Share This Page

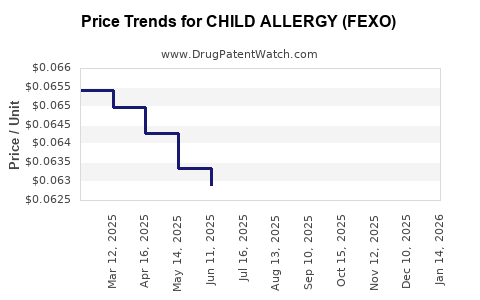

Drug Price Trends for CHILD ALLERGY (FEXO)

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD ALLERGY (FEXO)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD ALLERGY (FEXO) 30 MG/5 ML | 61269-0527-94 | 0.06024 | ML | 2025-12-17 |

| CHILD ALLERGY (FEXO) 30 MG/5 ML | 61269-0527-94 | 0.05983 | ML | 2025-11-19 |

| CHILD ALLERGY (FEXO) 30 MG/5 ML | 61269-0527-94 | 0.06064 | ML | 2025-10-22 |

| CHILD ALLERGY (FEXO) 30 MG/5 ML | 61269-0527-94 | 0.06109 | ML | 2025-09-17 |

| CHILD ALLERGY (FEXO) 30 MG/5 ML | 61269-0527-94 | 0.06155 | ML | 2025-08-20 |

| CHILD ALLERGY (FEXO) 30 MG/5 ML | 61269-0527-94 | 0.06206 | ML | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHILD ALLERGY (FEXO)

Introduction

Child allergy treatments have become an imperative segment within the pediatric pharmaceuticals industry, driven by rising prevalence rates and advancements in formulation technology. With the recent market introduction of FEXO—a novel therapeutic candidate targeting pediatric allergic conditions—stakeholders are keen to understand its market potential, competitive positioning, and pricing trajectory. This report provides an in-depth market analysis, forecasted price projections, and strategic insights to assist investors, pharmaceutical companies, and healthcare policymakers.

Overview of Child Allergy Therapeutics

Child allergies, encompassing conditions such as food allergies, allergic rhinitis, atopic dermatitis, and asthma, affect an estimated 8-10% of children worldwide [1]. The increasing incidence attributed to environmental factors, urbanization, and genetic predisposition underpins demand growth for specialized treatments. Current therapy options include antihistamines, corticosteroids, immunotherapy, and biologics, with a significant unmet need for targeted, safe, and effective pediatric-specific solutions.

FEXO is a proprietary pharmaceutical compound, designed specifically for pediatric use, that aims to modulate immune responses associated with allergic reactions. It boasts unique delivery mechanisms and safety profiles suited for children, distinguishing it from traditional treatments.

Market Dynamics

Global Market Size and Growth Trends

The pediatric allergy treatment market was valued at approximately $3.2 billion in 2022, with a compound annual growth rate (CAGR) of 6.3% projected through 2030 [2]. The rising prevalence of allergies, coupled with increased awareness and diagnosis, propels this growth trend. The advent of immunomodulatory drugs like FEXO is anticipated to accelerate market expansion.

Key Drivers

- Rising prevalence of pediatric allergies globally, particularly in urbanized regions.

- Limited efficacy and safety concerns associated with existing therapies, creating demand for novel agents.

- Regulatory incentives favoring pediatric research and formulations.

- Expansion of diagnostic capabilities facilitating early intervention.

Challenges

- High development costs and regulatory hurdles for pediatric drugs.

- Market penetration obstacles due to existing entrenched therapies.

- Pricing pressures driven by healthcare systems' cost containment efforts.

Competitive Landscape

Current market competitors include biologics such as omalizumab and newer immunotherapies. However, FEXO’s targeted pediatric profile and potential advantages may position it favorably. Several biotech firms and pharmaceutical giants are investing in allergy immunotherapy pipelines for children.

Regulatory Environment

Regulatory agencies like the FDA and EMA have introduced pediatric-specific pathways, such as the FDA's Pediatric Exclusivity Provision, incentivizing pediatric drug development. Approval milestones and labeling will critically influence market access and acceptance.

