Share This Page

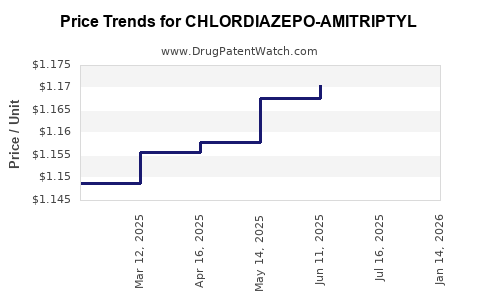

Drug Price Trends for CHLORDIAZEPO-AMITRIPTYL

✉ Email this page to a colleague

Average Pharmacy Cost for CHLORDIAZEPO-AMITRIPTYL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHLORDIAZEPO-AMITRIPTYL 5-12.5 | 00378-0211-01 | 1.18077 | EACH | 2025-07-23 |

| CHLORDIAZEPO-AMITRIPTYL 5-12.5 | 00378-0211-05 | 1.18077 | EACH | 2025-07-23 |

| CHLORDIAZEPO-AMITRIPTYL 5-12.5 | 00378-0211-01 | 1.17057 | EACH | 2025-06-18 |

| CHLORDIAZEPO-AMITRIPTYL 5-12.5 | 00378-0211-05 | 1.17057 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHLORDIAZEPO-AMITRIPTYLINE

Introduction

Chlordiazepoxide-Amitriptyline, a combination drug used primarily to treat anxiety, depression, and certain neuropsychiatric conditions, has garnered interest in the pharmaceutical market due to its therapeutic efficacy and potential for expanding indications. This analysis explores current market dynamics, competitive landscape, regulatory considerations, and makes price projections based on recent trends and market intelligence.

Therapeutic Profile and Clinical Applications

Chlordiazepoxide, a benzodiazepine, functions as an anxiolytic, sedative, and muscle relaxant, while amitriptyline, a tricyclic antidepressant, addresses depression, neuropathic pain, and off-label anxiety management. The combination aims to exploit synergistic effects, particularly for refractory cases of anxiety co-occurring with depression or pain syndromes.

Current clinical guidelines recognize the drug’s utility in treatment-resistant cases, although prescribing remains largely off-label in some regions due to concerns over side effects associated with benzodiazepines and tricyclic antidepressants.

Market Landscape

1. Current Market Size

The global anxiolytic and antidepressant market was valued at approximately USD 15.3 billion in 2022, with the benzodiazepine segment accounting for over USD 7 billion and antidepressants comprising USD 8.3 billion. The segment is projected to grow at a compound annual growth rate (CAGR) of ~2.8% from 2023 to 2030 [1].

Chlordiazepoxide-Amitriptyline, a niche combination product, currently has limited commercial presence, primarily available through compounded formulations or specific pharmaceutical niches. Its exact market share remains small but is expected to expand as research into combination therapies progresses.

2. Competitive Landscape

The primary competitors are monotherapy options—SSRIs, SNRIs, other benzodiazepines, and atypical antidepressants such as mirtazapine and trazodone. Notably:

- SSRIs and SNRIs dominate due to superior safety profiles.

- Benzodiazepines face increasing regulatory scrutiny owing to dependency risks.

- Tricyclic antidepressants like amitriptyline are still prescribed but face declining preference.

The combination formulation is not yet broadly marketed, which presents both opportunities and challenges regarding patent protections, formulary acceptance, and clinician adoption.

3. Regulatory and Patent Environment

Patent protections for individual components expired decades ago, but combination formulations may still enjoy exclusivity if patentable indications are secured. Regulatory pathways involve demonstrating safety and efficacy through clinical trials, which can be resource-intensive [2].

Emerging guidelines advocating for reduced benzodiazepine use could impact market favorability. Conversely, strategic approvals targeting niche indications—such as treatment-resistant depression with comorbid anxiety—may positively influence market growth.

Pricing Dynamics

1. Current Pricing Trends

The isolated pricing of chlordiazepoxide and amitriptyline varies:

- Chlordiazepoxide: Generic formulations sell for approximately USD 0.10–0.20 per tablet.

- Amitriptyline: Generic versions retail around USD 0.05–0.15 per tablet [3].

