Share This Page

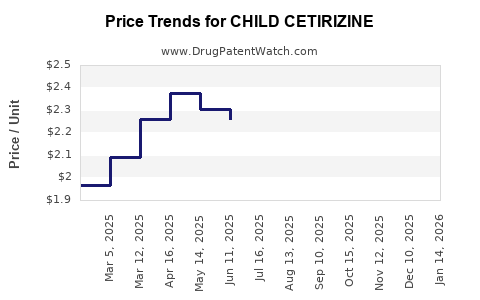

Drug Price Trends for CHILD CETIRIZINE

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD CETIRIZINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD CETIRIZINE HCL 1 MG/ML | 70752-0104-06 | 0.03609 | ML | 2025-12-17 |

| CHILD CETIRIZINE 10 MG CHEW TB | 47335-0344-83 | 2.19445 | EACH | 2025-12-17 |

| CHILD CETIRIZINE HCL 1 MG/ML | 00904-6765-20 | 0.03609 | ML | 2025-12-17 |

| CHILD CETIRIZINE HCL 1 MG/ML | 70752-0104-06 | 0.03670 | ML | 2025-11-19 |

| CHILD CETIRIZINE 10 MG CHEW TB | 47335-0344-83 | 2.09893 | EACH | 2025-11-19 |

| CHILD CETIRIZINE HCL 1 MG/ML | 00904-6765-20 | 0.03670 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Child Cetirizine

Introduction

Child cetirizine, a pediatric formulation of the antihistamine cetirizine, is widely used for treating allergic rhinitis, urticaria, and other allergic conditions in children. Its market dynamics are influenced by regulatory approvals, demographic trends, competitive landscape, and manufacturing costs. This analysis offers comprehensive insights into current market conditions and presents price projections grounded in market trends, regulatory factors, and economic fundamentals.

Market Landscape

Global Market Overview

The pediatric antihistamine segment, with child cetirizine as a primary product, exhibits robust growth driven by increasing prevalence of allergies among children worldwide. According to a report by Grand View Research, the global antihistamines market was valued at USD 4.7 billion in 2021 and is projected to reach USD 7.2 billion by 2030, expanding at a CAGR of 4.9% [1].

Key markets include North America, Europe, and Asia-Pacific. North America dominates due to high allergy awareness, advanced healthcare infrastructure, and widespread OTC availability of cetirizine formulations. Asia-Pacific offers significant growth potential due to rising urbanization, changing lifestyles, and increased pediatric allergy diagnoses.

Regulatory Environment

Regulatory approvals impact market accessibility and pricing. In the United States, the FDA regulates pediatric formulations, requiring rigorous safety and efficacy data. Cetirizine is available OTC for adults and children over six months, fostering broad usage. Similar regulatory frameworks exist in Europe (EMA) and Asia. Patent expirations and the rise of generic formulations have increased market competition, impacting pricing strategies.

Competitive Dynamics

The market features multiple generic manufacturers, with a few key branded players. Generic cetirizine formulations, especially for pediatric use, have saturated markets. Innovative administration forms such as liquid syrups, dissolvable tablets, and dispersible tablets enhance pediatric compliance. Companies focus on formulation improvements, supply chain efficiency, and marketing to retain market share.

Consumer and Prescriber Trends

Increasing awareness about allergy management guides more pediatric prescriptions. Furthermore, OTC availability for specific formulations influences sales volume. The COVID-19 pandemic temporarily disrupted supply chains but ultimately accelerated demand due to heightened awareness of respiratory health.

Price Analysis

Current Market Pricing

The price of child cetirizine varies significantly across regions due to factors such as manufacturing costs, regulatory fees, patent status, and market competition.

-

United States:

The OTC liquid formulations of child cetirizine (e.g., 5 mg/5 mL syrups) retail at approximately USD 10-15 for a 4 oz bottle, with generics priced slightly lower. The wholesale acquisition cost (WAC) for generics ranges from USD 1-3 per 5 mL dose, depending on the supplier and volume commitments. -

Europe:

Pediatric cetirizine formulations retail between EUR 8-12 per bottle, with generics close to EUR 5-8. Price competition is high owing to multiple market entrants. -

Asia-Pacific:

Prices are more variable due to differing healthcare reimbursement policies. A typical pediatric cetirizine syrup costs about USD 3-8 per bottle. Price sensitivity among consumers is higher.

