Share This Page

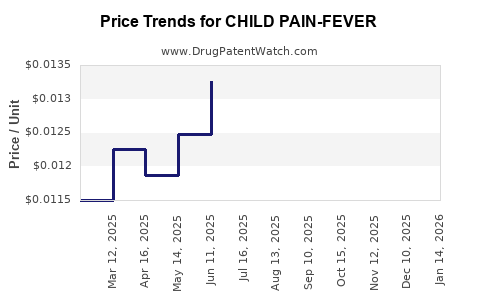

Drug Price Trends for CHILD PAIN-FEVER

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD PAIN-FEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD PAIN-FEVER 160 MG/5 ML | 83720-0500-16 | 0.01412 | ML | 2025-12-17 |

| CHILD PAIN-FEVER 160 MG/5 ML | 46122-0209-26 | 0.02095 | ML | 2025-12-17 |

| CHILD PAIN-FEVER 160 MG/5 ML | 46122-0210-26 | 0.02095 | ML | 2025-12-17 |

| CHILD PAIN-FEVER 160 MG/5 ML | 46122-0322-26 | 0.02095 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: Child Pain-Fever

Introduction

Child Pain-Fever medications are an essential segment within the broader pediatric pharmaceutical market, primarily addressing the common ailments of pain relief and fever reduction. This market, driven by pediatric healthcare needs, regulatory dynamics, and pharmaceutical innovation, presents a nuanced landscape for strategic positioning. This analysis projects market trends, competitive positioning, regulatory considerations, and pricing trajectories for Child Pain-Fever therapeutics over the next five years.

Market Overview

Market Size and Growth Drivers

The global pediatric analgesics and antipyretics market was valued at approximately $2.1 billion in 2022, with a compound annual growth rate (CAGR) estimated at 4-6% until 2027 [1]. The key drivers include increasing awareness of pediatric health, parental healthcare shopping patterns, and persistent demand for over-the-counter (OTC) products like acetaminophen and ibuprofen.

The COVID-19 pandemic amplified awareness of fever management, expanding market adoption. Additionally, rising infectious diseases and chronic conditions in children bolster market expansion, especially in developing regions where healthcare access is improving.

Key Market Segments

- By Ingredient: Acetaminophen (paracetamol), Ibuprofen, Other NSAIDs, and combination formulations.

- By Distribution Channel: OTC retail, pharmacies, hospitals, and e-commerce.

- By Geography: North America dominates (~45%), followed by Europe (~25%), with rapid growth in Asia-Pacific (~20%) driven by healthcare infrastructure expansion.

Competitive Landscape

Major players include Johnson & Johnson (Delsym, Tylenol), Pfizer, GlaxoSmithKline, and local over-the-counter brands. Generic formulations comprise a significant portion of the market share, especially in price-sensitive regions.

Innovations like combination therapies (pain + fever, multivitamins), and new formulations (liquids, fast-acting gels) aim to improve adherence and efficacy.

Regulatory Environment

Global regulatory agencies such as the FDA and EMA maintain rigorous standards for pediatric formulations, emphasizing safety and efficacy. Regulatory approvals influence pricing and market access, particularly for new formulations or novel delivery mechanisms.

In developing markets, regulatory pathways are evolving, with increasing approval of generic versions at lower cost. Stringent regulations often lead to higher development costs but create barriers for entry, affecting market pricing dynamics.

Price Trends and Projections

Historical Price Trends

Over the past decade, average OTC Child Pain-Fever medication prices have remained relatively stable in mature markets, with minor fluctuations due to inflation and manufacturing costs. In the U.S., the average retail price for a standard adult-sized bottle of acetaminophen has hovered around $5-$8, with pediatric formulations priced proportionally lower.

In developing markets, prices are significantly lower, often below $2 due to local manufacturing and generic competition.

Future Price Projections

Based on current market dynamics, several factors could influence future prices:

- Generic Competition: Increased entry of high-quality generics is likely to put downward pressure on prices, especially in emerging markets.

- Formulation Innovation: Introduction of novel delivery systems (e.g., rapid onset liquids, dissolvables) tend to command premium prices initially but may become more affordable over time as acceptance grows.

- Regulatory and Supply Chain Costs: Stricter regulations and supply chain disruptions (post-pandemic) could marginally elevate prices in the short term.

- Market Penetration Strategies: Companies focusing on direct-to-consumer channels or bundling products may implement differential pricing strategies to maximize reach.

Projected Price Range (2023-2028):

| Year | Expected Average Price per 100ml/100mg dose (USD) | Notes |

|---|---|---|

| 2023 | $4.50 - $7.00 | Stability with moderate fluctuations |

| 2024 | $4.20 - $6.80 | Slight decline with increased generic competition |

| 2025 | $4.00 - $6.50 | Price stabilization as patents expire |

| 2026 | $3.80 - $6.00 | Market saturation drives discounts |

| 2027 | $3.80 - $5.80 | Continued downward pressure, especially in emerging markets |

| 2028 | $3.50 - $5.50 | Potential for further discounts with increased innovation |

Market Entry and Pricing Strategies

New entrants should leverage cost-efficient manufacturing, focus on differentiated formulations, and align with regulatory standards to capture market share. Pricing strategies should consider local economic conditions, competitive landscape, and brand positioning.

Premium pricing may be justified through value-added features such as better taste, ease of dosing, or improved safety profiles, especially in high-income markets.

Implications for Stakeholders

- Pharmaceutical Companies: Focus on cost-effective production, innovative formulations, and strategic pricing aligned with regional market dynamics.

- Investors: Growth potential exists, especially with emerging markets and novel formulation pipelines; however, significant competition necessitates careful due diligence.

- Healthcare Providers: Emphasize the importance of affordable, safe, and efficacious options to ensure pediatric health management adherence.

Key Takeaways

- The Child Pain-Fever market is expected to grow at 4-6% CAGR over the next five years, driven by demographic and increased healthcare awareness.

- Pricing will trend downward, especially with the proliferation of generic products and increasing market saturation.

- Innovation in formulations and delivery mechanisms will support premium pricing but may become more affordable over time.

- Regulatory pathways and supply chain stability are critical factors influencing price stability and market accessibility.

- Entering emerging markets with cost-effective strategies presents significant growth opportunities due to their growing healthcare infrastructure.

FAQs

Q1: What are the main drivers of growth in the Child Pain-Fever medication market?

A1: Increasing pediatric populations, rising parental health awareness, product innovation, and greater access to healthcare contribute to market growth.

Q2: How will regulatory changes impact pricing strategies?

A2: Stricter regulations may increase development costs but can also raise barriers for new entrants, influencing pricing structures favorably for established brands.

Q3: Will new formulations command higher prices?

A3: Yes. Innovative delivery systems often justify premium pricing initially, especially in developed markets where efficacy, convenience, and safety are prioritized.

Q4: How does generic competition influence prices?

A4: Increased generic penetration typically drives prices downward, making pediatric pain and fever medications more accessible but reducing profit margins for branded manufacturers.

Q5: Which markets present the most significant growth potential for Child Pain-Fever drugs?

A5: Emerging markets in Asia-Pacific and Latin America have substantial growth potential due to expanding healthcare infrastructure and rising healthcare expenditure.

References

[1] MarketWatch, “Global Pediatric Analgesics and Antipyretics Market Size, Share & Trends Analysis Report,” 2022.

More… ↓