Share This Page

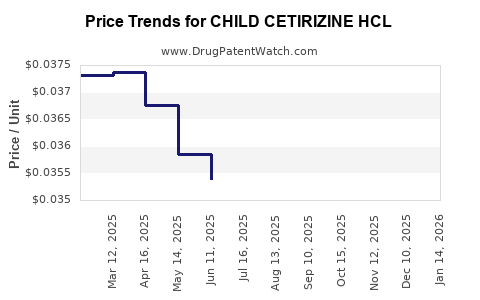

Drug Price Trends for CHILD CETIRIZINE HCL

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD CETIRIZINE HCL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD CETIRIZINE HCL 1 MG/ML | 00904-6765-20 | 0.03609 | ML | 2025-12-17 |

| CHILD CETIRIZINE HCL 1 MG/ML | 70752-0104-06 | 0.03609 | ML | 2025-12-17 |

| CHILD CETIRIZINE HCL 1 MG/ML | 00904-6765-20 | 0.03670 | ML | 2025-11-19 |

| CHILD CETIRIZINE HCL 1 MG/ML | 70752-0104-06 | 0.03670 | ML | 2025-11-19 |

| CHILD CETIRIZINE HCL 1 MG/ML | 70752-0104-06 | 0.03611 | ML | 2025-10-22 |

| CHILD CETIRIZINE HCL 1 MG/ML | 00904-6765-20 | 0.03611 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Child Cetirizine HCl

Introduction

Child cetirizine hydrochloride (HCl), a widely used second-generation antihistamine, is formulated for pediatric management of allergic conditions such as hay fever, allergic rhinitis, and chronic urticaria. Its favorable side effect profile, primarily reduced sedation compared to first-generation antihistamines, ensures steady demand within pediatric healthcare settings. This report provides an in-depth market analysis, current pricing dynamics, and future price projections for child cetirizine HCl, considering factors like market size, competitive landscape, regulatory environment, and key market drivers.

Market Overview and Scope

The global pediatric antihistamine market is experiencing steady growth, driven by increased prevalence of allergies, rising pediatric healthcare awareness, and expanding healthcare coverage. Child cetirizine features prominently within this segment, with formulations available in oral syrups, dispersible tablets, and chewables. The market for cetirizine-based pediatric products is segmented regionally into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each with unique dynamics shaped by healthcare infrastructure, regulatory pathways, and consumer preferences.

Market Size and Growth Dynamics

Global Market Valuation:

The global pediatric antihistamine market was valued at approximately USD 2.6 billion in 2022 and is projected to grow at a CAGR of roughly 6.2% through 2028, reaching close to USD 3.7 billion [1]. Child cetirizine HCl constitutes a significant share owing to its efficacy, safety profile, and established brand presence.

Regional Insights:

- North America: The largest market, driven by high allergy prevalence (~30% of children affected) and robust healthcare infrastructure. Regional preference for non-sedating antihistamines supports cetirizine’s dominance.

- Europe: Similar healthcare standards and allergy incidences contribute to consistent demand. Regulatory approval processes are streamlined but vary across countries.

- Asia-Pacific: Fastest-growing segment due to rising allergy awareness, increased pediatric prescriptions, and expanding healthcare access. China and India lead regional growth.

Drivers of Market Expansion:

- Increasing allergy diagnosis rates in children.

- Greater pediatric healthcare awareness.

- Development of user-friendly formulations (e.g., dispersible tablets, liquids).

- Expanding pharmacy networks and e-prescription adoption.

Competitive Landscape

Major pharmaceutical companies dominate the cetirizine child market, including UCB Pharma, Mylan (now part of Viatris), Pfizer, and Teva Pharmaceuticals. These firms leverage strong brand recognition, extensive distribution channels, and ongoing R&D investments to maintain market share.

Product Differentiation Factors:

- Formulation innovation (taste-masking, ease of administration).

- Price competitiveness.

- Regulatory compliance and approvals across regions.

- Marketing strategies targeting pediatric care practitioners.

Market Entry Barriers:

- Stringent regulatory approvals for pediatric formulations.

- High R&D costs for demonstrating safety and efficacy in children.

- Established brand loyalty among physicians and consumers.

Regulatory Environment and Its Impact

Regulatory bodies such as the FDA (USA), EMA (Europe), and respective national agencies govern pediatric formulations’ approval processes. Approval pathways necessitate comprehensive clinical data demonstrating safety, dosage accuracy, and stability in pediatric populations. Recently, regulatory agencies encourage development of age-appropriate formulations, which influence market offerings and pricing strategies.

Pricing Dynamics and Factors Influencing Price

Current Price Landscape:

The unit price of child cetirizine HCl varies substantially by formulation, region, and brand. In the United States, a typical 30mL bottle of cetirizine syrup can range from USD 10 to USD 20, whereas chewable tablets or dispersible forms may range similarly, often influenced by brand premiums.

