Share This Page

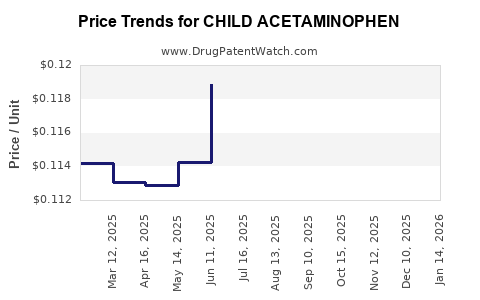

Drug Price Trends for CHILD ACETAMINOPHEN

✉ Email this page to a colleague

Average Pharmacy Cost for CHILD ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHILD ACETAMINOPHEN 160 MG | 70000-0309-01 | 0.11689 | EACH | 2025-12-17 |

| CHILD ACETAMINOPHEN 160 MG | 70000-0310-01 | 0.11689 | EACH | 2025-12-17 |

| CHILD ACETAMINOPHEN 160 MG | 70000-0309-01 | 0.11463 | EACH | 2025-11-19 |

| CHILD ACETAMINOPHEN 160 MG | 70000-0310-01 | 0.11463 | EACH | 2025-11-19 |

| CHILD ACETAMINOPHEN 160 MG | 70000-0310-01 | 0.11636 | EACH | 2025-10-22 |

| CHILD ACETAMINOPHEN 160 MG | 70000-0309-01 | 0.11636 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Child Acetaminophen

Introduction

Child acetaminophen, also known as paracetamol, remains the predominant analgesic and antipyretic in pediatric medicine. Its widespread use in treating pain and fever in children — coupled with a robust global demand and evolving regulatory and manufacturing landscapes — makes understanding its market dynamics essential for stakeholders ranging from pharmaceutical manufacturers to healthcare providers. This article offers an in-depth market analysis and forecasts future pricing trends for child acetaminophen, emphasizing key factors impacting supply, demand, regulatory environment, and competitive landscape.

Market Landscape

Global Demand and Usage Trends

Child acetaminophen's usage is heavily influenced by pediatric healthcare needs, with a consistent demand fueled by its safety profile, efficacy, and over-the-counter (OTC) availability. According to IQVIA data, pediatric analgesics and antipyretics accounted for approximately 20-25% of the global OTC market in 2022, with acetaminophen-based formulations dominating this segment.

Developed markets, such as North America and Europe, maintain high consumption levels, driven by routine pediatric use and widespread OTC availability. Emerging markets—like China, India, and Southeast Asia—are experiencing accelerated growth due to increasing awareness, improving healthcare infrastructure, and rising disposable incomes.

Manufacturing and Supply Chain Dynamics

Major pharmaceutical companies, including Johnson & Johnson, Sanofi, and GlaxoSmithKline, manufacture pediatric acetaminophen in various forms: suspensions, chewables, drops, and suppositories. The supply chain is intricately linked with active pharmaceutical ingredient (API) sourcing, manufacturing capacities, and regulatory compliance.

Recent disruptions—like the 2020-2021 global supply chain constraints—have resulted in temporary shortages in several regions. These shortages led to price volatility and spurred new investments in API production capabilities, especially in regions with lower manufacturing costs.

Regulatory Environment

Regulatory agencies such as the FDA (USA), EMA (EU), and regulatory bodies in emerging markets, have tightened quality standards for pediatric formulations. Recent initiatives include enhanced labeling requirements, age-appropriate dosing guidelines, and restrictions on certain excipients. These regulatory changes influence manufacturing costs, ultimately impacting retail prices.

Furthermore, safety concerns, such as the association between excessive acetaminophen use and liver toxicity, have prompted regulatory reviews and consumer education campaigns, affecting demand and pricing strategies.

Competitive Landscape

The market is fragmented, with numerous generics companies competing alongside multinational corporations. Innovation focuses on developing more palatable formulations, extended-release products, and combination therapies. The generic nature of most formulations underpins price competition, although premium branding persists for certain organic or preservative-free products.

Market Size and Revenue Projections

Current Market Value

The global pediatric acetaminophen market was valued at approximately USD 2.5 billion in 2022. North America dominates, accounting for nearly 45% of sales, followed by Europe, at around 25%. The Asian-Pacific region is emerging rapidly, with a compound annual growth rate (CAGR) of approximately 6% over the past five years.

Future Market Growth

Forecasts suggest a steady growth trajectory, with the global market expected to reach USD 3.7 billion by 2028, with a CAGR of around 7%. Factors contributing to this growth include increasing pediatric populations, rising awareness, and expanding distribution channels in emerging markets.

Emerging trends such as digital health monitoring, telemedicine, and direct-to-consumer marketing will further influence demand patterns, especially in developed markets.

Price Trends and Projections

Historical Price Trends

Historically, retail prices for child acetaminophen suspensions have exhibited minimal fluctuation, influenced mainly by raw material costs, regulatory compliance, and manufacturing efficiencies. In North America, the average retail price per 100 ml dose fluctuated between USD 0.25 and USD 0.35 over the past five years.

