Last updated: July 28, 2025

Introduction

Cevimeline hydrochloride (HCl) is an oral muscarinic receptor agonist primarily indicated for the symptomatic management of Sjögren’s syndrome, a chronic autoimmune condition characterized by xerostomia and keratoconjunctivitis sicca. Approved by regulatory agencies such as the U.S. Food and Drug Administration (FDA), Cevimeline presents an emerging commercial opportunity due to the increasing prevalence of Sjögren’s syndrome and overall demand for targeted therapies for dry mouth conditions. This analysis evaluates the current market landscape, competitive environment, pricing strategies, and future price projections for Cevimeline HCl.

Market Landscape for Cevimeline HCl

Prevalence and Market Demand

Sjögren’s syndrome affects an estimated 0.1% to 4% of the population globally, with higher prevalence among women aged 40–60, according to the American College of Rheumatology. The U.S. alone reports approximately 1.2 million diagnosed cases, with many remaining undiagnosed. This substantial patient base underpins a consistent demand for effective symptomatic treatments, notably saliva-stimulating drugs like Cevimeline.

Current Treatment Paradigm

Cevimeline is positioned as a first-line pharmacotherapy for dry mouth associated with Sjögren’s syndrome. It competes with non-specific symptomatic approaches such as saliva substitutes and other cholinergic agents like pilocarpine. Unlike generic options, Cevimeline’s branded status, if maintained, can command premium pricing due to its targeted mechanism of action and established efficacy profile.

Regulatory and Patent Landscape

Manufacturers have secured patent protections extending into the late 2020s or early 2030s, preventing generic entry in key markets. The patent life extension, coupled with regulatory exclusivity in regions such as the U.S. and European Union (EU), supports a period of monopolistic pricing potential.

Competitive Environment

Existing Competition

- Pilocarpine: Generic availability makes it a low-cost alternative, impacting Cevimeline’s market share in cost-sensitive segments.

- Emerging Biosimilars or Alternative Agents: As of now, no biosims for Sjögren’s symptom management are in late-stage development.

Potential Disruptors

- New Therapies: Future drugs targeting underlying autoimmune pathology could reduce reliance on symptomatic treatments.

- Market Dynamics: Increasing awareness and diagnosis rates may expand the market, offsetting competition from generics.

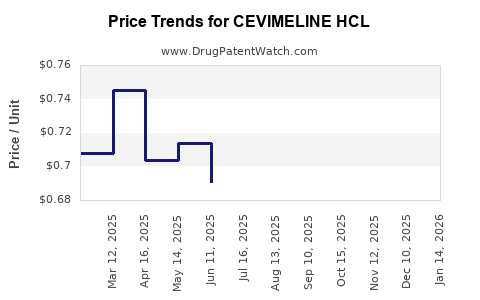

Pricing Strategies and Trends

Historical Pricing

Cevimeline HCl has historically been priced in the range of $200–$300 per month in the U.S., reflecting its branded status and clinical exclusivity. Generic alternatives like pilocarpine are typically priced below $50–$100 per month, emphasizing the importance of brand positioning for Cevimeline.

Pricing Models

- Premium Pricing: Maintains high margins due to brand loyalty, efficacy, and safety profile.

- Value-based Pricing: Could leverage clinical data demonstrating superior symptom control or fewer side effects, justifying higher costs.

- Reimbursement Dynamics: Insurance coverage and formulary inclusion significantly influence patient access and price realization.

Market Valuation and Future Price Projections

Current Market Estimate

Based on the prevalence data and current pricing, the U.S. market for Cevimeline is estimated at approximately $300–$500 million annually, considering conservative uptake assumptions (30–50% of diagnosed patients).

Price Projection for the Next 5 Years

- Scenario 1 – Status Quo: Price remains stable at $250–$300/month with gradual market expansion owing to increased awareness and insurance coverage.

- Scenario 2 – Premium Strategy: Introduction of value-added formulations or combination therapies elevates monthly pricing to $350–$500.

- Scenario 3 – Competitive Market: Entry of generics and biosimilars leads to pricing erosion of 10–20% annually, reducing annual revenue to approximately $150–$250 million by 2028.

Influencing Factors

- Regulatory extensions and patent protections could sustain higher prices longer.

- Growing diagnosis rates and clinician awareness will expand the patient population.

- Cost containment pressures and payer negotiations may temper price increases.

Strategic Considerations for Stakeholders

- Innovative Formulations: Developing sustained-release or combination options can differentiate Cevimeline and support premium pricing.

- Market Expansion: Exploring indications beyond Sjögren’s syndrome, such as neurogenic bladder or other muscarinic receptor-related conditions, could broaden market potential.

- Global Market Entry: Emerging markets could offer growth opportunities, albeit at lower price points influenced by local economic factors.

Key Takeaways

- High Market Potential: The persistent unmet need among Sjögren’s syndrome patients sustains demand, with the indication area poised for moderate growth.

- Pricing Power: Cevimeline’s branded status and patent protections currently support premium pricing, but long-term sustainability depends on market dynamics and competition.

- Pricing Erosion Risks: Introduction of generics and biosimilars, combined with payer pressures, pose risks of declining prices through the next decade.

- Innovation Imperative: To maintain profitability, companies should invest in formulation improvements, expanded indications, and strategic market expansion.

- Regulatory & Reimbursement Strategies: Securing and extending exclusivity, along with favorable reimbursement terms, remain critical for optimal pricing.

FAQs

1. How does Cevimeline’s market size compare to other treatments for autoimmune dry mouth?

Cevimeline addresses a niche segment within Sjögren’s syndrome management, with a global patient base of approximately 1.2 million in the U.S. alone. While smaller than broader autoimmune therapies, its targeted indication and lack of competition in specific markets provide strategic pricing leverage.

2. What are the main factors influencing Cevimeline’s price in different markets?

Regulatory exclusivity, local healthcare policies, payer reimbursement levels, and competitive generic presence are primary determinants. High-income regions such as North America and Western Europe typically see higher prices due to better reimbursement.

3. How might patent expirations affect Cevimeline’s pricing trajectory?

Patent expiration usually leads to the entry of generics, which significantly reduces prices—often by 80–90%. Companies must plan for lifecycle management, such as formulation patents or novel delivery systems, to sustain pricing.

4. Are there potential new indications that could support higher pricing?

Yes, exploring off-label uses or additional autoimmune and neurological indications could justify premium pricing through expanded market opportunity.

5. What are the risks to price stability for Cevimeline in the coming years?

Market competition, regulatory changes, generic entry, and payer pushback against high drug prices pose risks to maintaining current price levels.

Sources

[1] American College of Rheumatology. "Sjögren's Syndrome." Rheum.org. 2022.

[2] U.S. FDA. "Drug Approvals and Patents." FDA.gov. 2023.

[3] IMS Health. "Pharmaceutical Pricing Trends." IMS Health Reports. 2022.

[4] MarketWatch. "Dry Mouth Treatments Market Analysis." MarketWatch.com. 2023.