Price Determinants:

- Manufacturing costs: Child-specific formulations demand rigorous testing and stability studies.

- Regulatory compliance: Additional costs related to pediatric approvals.

- Market competition: Price wars among generics generally lead to lower consumer prices.

- Distribution channels: Exclusive pediatric formulations sold via pharmacies may command premiums.

- Branding and marketing: Well-established brands tend to maintain higher price points.

Impact of Generic Entry:

Entry of generic cetirizine formulations has led to significant price erosion, especially in developed markets. For example, generic options in the US are approximately 40-60% cheaper than branded equivalents [2].

Price Projections (2023-2033)

Assumption Framework:

- Continued growth in pediatric allergy cases at an annual rate of 4%.

- Increasing adoption of pediatric formulations due to regulatory incentivization.

- Intensification of generic market penetration, especially in emerging markets.

- Incremental technological innovations leading to cost efficiencies.

Projection Highlights:

- North America and Europe: Expect stabilization of prices with slight downward pressure (~2-3% annually) driven by generic competition but supported by premium formulations and patient preference for branded products.

- Asia-Pacific and Latin America: Prices likely to decline more sharply (~4-6% annually) owing to rapid generics market growth and price sensitivity.

- Over the next decade, retail prices for pediatric cetirizine HCl will likely decrease by 20-30% regionally, aligning with the broader trend of generic substitution.

Future Market Trends:

- Increased penetration of biosimilar and comparator formulations could influence pricing strategies.

- Digital health integration, such as telemedicine-driven prescriptions, may impact pricing and distribution strategies.

- Regulatory relaxation and accelerated pediatric approval pathways could promote further market expansion, potentially stabilizing prices in some regions.

Key Challenges and Opportunities

Challenges:

- Stringent regulatory approval processes for pediatric formulations.

- Competition from alternative antihistamines (e.g., loratadine, levocetirizine).

- Price wars impacting profit margins for manufacturers.

- Variability in regulatory standards across markets.

Opportunities:

- Development of novel delivery systems, such as dissolvable films.

- Expansion into emerging markets with large pediatric populations.

- Strategic partnerships for distribution and marketing.

- Focused research enhancing safety profiles, thus commanding premium pricing in niche segments.

Regulatory and Healthcare Policy Impacts

Emerging policies favoring age-appropriate formulations are propelling innovation in pediatric antihistamines. Authorities like the EMA actively promote pediatric investigation plans, incentivizing companies to develop formulations tailored for children, which can justify higher pricing and create segmentation opportunities.

Furthermore, healthcare policies emphasizing reducing the cost of medications, particularly generics, may limit price inflation but also generate pressure for cost reduction, influencing profit margins.

Conclusion

The global market for child cetirizine HCl remains robust, with steady growth projected over the next decade. While price reductions driven by generic competition and regional market dynamics are inevitable, strategic innovation and regulatory alignment offer avenues for premium pricing and market differentiation. Industry participants must balance cost efficiencies, regulatory compliance, and formulation innovation to optimize market share and profitability.

Key Takeaways

- Market Size: The pediatric antihistamine sector, especially cetirizine formulations, will continue its upward trajectory, driven by allergy prevalence and pediatric healthcare improvements.

- Price Trends: Prices are expected to decline by 20-30% over the next decade due to increased generic penetration, with regional variations.

- Strategic Focus: Companies should prioritize developing innovative formulations, align with regulatory incentives, and expand into emerging markets to withstand pricing pressures.

- Regulatory Influence: Streamlined pediatric approval processes and global policy shifts are key drivers shaping product development and pricing strategies.

- Competitive Dynamics: Branding, formulation differentiation, and market access will determine pricing power amidst intense competition from generics.

FAQs

1. What are the primary factors influencing the price of child cetirizine HCl?

Manufacturing costs, regulatory compliance, market competition, formulation type, and regional purchasing power are primary price influencers.

2. How does generic competition impact cetirizine prices?

Generic entries typically lead to significant price reductions—often 40-60%—making pediatric cetirizine more affordable but squeezing profit margins for branded manufacturers.

3. Are there opportunities for premium pricing in the pediatric cetirizine market?

Yes, through innovative formulations, improved taste profiles, or added convenience features, companies can command higher prices, particularly in developed markets.

4. Which regions offer the most growth potential for child cetirizine HCl?

Asia-Pacific, Latin America, and Africa hold substantial growth opportunities due to rising allergy prevalence and expanding healthcare infrastructure.

5. What regulatory trends could influence future pricing?

Policies encouraging age-appropriate formulations, faster approval pathways, and incentivization for pediatric drug development are likely to shape pricing and market dynamics.

Sources

[1] MarketWatch. Pediatric Antihistamines Market Forecast and Trends, 2023–2028.

[2] IQVIA. US Generic Drug Pricing Trends, 2022.

More… ↓