Market shortages and raw material price spikes—such as during the 2020 COVID-19 pandemic—occasionally caused short-term price surges. Conversely, increased competition and manufacturing scale-up efforts have pushed prices downward in some segments.

Projected Price Trajectory

Looking forward to 2028, the retail price of standard child acetaminophen formulations is expected to grow modestly, at a CAGR of approximately 2-3%, influenced by:

-

Raw Material Costs: Fluctuations depend on API supply stability, with potential increases driven by environmental regulations and demand for raw materials like p-aminophenol.

-

Regulatory Costs: Compliance with evolving safety standards may increase manufacturing expenses, which could be passed on to consumers.

-

Market Competition: The proliferation of generics sustains price competition, counteracting upward pressures.

-

Demand Dynamics: Increasing pediatric populations and awareness will sustain steady demand but with limited elasticity in pricing due to OTC status.

By 2028, average retail prices per 100 ml suspension are projected to reach approximately USD 0.38-0.45, with premium formulations potentially priced higher.

Regional Variations

- North America and Europe: Prices are likely to remain relatively stable. Slight increases are expected due to stricter regulations and higher manufacturing standards.

- Asia-Pacific: Rapid market expansion coupled with increasing competition could exert downward pressure on prices, despite rising demand.

- Emerging Markets: Price growth may be constrained by local affordability and regulatory environments but will still benefit from increasing volume sales.

Impacts of Regulatory and Market Developments

Regulatory efforts emphasizing pediatric safety guide innovation and pricing strategies for child acetaminophen. For instance, formulations with lower doses or specialized delivery mechanisms (e.g., droppers, flavored suspensions) command higher prices. Additionally, the potential introduction of stricter safety warnings or bans on certain excipients could temporarily influence prices—a trend observed with past regulatory actions on formulations containing certain preservatives.

Market consolidation or the entrance of new entrants can alter competitive prices sharply. Patent expirations, although less impactful for generic acetaminophen, create opportunities for new formulations, impacting overall market pricing structures.

Country-Specific Price Dynamics

United States

The U.S. OTC market exhibits consistent pricing, with discounts and insurance coverage influencing retail prices. The FDA's ongoing safety reviews and labeling reforms may lead to minor price adjustments but are unlikely to cause major shifts.

European Union

EU markets see coordinated regulation, with varying pricing driven by national healthcare policies and reimbursement schemes. Price negotiations by national health services remain influential, often capping prices and impacting market margins.

Emerging Markets

Price sensitivity remains high, with manufacturers adopting tiered pricing strategies. The focus is on volumetric sales rather than premium pricing, leading to lower average prices relative to developed markets.

Conclusion

The global child acetaminophen market is characterized by steady growth, driven by expanding pediatric populations and increasing healthcare access, especially in developing regions. While current prices are relatively stable, moderate increases are anticipated due to regulatory developments, raw material costs, and innovation in formulation types. The segment’s highly competitive landscape maintains downward pressure on prices, favoring consumers but challenging manufacturers seeking margins.

Industry players should monitor regulatory shifts and raw material supply chains closely, as these factors significantly influence pricing. Investing in differentiated formulations and supply chain efficiencies can position firms competitively in this evolving market.

Key Takeaways

- The global market for child acetaminophen is projected to reach USD 3.7 billion by 2028 with a CAGR of approximately 7%.

- Prices are expected to grow modestly, averaging 2-3% annually, with regional variations driven by regulation and competition.

- Supply chain stability and regulatory compliance will remain critical factors influencing market prices.

- Emerging markets will drive volume growth, offering significant opportunities despite price sensitivity.

- Innovation in formulation and safety features can command premium pricing, while commoditization will sustain competition and price pressures.

FAQs

1. What factors are most influential in determining the future price of child acetaminophen?

Raw material costs, regulatory compliance expenses, manufacturing efficiencies, competition levels, and demand dynamics collectively influence prices. Supply chain stability and safety regulations are particularly impactful.

2. How will emerging markets impact the global child acetaminophen market?

Emerging markets contribute to volume growth due to increasing pediatric populations and expanding healthcare infrastructure. Price sensitivities may limit margins, but regional growth opportunities remain substantial.

3. Are there significant patent protections for child acetaminophen formulations?

Since acetaminophen itself is a generic compound, patent protections are limited primarily to specific formulations or delivery systems. Most formulations operate within a highly competitive generic landscape.

4. How might regulatory changes influence pricing strategies?

Enhanced safety standards can increase manufacturing costs, potentially raising prices. Conversely, regulations favoring generics and standardization can sustain competitive pricing and limit price inflation.

5. What competitive advantages can manufacturers pursue in this market?

Focusing on formulation innovation, cost-efficient manufacturing, robust supply chains, and compliance with safety standards can provide differentiation and pricing leverage.

Sources:

[1] IQVIA. Global Pediatric OTC Market Data, 2022.

[2] FDA Guidelines and Safety Reports, 2021-2022.

[3] Industry Market Reports, 2022-2023.

More… ↓