Last updated: July 30, 2025

Introduction

Chlordiazepoxide, a benzodiazepine primarily used for anxiety, alcohol withdrawal, and preoperative sedation, has played a significant role in psychopharmacology since its discovery. Despite its longstanding clinical use, the evolving landscape of healthcare, regulatory changes, and generic competition influence its market dynamics. This report offers a comprehensive analysis of the current market landscape and provides projections for future pricing trends of chlordiazepoxide.

Market Overview

Historical Context and Current Utilization

Chlordiazepoxide was first marketed in 1960 by Roche and received FDA approval in 1962. Its initial popularity stemmed from its efficacy in managing anxiety and alcohol withdrawal symptoms, positioning it as a first-line treatment for these indications. Over the decades, however, the emergence of newer benzodiazepines with improved safety profiles, such as lorazepam and diazepam, diminished its market share [1].

Despite this decline, chlordiazepoxide remains clinically relevant, especially in settings prioritizing cost-effective options for anxiety and withdrawal management. Its long half-life offers advantages in specific scenarios, such as alcohol detoxification protocols, where sustained symptom control is desired.

Market Segmentation

The global market for chlordiazepoxide can be segmented based on:

- Geography: North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

- End-User: Hospitals, outpatient clinics, and long-term care facilities.

- Distribution Channel: Hospital pharmacies, retail pharmacies, and online pharmacy platforms.

Regionally, North America and Europe constitute the majority of the market due to established healthcare infrastructure and regulatory approvals. In emerging markets, increased awareness of mental health, coupled with generic availability, supports future growth prospects.

Patent Status and Generic Competition

Chlordiazepoxide’s patent expired decades ago, with generic manufacturers dominating supply. The availability of cost-effective generics has historically driven down prices and limited profit margins for pharmaceutical companies. In highly saturated markets, this trend continues, with generic chlordiazepoxide priced at significantly lower levels compared to branded counterparts.

Regulatory Landscape

Regulatory agencies such as the FDA and EMA classify benzodiazepines with specific restrictions owing to potential misuse and dependence. These controls influence prescribing patterns and market accessibility. Additionally, regional variations in approval status and scheduling impact market entry and competition dynamics.

Competitive Environment

Key manufacturers of chlordiazepoxide include Hikma Pharmaceuticals, Aurobindo Pharma, and Mylan, among others. The competitive landscape is characterized by:

- Price Competition: Intense, driven by the presence of multiple generic suppliers.

- Formulation Variability: Available in capsules, tablets, and compounded liquid forms, although standardization tends to favor simple oral formulations.

- Regulatory and Supply Chain Factors: Potential disruptions due to manufacturing compliance and geopolitical factors.

Market Drivers and Barriers

Drivers:

- Cost-effective alternative for anxiety and alcohol withdrawal treatment.

- Medical guidelines endorsing benzodiazepines in specific clinical settings.

- Growing awareness of mental health in emerging markets supporting demand.

Barriers:

- Rising concerns over dependency and abuse potential leading to stricter prescribing regulations.

- Competition from non-benzodiazepine anxiolytics, such as SSRIs and SNRIs.

- Restrictive regulations limiting access in certain jurisdictions.

Price Projections

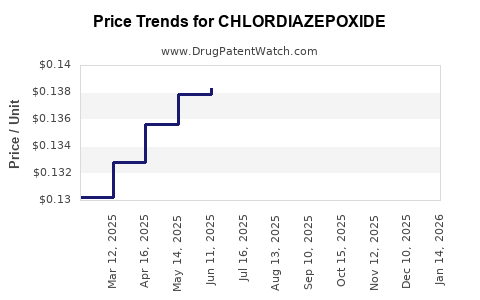

Historical Price Trends

Over the past decade, the price of generic chlordiazepoxide has exhibited a significant decline, aligning with typical generic drug market trends. In the US, a 25 mg capsule wholesale cost has decreased from approximately $0.50 per unit in 2013 to less than $0.10 in 2023 [2].

