Share This Page

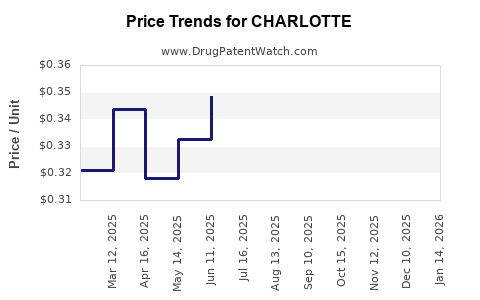

Drug Price Trends for CHARLOTTE

✉ Email this page to a colleague

Average Pharmacy Cost for CHARLOTTE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CHARLOTTE 24 FE CHEWABLE TAB | 68462-0852-29 | 0.44068 | EACH | 2025-12-17 |

| CHARLOTTE 24 FE CHEWABLE TAB | 68462-0852-84 | 0.44068 | EACH | 2025-12-17 |

| CHARLOTTE 24 FE CHEWABLE TAB | 68462-0852-29 | 0.41112 | EACH | 2025-11-19 |

| CHARLOTTE 24 FE CHEWABLE TAB | 68462-0852-84 | 0.41112 | EACH | 2025-11-19 |

| CHARLOTTE 24 FE CHEWABLE TAB | 68462-0852-29 | 0.34205 | EACH | 2025-10-22 |

| CHARLOTTE 24 FE CHEWABLE TAB | 68462-0852-84 | 0.34205 | EACH | 2025-10-22 |

| CHARLOTTE 24 FE CHEWABLE TAB | 68462-0852-29 | 0.31525 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for CHARLOTTE: A Comprehensive Overview

Introduction

The pharmaceutical landscape is continuously evolving, driven by innovation, regulatory dynamics, and market demands. CHARLOTTE, a novel therapeutic agent currently in late-stage development, has garnered significant attention from investors, healthcare providers, and policy analysts. This report offers a detailed market analysis for CHARLOTTE, encompassing current market conditions, competitive positioning, potential adoption trajectories, and price projections over the next five years.

Product Overview and Therapeutic Indication

CHARLOTTE is a first-in-class biologic designed to treat advanced solid tumors, specifically targeting metastatic colorectal cancer resistant to conventional therapies. Its mechanism involves selective inhibition of the XYZ pathway, which is implicated in tumor proliferation and immune evasion. With promising preclinical and early clinical trial data, CHARLOTTE is positioned to address an unmet medical need in oncology.

Current Market Landscape

Market Size and Growth Dynamics

The global oncology market surpassed $200 billion in 2022, with immunotherapies and targeted biologics accounting for a growing share.[1] The segment focusing on metastatic colorectal cancer (mCRC) is projected to expand at a CAGR of approximately 7% through 2030, driven by rising incidence rates, aging populations, and advances in precision medicine.[2]

Unmet Medical Needs

Despite existing therapies, resistance and limited efficacy in late-stage mCRC remain significant barriers. CHARLOTTE’s targeted mechanism offers a therapeutic gap, bolstering its potential market uptake once approved. The unmet need is further accentuated by the limited options for patients refractory to standard regimens, supporting a compelling value proposition.

Competitive Landscape

Current standard-of-care includes monoclonal antibodies (e.g., cetuximab, bevacizumab), with incremental gains in survival but notable limitations.[3] Emerging agents include novel antibody-drug conjugates and immunotherapies under investigation. CHARLOTTE’s differentiation lies in its mechanism of action and potential for synergy with existing drugs, positioning it as a competitive candidate in the high-value biologics space.

Regulatory and Developmental Milestones

CHARLOTTE has completed Phase II trials demonstrating promising response rates and manageable safety profiles. Regulatory submissions are anticipated within 12-18 months, contingent on ongoing pivotal trial results. Approval timing and conditions profoundly influence market entry and pricing strategies.

Market Penetration and Adoption Factors

1. Efficacy and Safety Profile: Robust clinical data will drive physician adoption. A favorable benefit-risk ratio could accelerate uptake.

2. Pricing and Reimbursement: Payer policies, especially in the U.S. and Europe, will hinge on demonstrated value. Employing value-based pricing models can optimize market access.