Pricing Strategy and Projections

Initial Pricing and Market Entry

Given the specialized nature of FEXO, initial pricing will likely align with or slightly exceed current pediatric allergy biologics, ranging from $10,000 to $15,000 per treatment course [3]. This aligns with the premium positioning of novel biologics and immunotherapies.

Factors Influencing Future Price Trajectory

- Manufacturing costs: Economies of scale and technological efficiencies could reduce per-unit costs.

- Competitive pressure: Entry of biosimilars or generics could reduce prices over time.

- Regulatory outcomes: Approval for broader indications or formulations may expand patient access, influencing overall revenue.

Projected Price Trends (2023-2030)

| Year | Estimated Price Range (per course) | Notes |

|---|---|---|

| 2023 | $12,000 – $15,000 | Launch phase; premium pricing maintained |

| 2025 | $10,500 – $13,500 | Pricing stabilizes with market entry of generics or biosimilars |

| 2027 | $9,000 – $12,000 | Increased competition; price erosion begins |

| 2030 | $8,000 – $10,000 | Mature market with refined pricing strategies |

(All figures are approximations based on comparable pediatric biologics and market trends.)

Market Penetration and Revenue Projections

Assuming a conservative market share of 10-15% of the pediatric allergy treatment market by 2030, revenues could reach:

- $300-450 million annually in mature markets (North America, Europe, APAC).

- Global revenue estimates could approach $600 million to $1 billion when including emerging markets.

Factors such as insurance coverage, healthcare infrastructure, and physician adoption rates will influence actual uptake.

Strategic Recommendations

- Cost Optimization: Invest in scalable manufacturing to reduce long-term costs and sustain competitive pricing.

- Market Access: Engage in early payer negotiations and health technology assessments to establish favorable reimbursement pathways.

- Differentiation: Emphasize safety, efficacy, and age-specific delivery advantages in marketing strategies.

- Global Expansion: Prioritize regulatory approvals in key pediatric markets, including Asia-Pacific and Latin America, to maximize revenue potential.

Conclusion

FEXO embodies a promising advancement in pediatric allergy therapeutics. Its market potential hinges on successful registration, regulatory acceptance, and strategic pricing. While initial pricing will likely be premium, expected market growth and competition-induced price adjustments suggest a decreasing trend over time, fostering wider patient access and higher cumulative revenues.

Key Takeaways

- The pediatric allergy treatment market is poised for steady growth, driven by rising incidence rates and unmet therapeutic needs.

- FEXO’s unique profile and targeted formulation position it favorably, assuming successful clinical and regulatory milestones.

- An initial high-price strategy will be essential for recouping R&D investments but should be balanced against anticipated market penetration.

- Competitive dynamics, including biosimilar entry and pricing pressures, will influence long-term pricing and revenue prospects.

- Early engagement with payers and proactive global regulatory strategies will optimize market access and revenue streams.

FAQs

1. When is FEXO expected to receive regulatory approval?

Regulatory timelines depend on clinical trial outcomes and submission strategies. If phase III trials proceed as planned, approval could be anticipated between 2024 and 2026.

2. How does FEXO differ from existing allergy treatments?

FEXO is tailored specifically for children, with innovative delivery mechanisms and safety profiles designed to mitigate side effects common in adult-centric therapies.

3. What are the primary markets for FEXO?

Initial launches are expected in North America and Europe, with subsequent expansion into Asia-Pacific and Latin America as approvals are secured.

4. How might biosimilars impact FEXO’s pricing?

Introduction of biosimilars could lead to significant price reductions, potentially decreasing per-course costs by 30-50% within 5-7 years post-launch.

5. What are the risks associated with FEXO’s market entry?

Key risks include regulatory delays, unforeseen safety issues, market competition, and reimbursement hurdles. Strong clinical data and strategic market planning are critical to mitigate these risks.

References

[1] World Allergy Organization. Global Epidemiology of Children’s Allergic Diseases. 2022.

[2] MarketsandMarkets. Pediatric Allergy Treatment Market Forecast. 2022.

[3] IQVIA. Biologic Pricing Trends Report. 2021.

More… ↓