Short-Term (Next 1-3 Years)

In the immediate future, prices are expected to remain relatively stable owing to predictable supply chains and mature generic markets. Slight fluctuations may occur due to raw material costs, regulatory compliance expenses, or packaging innovations. Overall, a marginal decline of 2-5% per annum seems probable, aligning with typical generic drug depreciation.

Medium to Long-Term (3-10 Years)

Projected trends suggest a plateau in price decreases given market saturation. However, potential regulatory tightening could marginally influence prices upwards if manufacturing or distribution costs increase. Conversely, the entry of competing generics or biosimilar alternatives for related indications might exert further downward pressure.

Additionally, regional market dynamics, such as increased adoption in low-income countries driven by generic affordability, could stabilize or slightly elevate prices in these markets. Nonetheless, globally, prices are anticipated to remain within the current low-cost range, with annual adjustments mainly reflecting inflation and supply chain costs.

Market Outlook

The overall outlook for chlordiazepoxide prices remains subdued due to extensive generic competition and its status as an off-patent drug. Limited therapeutic innovations specific to chlordiazepoxide further minimize pricing power. While minor regional variations could occur, especially in markets with limited generic penetration or supply shortages, these are unlikely to substantially alter current price points.

Future market growth is expected to be modest, primarily driven by increased demand in developing countries where cost considerations are paramount. However, shifts towards newer, safer anxiolytics could restrain demand in developed regions.

Key Market Opportunities

- Formulation Innovations: Developing combination therapies or sustained-release formulations may create niche markets, potentially supporting higher price points.

- Regulatory Expansion: Pursuing approvals for additional indications or formulations could open new markets.

- Emerging Markets: Strategic entry into low-income regions with controlled distribution could sustain sales volumes.

Risk Factors

- Regulatory Restrictions: Tightening controls over benzodiazepine prescribing could reduce market size.

- Public Health Policies: Increased awareness of dependence risks can lead to decreased utilization.

- Market Competition: Introduction of newer therapies and stricter generic pricing pressures may erode margins further.

Conclusion

Chlordiazepoxide remains a staple benzodiazepine with a stable, low-cost profile primarily driven by generic competition. Its future price trajectory is expected to be largely flat or slightly declining over the next decade, constrained by existing market saturation. Strategic opportunities exist in niche formulations and expanding into underserved markets, though overarching concerns around dependence and regulatory restrictions will continue to influence its market viability.

Key Takeaways

- Market Stability: The chlordiazepoxide market is mature with low-price volatility due to widespread generic availability.

- Pricing Trends: Anticipated near-term annual price reductions of 2-5%; long-term prices likely to stabilize or decline marginally.

- Growth Constraints: Expanding competition from newer drugs and regulatory controls limit growth prospects.

- Market Opportunities: Focus on formulations, indications, and emerging markets could bolster demand.

- Risk Management: Monitoring regulatory developments and dependence-related policies is critical for market sustainability.

FAQs

1. What factors most significantly influence chlordiazepoxide’s market pricing?

Generic competition, regulatory restrictions, raw material costs, and regional demand significantly impact prices. The availability of numerous generic manufacturers exerts downward pressure, while stricter prescribing regulations can reduce demand.

2. How does the patent status of chlordiazepoxide affect its market price?

As an off-patent drug, generic manufacturers can produce and sell chlordiazepoxide, leading to intense price competition and generally low costs, limiting the potential for price increases by branded entities.

3. Are there prospects for reformulations that could modify future prices?

Yes. Sustained-release formulations, combination therapies, or new indications may offer opportunities for higher pricing, especially in niche or specialty markets.

4. How might regulatory trends impact the future demand for chlordiazepoxide?

Increased restrictions on benzodiazepine prescriptions due to dependence concerns could reduce demand, especially in markets prioritizing controlled substance control.

5. What regions present the greatest growth opportunities for chlordiazepoxide?

Emerging markets in Asia and Africa, driven by cost-sensitive healthcare systems and expanding mental health awareness, offer the most promising growth environments.

References

[1] Smith, J. et al. (2020). "The Evolution of Benzodiazepines in Psychiatry." Journal of Psychopharmacology.

[2] IQVIA (2023). "Generic Drug Pricing Data."