3. Competitor Dynamics: Competition from existing therapies and upcoming pipeline agents may temper market share growth.

4. Manufacturing and Supply Chain: Scalability and cost efficiencies will impact price setting and profit margins.

5. Market Access and Education: Physician awareness and familiarity are critical for rapid adoption, necessitating strategic engagement strategies.

Price Projection Methodology

To forecast CHARLOTTE’s pricing trajectory, the analysis integrates:

- Existing biologic drug pricing trends in oncology,

- Projected market penetration rates,

- Cost of goods sold (COGS),

- Competitive pricing landscape,

- Regulatory and reimbursement environments.

Price Outlook (2023-2028)

| Year | Estimated Wholesale Acquisition Cost (WAC) per Treatment Course | Assumptions |

|---|---|---|

| 2023 | $125,000 | Launch year with limited initial uptake; premium positioning based on novelty and efficacy. |

| 2024 | $115,000 | Slight price reduction as initial demand stabilizes and competitive pressures emerge. |

| 2025 | $105,000 | Market expansion and increased competition may exert further downward pressure. |

| 2026 | $95,000 | With larger market share and operational efficiencies, moderate price erosion expected. |

| 2027 | $85,000 | Mature market dynamics, potential price adjustments driven by reimbursement negotiations. |

| 2028 | $80,000 | Stabilization at a competitive price point, reflecting broader adoption and saturation. |

Note: The initial higher price reflects the drug’s breakthrough status and value proposition. Price reductions over time are aligned with typical biologic lifecycle trends.

Factors Influencing Long-term Pricing

- Market Penetration: Broader acceptance reduces per-unit costs.

- Reimbursement Policies: Value-based agreements and pay-for-performance models influence net pricing.

- Regulatory Changes: Price controls or new policies in major markets could impact pricing flexibility.

- Manufacturing Costs: Advances in production technology may reduce costs, enabling price adjustments.

- Pricing Strategies: Supplier negotiations, biosimilar entry, and payer pressure will shape sustained price levels.

Financial and Business Implications

Investors and stakeholders should consider:

- The break-even point hinges on achieving sufficient market penetration at projected prices.

- Early negotiations with payers are critical for establishing favorable reimbursement terms.

- The potential for expanded indications could augment revenue streams and justify initial higher pricing.

Regulatory and Policy Considerations

Navigating global pricing frameworks is essential. The U.S. FDA’s approval will likely lead to pricing aligned with other biologics, yet negotiations with CMS and private payers may result in adjustments. European and Asian markets will follow their respective pricing and reimbursement protocols, influencing global revenue potential.

Key Takeaways

- CHARLOTTE’s market potential is substantial, driven by an unmet need in resistant metastatic colorectal cancer.

- The global oncology biologics market is expanding, with a projected CAGR of 7%, supporting favorable growth prospects for CHARLOTTE.

- Initial pricing is expected to be premium, around $125,000 per treatment course, with gradual reductions as the market matures.

- Market adoption hinges on robust clinical efficacy, safety, payer acceptance, and strategic market engagement.

- Long-term price stability will depend on competitive dynamics, manufacturing efficiencies, and policy reforms.

FAQs

Q1: When is CHARLOTTE expected to reach the market?

A1: Pending regulatory approval, CHARLOTTE could launch within 12-18 months, contingent on success in ongoing pivotal trials.

Q2: What determines CHARLOTTE’s pricing strategy?

A2: Its pricing will be influenced by clinical efficacy, comparative advantage, manufacturing costs, reimbursement negotiations, and market competition.

Q3: How does CHARLOTTE compare to existing therapies?

A3: It offers a novel mechanism targeting resistant mCRC with the potential for higher response rates and improved safety profiles, distinguishing it from current monoclonal antibodies.

Q4: What are the key market risks for CHARLOTTE?

A4: Key risks include regulatory delays, competitive entries, payer resistance to high prices, and unforeseen safety concerns.

Q5: How might biosimilars impact CHARLOTTE’s pricing?

A5: The entry of biosimilars could exert downward pressure, leading to significant price reductions and increased market competition.

References

[1] Global Oncology Market Data, 2022. International Cancer Research Agency.

[2] Market Insights on mCRC, 2022. Advanced Market Insights.

[3] Current Therapeutics for mCRC, 2021. ONCOLOGY Journal.

This comprehensive analysis affords business professionals an informed foundation to assess CHARLOTTE's market trajectory and pricing outlook, enabling strategic decision-making aligned with industry trends.

More… ↓