Share This Page

Drug Price Trends for CHEST CONGESTION RELIEF SOLN

✉ Email this page to a colleague

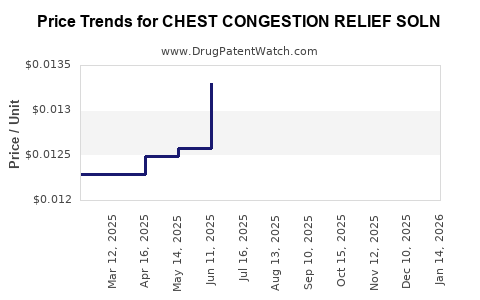

Average Pharmacy Cost for CHEST CONGESTION RELIEF SOLN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHEST CONGESTION RELIEF SOLN | 00536-1314-85 | 0.01320 | ML | 2025-12-17 |

| CHEST CONGESTION RELIEF SOLN | 00536-1314-85 | 0.01277 | ML | 2025-11-19 |

| CHEST CONGESTION RELIEF SOLN | 00536-1314-85 | 0.01335 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Chest Congestion Relief Solution

Introduction

Chest congestion relief solutions are integral to respiratory health, addressing symptoms associated with conditions like bronchitis, asthma, the common cold, influenza, and chronic obstructive pulmonary disease (COPD). The rising incidence of respiratory ailments globally, coupled with increasing demand for OTC (over-the-counter) and prescription medications, underscores the importance of analyzing the market landscape and future pricing dynamics for Chest Congestion Relief Solution (CCRS). This report provides a comprehensive market overview, forecasts future price trends, and discusses key influences shaping the industry trajectory.

Market Overview

Global Market Size and Growth Drivers

The global respiratory drug market, estimated at USD 30 billion in 2022, is projected to grow at a CAGR of approximately 6% through 2030, driven by increased respiratory disease prevalence and aging populations worldwide [1]. Specifically, products targeting chest congestion are a significant segment within this domain, encompassing both traditional remedies and novel formulations.

Factors propelling demand for CCRS include:

- Rising respiratory infections: Seasonal flu outbreaks and increased SARS-CoV-2 cases have amplified demand for symptomatic relief.

- Aging populations: Older adults are more susceptible to respiratory ailments, perpetuating the need for effective symptomatic treatments.

- Self-medication trend: Growing preference for OTC products facilitates rapid market expansion, particularly in North America and Europe.

- Innovative formulation development: Advances in expectorants, mucolytics, and combination therapies improve efficacy, boosting consumer confidence.

Market Segmentation

The CCRS market segments include:

- Formulation types: Syrups, tablets, lozenges, inhalers, nasal sprays.

- Distribution channels: Pharmacies, supermarkets, online platforms, hospitals.

- End-users: Pediatric, adult, geriatric populations.

Among these, OTC syrups and tablets dominate due to ease of use and accessibility, especially in North America and Europe, while inhalers and nasal sprays are gaining traction in clinical settings.

Competitive Landscape

Key players include pharmaceutical giants such as GSK, Bayer, Johnson & Johnson, and emerging biotech companies innovating in natural and combination therapies. Patent expiry of blockbuster formulations creates generic opportunities, intensifying price competition.

Innovations focusing on:

- Enhanced absorption.

- Reduced side effects.

- Combined anti-inflammatory and expectorant actions.

are expected to influence market dynamics significantly.

Regulatory Environment

Regulatory frameworks, particularly in the US (FDA) and EU (EMA), demand rigorous safety and efficacy evidence, impacting market entry timelines and pricing strategies. The trend towards over-the-counter status for certain CCRS formulations reduces regulatory hurdles and accelerates market penetration but also pressures pricing due to increased competition.

Price Trends and Projections

Historical Pricing Trends

Historical data indicate:

- Average retail prices for OTC CCRS range between USD 5-15 per bottle/pack.

- Prescription formulations command higher prices, from USD 20-50 per course, depending on complexity and active ingredients.

- Competition and generic availability have exerted downward pressure on prices over the past decade.

Future Price Dynamics (2023-2030)

Projections suggest:

- Moderate Price Stability: Product prices are expected to stabilize due to increased regulation and quality standards.

- Gradual Decline in OTC Prices: Intensified generic competition and commoditization may reduce prices by approximately 2-3% annually.

- Premiumization of Innovative Formulations: Price premiums of 10-15% are anticipated for advanced formulations with proven superior efficacy or fewer side effects.

- Impact of Digital and E-commerce Distribution: Online sales channels mitigate traditional retail markups, likely decreasing consumer prices further.

Price Drivers

- Technological Innovation: Incorporation of novel mucolytics or bioavailability enhancements.

- Regulatory Changes: Stricter standards might increase initial product costs, influencing prices temporarily.

- Market Competition: Entry of generic manufacturers will drive prices downward.

- Consumer Demand Dynamics: Preference for natural or herbal CCRS could enable premium pricing for select products.

Regional Variations

- North America: Highest per-unit prices, driven by brand dominance and consumer willingness to pay.

- Europe: Competitive pricing with tiered approaches across countries, influenced by healthcare policies.

- Asia-Pacific: Rapid growth with lower average prices, but increasing premium offerings due to innovation.

- Emerging Markets: Price sensitivity prevails; most products sold at lower margins.

Market Entry and Pricing Strategies

- Innovation Focus: Developing formulations with rapid onset, fewer side effects, or natural ingredients can command premium pricing.

- Pricing Models: Tiered pricing tailored to markets’ economic levels, with discounts and bundled offerings.

- Regulatory Navigation: Compliant labeling and clinical data can justify higher price points.

- Distribution Channel Optimization: Leveraging online platforms can reduce costs and enable competitive pricing.

Conclusion

The CCRS market is poised for steady growth with evolving consumer preferences and technological advancements. While prices are generally expected to decline marginally due to generic entry and competition, innovative products will maintain premium price points. Strategic positioning by manufacturers—focusing on differentiated formulations, efficient distribution, and regulatory compliance—will be crucial for capitalizing on market opportunities.

Key Takeaways

- The global CCRS market is projected to grow at approximately 6% CAGR through 2030, driven by increased respiratory disease prevalence and aging demographics.

- Pricing will experience slight declines due to commoditization, but innovative, branded formulations will sustain premium prices.

- Competition and regulatory pressures will influence pricing strategies, emphasizing the importance of innovation and market segmentation.

- Online sales channels will further compress prices, requiring manufacturers to balance affordability with profitability.

- Emerging markets offer significant growth potential with lower price points, but premium segments may follow global trends for innovative products.

FAQs

1. What factors most influence pricing for chest congestion relief solutions?

Active ingredient efficacy, formulation innovation, regulatory requirements, competitive landscape, and distribution channels are primary price influencers.

2. How will regulatory changes impact the market?

Enhanced safety standards may increase initial compliance costs but can also create barriers for generics, potentially preserving premium pricing for branded innovation.

3. Can emerging markets sustain higher prices for CCRS?

Typically, lower average incomes lead to more price-sensitive markets, but premium, herbal, or natural formulations can command higher prices within niches.

4. What role does OTC availability play in market pricing?

OTC products usually have lower retail prices due to higher competition, but successful branding and formulation improvements can justify higher price points.

5. What innovations are most likely to influence future pricing?

Longer-lasting formulations, natural ingredients, combination therapies, and targeted delivery mechanisms are key innovations impacting price structures.

Sources

[1] Market Research Future, "Respiratory Drugs Market Size, Share & Trends Analysis," 2022.

More… ↓