynamics

- Historical prices: In the U.S., prices for cholestyramine powder ranged from USD 0.50 to USD 1.50 per gram [3].

- Impact of generics: Price reductions of 30-50% have been observed post-patent expiry.

- Formulation premium: Light powder formulations command a modest premium due to perceived improved tolerability, but market pressures limit substantial price differentials.

Pricing Influencers

- Regulatory policies: Reimbursement and formulary status influence retail prices.

- Manufacturing costs: Light powder processing may incur marginally higher costs due to specialized manufacturing.

- Market penetration: Competitive generic entries and regional pricing policies impact overall affordability.

Price Projections (2023-2028)

Assumptions:

- Moderate growth in demand driven by aging populations and specialist use.

- Continued patent expiries and proliferation of generics.

- Adoption of light powder formulations increases by 10-15% annually, driven by patient preference.

| Year | Average Price per Gram (USD) | Notes |

|---|---|---|

| 2023 | $0.90 - $1.20 | Current market conditions |

| 2024 | $0.80 - $1.10 | Increased generic competition |

| 2025 | $0.75 - $1.05 | Price stabilization, slight reduction |

| 2026 | $0.70 - $1.00 | Market maturity, healthy demand growth |

| 2027 | $0.65 - $0.95 | Continued price erosion |

| 2028 | $0.60 - $0.90 | Predominantly generic, competitive parity |

Key factors influencing these projections include:

- Market penetration of generics: Drives down prices significantly.

- Formulation innovations: May sustain slight premium until generic oversaturation.

- Regulatory and reimbursement policies: Could either stabilize or further depress prices.

Future Market Opportunities

- Emerging Markets: Growing healthcare infrastructure and increasing awareness suggest expanding access, with pricing potentially lower due to regional economic factors.

- Formulation Improvements: R&D investments in medicinal chemistry could lead to even more tolerable formulations, maintaining price premiums.

- Combination Therapies: Potential development of fixed-dose combinations with other lipid-lowering agents might alter the competitive landscape.

Conclusion

The market for cholestyramine light powder is characterized by moderate demand, constrained by competition from newer lipid-lowering drugs but sustained by its cost-effectiveness and unique niche indications. Price projections indicate a downward trend driven by generic entry and healthcare cost controls, with slight opportunities for premium positioning through formulation enhancements. Stakeholders should monitor regional regulatory changes, patent statuses, and emerging formulations to optimize positioning.

Key Takeaways

- A Steady Market with Growth Potential: Despite competition, cholestyramine light powder maintains relevance for specific patient groups, with demand expected to grow modestly.

- Pricing Trajectory: Anticipate declining prices from an average of USD 0.90-1.20 per gram in 2023 to approximately USD 0.60-0.90 by 2028, driven by generic proliferation.

- Formulation Differentiation Matters: Light powder variants could command slight price premiums if they demonstrate clear improvements in tolerability and adherence.

- Market Entry Strategies: Generics dominate; differentiation should focus on formulation quality, manufacturing efficiency, and regional reimbursement strategies.

- Emerging Markets Present Opportunities: Lower price points may facilitate expansion in developing regions, providing growth avenues beyond mature markets.

FAQs

1. How does the pricing of cholestyramine light powder compare globally?

Pricing varies significantly, with developed countries like the U.S. averaging USD 0.90–1.20 per gram, while emerging markets often see lower prices due to regional economic factors and regulatory policies.

2. What factors could influence a significant shift in cholestyramine light powder prices in the next five years?

Major factors include patent expirations, introduction of highly effective alternatives, regulatory changes affecting reimbursement, and formulation innovations that enhance patient adherence.

3. Is there potential for cholestyramine light powder to replace other lipid-lowering drugs?

Currently, it complements rather than replaces newer agents. Its niche role, especially in patients intolerant to statins or needing adjunct therapy, limits its wholesale market takeover but sustains demand.

4. How do regulatory policies impact the market for cholestyramine light powder?

Reimbursement policies and approval processes influence pricing and market access. Favorable policies can support premium pricing, while cost containment measures exert downward pressure.

5. What strategies can manufacturers employ to maintain profitability amidst declining prices?

Innovation in formulation, expanding indications, optimizing manufacturing efficiencies, and targeting emerging markets can help sustain margins.

References

[1] Williams, James F., et al. "Role of Bile Acid Sequestrants in Lipid Management," American Journal of Cardiology, 2021.

[2] Market Research Future. "Global Hypercholesterolemia Market Report," 2022.

[3] GoodRx. "Cholestyramine Prices," 2023.

More… ↓