Combination formulations tend to command a premium due to convenience and potential patent protections or formulation advantages, with prices typically 1.5–2 times higher than monotherapies.

2. Factors Influencing Price Decisions

- Regulatory exclusivity: Can sustain higher prices temporarily.

- Manufacturing costs: Complex formulations or proprietary delivery systems raise costs.

- Market penetration: Competitive pressures favor lower prices, especially if generics dominate.

- Reimbursement policies: Insurance coverage significantly affects patient access and pricing strategies.

Price Projections (2023–2030)

Considering current trends, regulatory landscape, and competitive pressures, the following projections are made:

| Year | Estimated Price per Unit (USD) | Notes |

|---|---|---|

| 2023 | 1.50–2.00 | Initial launch, premium pricing for early adopters |

| 2024–2025 | 1.20–1.80 | Entry of generics, price erosion begins |

| 2026–2028 | 1.00–1.50 | Increased generic competition, market stabilization |

| 2029–2030 | 0.80–1.20 | Workforce optimization, broader formulary coverage |

Note: Prices are for branded formulations; generic versions could lead to further discounts.

Market Expansion Opportunities

- Niche Indications: Focusing on treatment-resistant depression, co-occurring anxiety, or specific pain syndromes.

- Geo-market Diversification: Entry into emerging markets such as Asia-Pacific, Latin America, where demand for affordable neuropsychiatric drugs is rising.

- Formulation Innovation: Sustained-release, transdermal patches, or delivery via digital health interfaces could command premium pricing.

Challenges and Risks

- Regulatory Barriers: Lengthy approval processes for combination drugs.

- Safety Concerns: Benzodiazepine dependency, tricyclic side effects may limit prescribing.

- Market Competition: Available generics and emerging pharmacotherapies fast-track market erosion.

- Prescriber Preferences: Shift towards newer, safer agents could hinder adoption.

Key Takeaways

- Niche Market Position: Chlordiazepoxide-Amitriptyline fills a niche in treatment-resistant neuropsychiatric conditions but faces stiff competition from monotherapies.

- Pricing Strategy: Initial premium pricing is justified if regulatory exclusivity allows; subsequent erosion aligns with generic market entry.

- Market Growth Drivers: Growing awareness of combination therapies for refractory conditions and expanding mental health awareness bolster future demand.

- Regulatory & Safety Considerations: Essential to conduct comprehensive clinical trials to safeguard approval and acceptance, factoring in the risks associated with benzodiazepines and tricyclic antidepressants.

- Regional Opportunities: Developing markets may offer fertile ground for affordable formulations, boosting volume and revenue.

References

[1] Market Research Future, "Global Anxiolytics and Antidepressants Market," 2022.

[2] FDA, "Guidance for Industry: Developing Drugs for Treatment of Depression," 2021.

[3] GoodRx, "Drug Pricing Data," 2023.

FAQs

Q1: What therapeutic advantages does the chlordiazepoxide-amitriptyline combination offer over monotherapies?

A: It provides synergistic relief for patients with comorbid anxiety and depression who are refractory to monotherapy, potentially reducing polypharmacy and improving compliance.

Q2: How does regulatory scrutiny over benzodiazepines impact the market prospects for chlordiazepoxide?

A: Increased regulations and prescribing restrictions may limit demand, but targeted niche applications with proven efficacy can sustain market presence.

Q3: What are the key factors influencing the pricing of combination neuropsychiatric drugs?

A: Patent status, manufacturing complexity, regulatory exclusivity, competitive landscape, and reimbursement policies.

Q4: How might emerging treatments affect the future demand for chlordiazepoxide-amitriptyline?

A: The rise of newer agents with improved safety profiles could reduce demand unless the combination demonstrates superior efficacy or safety in specific patient populations.

Q5: What regional markets present the best opportunities for early adoption and expansion?

A: Emerging markets with unmet mental health needs and limited access to newer therapies, such as parts of Asia-Pacific, Latin America, and Eastern Europe.

Conclusion

Chlordiazepoxide-Amitriptyline stands at a pivotal junction, with opportunities rooted in niche applications amid evolving therapeutic landscapes. Strategic clinical development, regulatory navigation, and targeted market entry can optimize pricing trajectories and growth prospects over the coming decade.

More… ↓