Factors Affecting Pricing Trends

-

Patent Status and Generics:

Mira Pharmaceuticals’ patent expiration in many jurisdictions has led to widespread generic production, reducing prices. As of 2022, cetirizine patents have expired in major markets, intensifying competition. -

Formulation Innovations:

Improved palatability or convenience (e.g., dissolvable tablets) allows premium pricing, but commoditization usually drives prices down. -

Regulatory Incentives:

Orphan drug status or pediatric exclusivity grants can maintain higher prices for branded formulations, but the overall trend favors generics. -

Supply Chain and Raw Material Costs:

Fluctuations in active pharmaceutical ingredient (API) costs directly influence formulation pricing, especially as demand fluctuates during global health crises.

Projected Price Trends (2023-2028)

-

Short-term (2023-2024):

Prices expected to remain stable or decline modestly (2-5%) due to ongoing generic competition. The introduction of biosimilars or reformulations with improved compliance features may create slight premium segments. -

Medium-term (2025-2028):

Prices may decline further (up to 10%) as market saturation increases. However, emerging markets' demand growth could offset price erosions in Western markets. -

Long-term (beyond 2028):

Prices could stabilize as manufacturers optimize production and supply chains. Innovative delivery systems may command higher premiums, maintaining differential pricing.

Market Entry and Pricing Strategies

New entrants contemplating the pediatric cetirizine landscape should consider:

-

Formulation Differentiation:

Introducing more palatable or easy-to-administer formats can justify a premium price. -

Manufacturing Efficiency:

Cost reduction through supply chain optimization enhances competitive pricing. -

Regulatory Navigation:

Achieving pediatric exclusivity or fast-track approvals boosts market position. -

Pricing Models:

Tiered pricing targeting high- and low-income markets maximizes accessibility while maintaining profitability.

Risks and Challenges

-

Regulatory Uncertainty:

Changes in pediatric formulation requirements could introduce delays or additional costs. -

Market Saturation:

High generic penetration constrains profit margins and compels differentiation. -

Pricing Pressure:

Payers and insurers’ push for lower drug costs threaten premium pricing segments. -

Supply Chain Vulnerabilities:

Disruptions impacting raw material availability could increase costs and influence pricing.

Conclusion

The pediatric cetirizine market remains a mature, highly competitive segment with steady demand driven by demographic and healthcare trends. Price trajectories are predominantly downward in the short to medium term, influenced by patent expiries, generics proliferation, and market saturation. Innovative formulations and strategic market positioning could offer avenues for value addition and premium pricing.

Key Takeaways

-

Market growth is sustained by rising allergy prevalence in children, especially in emerging markets.

-

The price of child cetirizine is expected to decline modestly over the next 3-5 years, with regional variations.

-

Generic competition significantly influences pricing, encouraging cost reductions while limiting margins for branded players.

-

Formulation innovation offers potential for premium pricing, especially in developed markets demanding ease-of-use and compliance.

-

Regulatory and supply chain factors will be pivotal in shaping future pricing and market accessibility.

FAQs

1. How does patent expiration affect the pricing of child cetirizine?

Patent expiration allows generic manufacturers to enter the market, significantly increasing supply and driving prices downward due to competition, thereby reducing retail and wholesale costs.

2. What are the main factors influencing regional differences in child cetirizine pricing?

Regulatory frameworks, market competition, healthcare reimbursement policies, and consumer purchasing power primarily influence regional pricing disparities.

3. Are there opportunities for premium pricing in the pediatric cetirizine market?

Yes, formulations that enhance palatability, convenience, or compliance (e.g., dissolvable tablets or flavoring) can command higher prices, especially in developed markets.

4. How might supply chain disruptions impact future prices?

Disruptions can increase production costs due to shortages or delays in raw materials, potentially pushing retail prices upward temporarily or prompting manufacturers to absorb costs through reduced margins.

5. What role does market saturation play in price projections?

High saturation with generics constrains pricing power, leading to gradual price declines. Conversely, niche formulations or innovative delivery systems can create offshoot markets for higher pricing.

Sources:

[1] Grand View Research, "Antihistamines Market Size, Share & Trends Analysis Report," 2022.

More… ↓